Filing Your LLC Paperwork in Virginia: The Ultimate Guide

Starting an LLC (Limited Liability Company) in Virginia can be both an exciting and intimidating journey. This guide will take you through the entire process, from forming your LLC to ensuring your business complies with all state requirements. Whether you're a first-time business owner or looking to shift your existing business into an LLC, understanding the steps and paperwork involved is crucial for success.

Understanding LLCs in Virginia

An LLC combines the flexibility of a partnership with the liability protection typically associated with corporations. In Virginia, this business structure limits the personal liability of owners for business debts, while offering pass-through taxation, which means the LLC itself is not taxed, but its income flows through to the members' personal income.

📌 Note: Virginia, like other states, does not require annual reports from LLCs, but maintaining good standing with the State Corporation Commission is essential.

Step-by-Step Process to File Your LLC

1. Choose a Business Name

- Your LLC name must include “Limited Liability Company,” “L.L.C.,” or abbreviations like “LLC.”

- It must be distinguishable from other business names registered in Virginia. Check availability through the Virginia State Corporation Commission.

2. Designate a Registered Agent

- A registered agent is responsible for receiving legal documents and state notices on behalf of your LLC. This can be an individual residing in Virginia or a company authorized to act as a registered agent.

3. File Articles of Organization

Complete and file the Articles of Organization with the Virginia State Corporation Commission (SCC). Here’s what you’ll need:

- Business name and type

- Registered agent’s name and address

- Name and address of each organizer (the person filing the articles)

- Management structure (whether the LLC will be member-managed or manager-managed)

- Effective date if different from the date of filing

Include the filing fee, which at the time of writing is $100.

