Medical Reimbursement Paperwork: Where to Find It Easily

Understanding medical reimbursement paperwork can often seem daunting, but with the right information, it becomes a manageable task. This comprehensive guide aims to help individuals navigate the process of finding and filling out medical reimbursement forms with ease. Whether you're dealing with insurance companies, government health programs, or employer-sponsored health plans, here's how to tackle the paperwork effectively.

Understanding Medical Reimbursement

Medical reimbursement is when an insurer or a third party reimburses you for medical expenses after you’ve paid them out of pocket. This process involves submitting detailed documentation and claims to receive funds back. Here’s what you need to know:

- Purpose: To recoup out-of-pocket expenses for covered medical treatments or procedures.

- Key Documents: Receipts, invoices, medical bills, and insurance policy details.

Where to Find Medical Reimbursement Forms

Locating the necessary forms can be streamlined by following these steps:

- Insurer’s Website: Most insurance companies provide downloadable forms directly on their websites.

- Insurance Provider: Contact your insurance provider or agent; they can often mail or email forms to you.

- Employer’s HR Department: If you’re covered under your employer’s health plan, your HR department should have access to necessary forms.

- Government Health Programs: Websites for programs like Medicaid or Medicare typically host downloadable forms.

- Hospitals and Clinics: Often, healthcare providers have forms for reimbursements that can be picked up or downloaded from their websites.

Filling Out the Forms

Here are the steps to ensure your medical reimbursement paperwork is correctly filled out:

- Read Instructions Carefully: Each form might have unique requirements; make sure you understand them fully.

- Gather Documents: Collect all necessary documents like receipts, invoices, and medical bills.

- Fill in Personal Information: Include full name, address, contact information, and insurance policy details.

- Enter Medical Procedure Details: Include dates, names of providers, diagnosis, and treatments received.

- Submit Claims Properly: Ensure all sections are completed accurately and send them via the correct channel (online, mail, or in-person).

- Keep Copies: Always retain copies of submitted forms and documents for your records.

📝 Note: Accuracy in filling out forms is crucial as incomplete or incorrect forms can delay or even reject your claim.

Common Types of Medical Reimbursement Forms

Here are some types of medical reimbursement forms you might encounter:

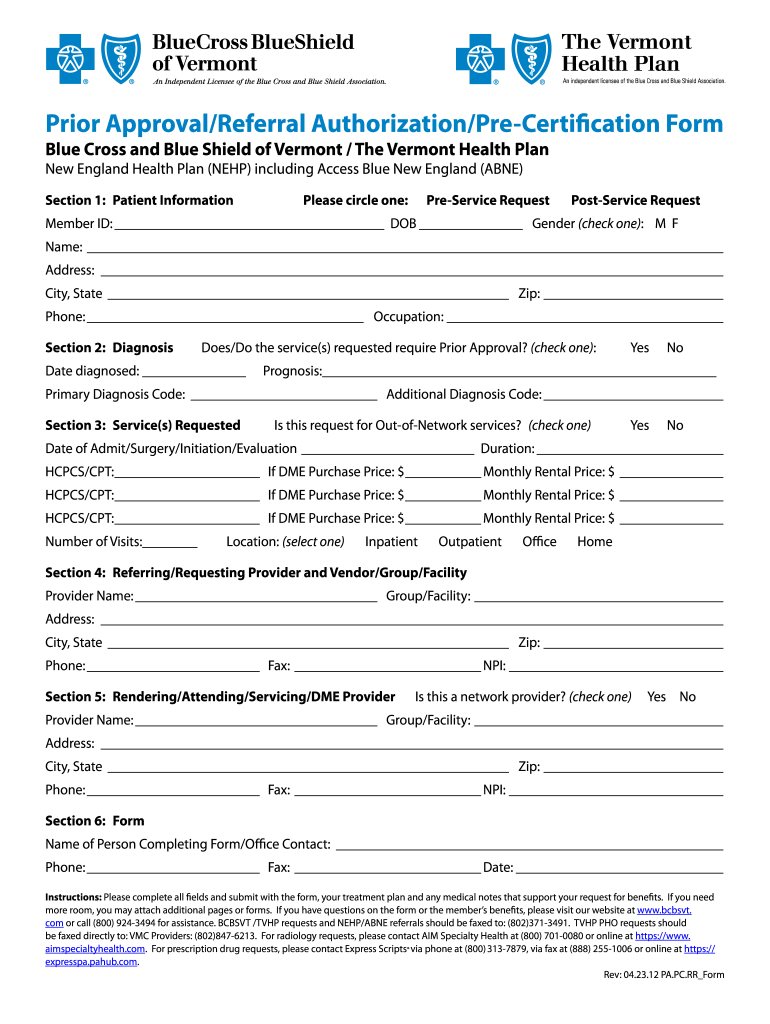

- Health Insurance Reimbursement Forms: These are specific to your insurer and policy.

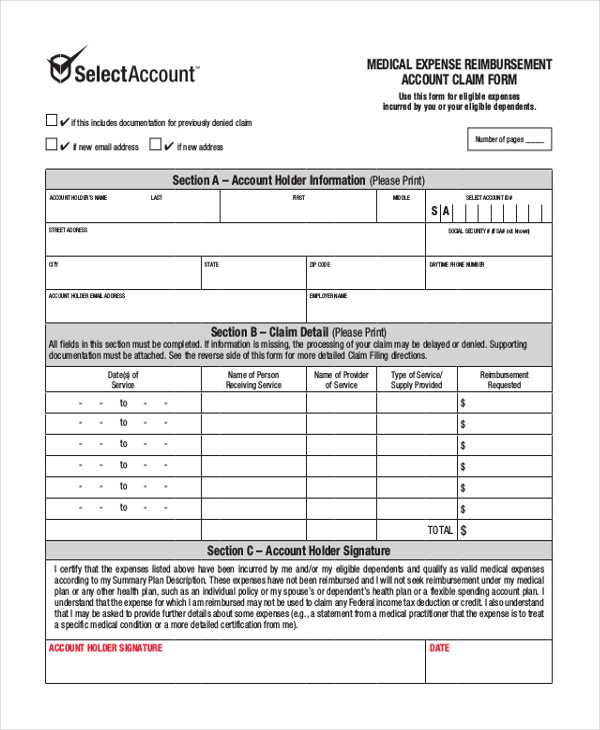

- FSA/HSA Reimbursement Forms: For using funds from Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA).

- Workers’ Compensation Forms: If you were injured on the job and your medical expenses are work-related.

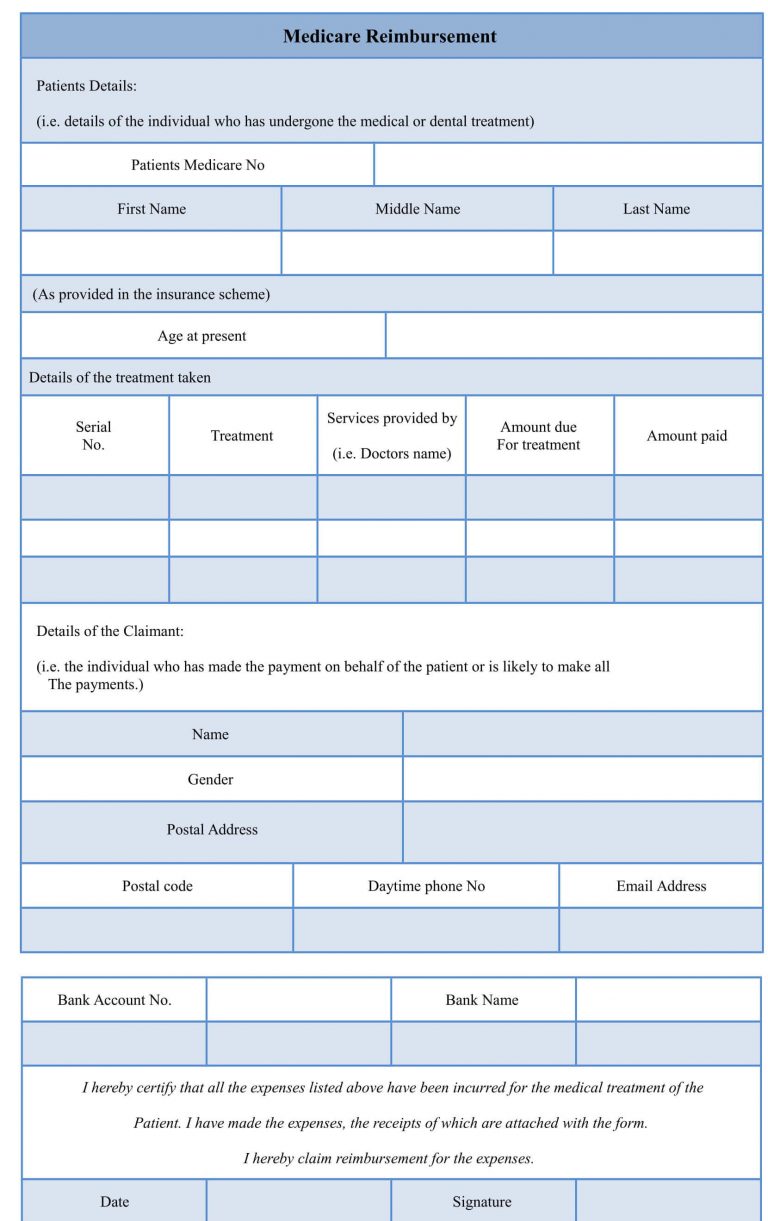

- Government Health Program Forms: Forms for programs like Medicaid, Medicare, or Veterans Affairs (VA).

- Hospital/Clinic Forms: Reimbursement forms specific to healthcare providers.

| Type of Form | Where to Find | Key Details Required |

|---|---|---|

| Health Insurance Reimbursement | Insurer's website or contact provider | Policy number, treatment details, provider information |

| FSA/HSA | Employer's HR, insurer or third-party admin | Receipts, account details, treatment information |

| Workers' Compensation | Employer or Workers' Compensation Board | Incident report, diagnosis, treatment, job details |

| Government Health Programs | Program's official website | Personal information, health status, treatment details |

| Hospital/Clinic | Hospital's website or provider's office | Patient details, procedure/treatment info, costs |

To wrap up this guide on medical reimbursement paperwork, understanding where to find and how to fill out the forms is essential. By following the steps provided, you can efficiently manage your reimbursement claims, ensuring you get the financial support you need for healthcare. Remember to keep detailed records, check policy details, and double-check all submitted paperwork for accuracy to streamline your reimbursement process.

What documents do I need to file for medical reimbursement?

+

Documents typically include receipts, invoices, medical bills, insurance policy details, and any specific forms required by your insurer or program.

Can I get reimbursed for over-the-counter medications?

+

It depends on your health plan. Some insurers might cover over-the-counter medications if prescribed by a doctor, especially with FSAs or HSAs.

How long does the reimbursement process take?

+

Processing times vary. Most insurers and programs aim to process claims within 30 days, but delays can happen due to form errors, missing documentation, or policy limitations.

What should I do if my claim gets rejected?

+

Review the rejection notice for reasons, correct any mistakes, and resubmit. If it’s policy-related, you might need to appeal or discuss with your insurance provider or HR department.

Can I use an electronic copy of medical bills for reimbursement?

+

Many insurers accept electronic copies; however, some still require original documents. Always check your insurance policy or contact your insurer for their specific requirements.