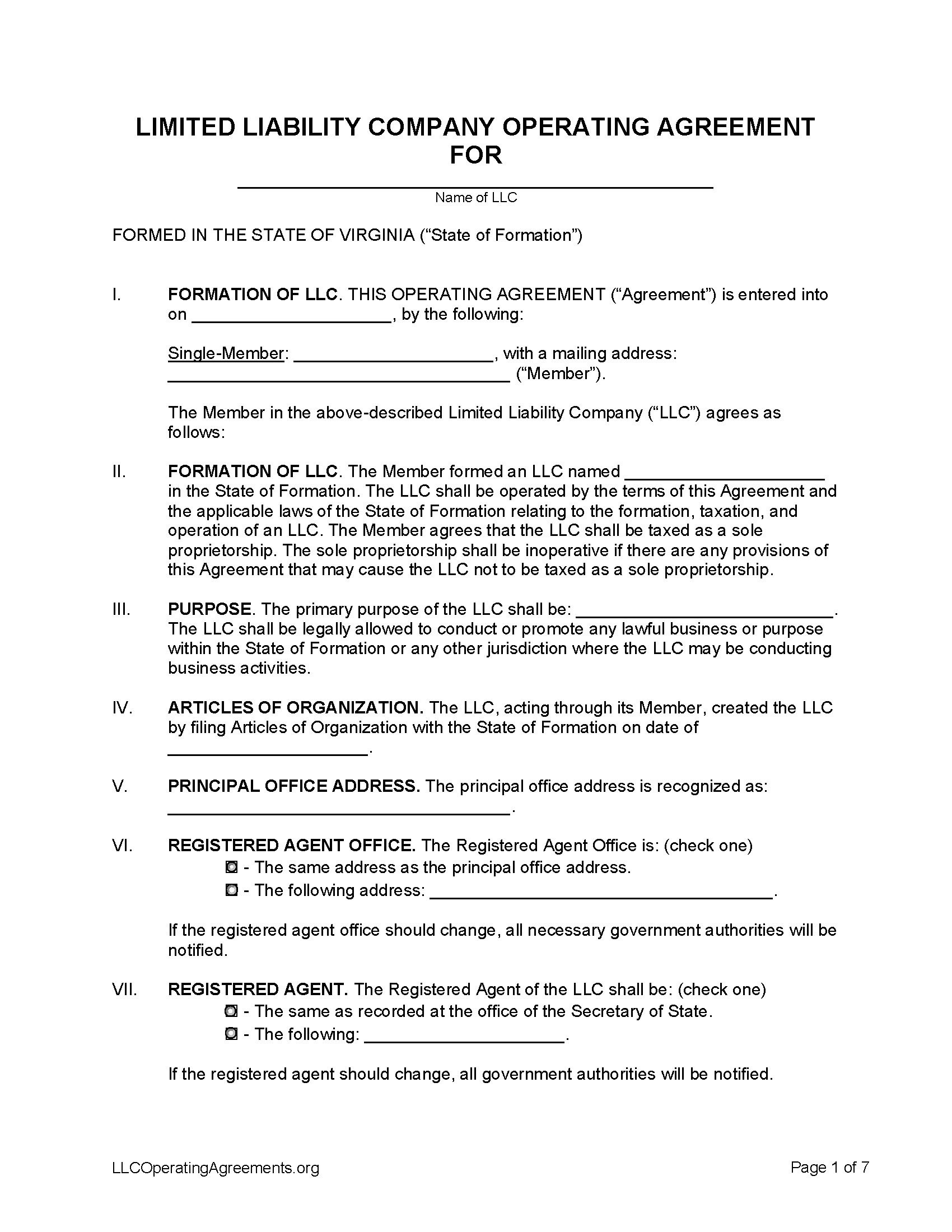

4. Prepare an Operating Agreement

While Virginia law does not require an LLC to have an operating agreement, having one is highly recommended. It outlines:

- Ownership interest

- Member rights and responsibilities

- How decisions will be made

- How profits will be distributed

- What happens when a member leaves or passes away

5. Obtain an EIN

An Employer Identification Number (EIN) from the IRS is necessary if your LLC has multiple members or will have employees. Even a single-member LLC can benefit from having an EIN for tax purposes.

6. Open a Business Bank Account

To keep your personal and business finances separate, open a business bank account using your EIN and the Articles of Organization.

7. Register for State and Local Taxes

Register for any relevant state and local taxes:

- Virginia sales tax if you’ll be selling taxable goods or services.

- Business, professional, and occupational license tax (BPOL), if required in your locality.

8. Obtain Necessary Business Licenses and Permits

Depending on your industry and location, you may need:

- State-specific licenses, e.g., for certain professional services.

- Local zoning permits or occupancy certificates.

- Federal licenses for activities like alcohol sales or radio broadcasting.

9. Maintain Your LLC

After setting up your LLC, here are ongoing compliance measures:

- Keep track of your company’s registered agent.

- Maintain accurate records, especially financials.

- Annually file a certificate of existence if your LLC makes changes to its Articles.

🔍 Note: While Virginia does not require an annual report, if you make significant changes to your LLC, like changing the registered agent or business name, you'll need to update your records with the SCC.

The Benefits of Forming an LLC in Virginia

Here are some advantages:

- Liability Protection: LLC members are not personally liable for the company's debts or actions.

- Flexibility in Management: Virginia allows for both member-managed and manager-managed LLC structures.

- Tax Benefits: The pass-through taxation is particularly beneficial for many small businesses.

- Operational Flexibility: LLCs can choose how they want to be taxed, either as a sole proprietorship, partnership, S-Corp, or C-Corp.

Common Pitfalls to Avoid

- Neglecting Paperwork: Not updating the SCC with changes in your LLC.

- Ignoring Compliance: Failing to obtain necessary licenses or not filing required tax documents.

- Improper Record Keeping: Mixing personal and business finances can jeopardize your LLC status.

Final Thoughts

Starting an LLC in Virginia can provide the legal structure, financial benefits, and flexibility necessary to thrive as a business owner. By carefully following the steps outlined, you not only lay a solid foundation for your company but also ensure that your LLC remains compliant with Virginia's laws. Remember that while the process might seem intricate, it's a part of building your business on a firm footing. Understanding your responsibilities as an LLC owner will serve you well in the long run. Keep up with regulatory changes, maintain your records, and operate within legal bounds to keep your LLC in good standing, providing yourself with peace of mind to focus on growing your business.

How long does it take to form an LLC in Virginia?

+

It typically takes 7-10 business days for standard processing. However, Virginia offers expedited services for an additional fee, which can reduce the waiting time.

Can I form an LLC by myself in Virginia?

+Yes, you can form an LLC on your own or with the help of an attorney or a formation service. Just ensure you comply with all the steps accurately.

What are the ongoing costs for an LLC in Virginia?

+While there is no annual report fee, expect to pay for:

- Annual registered agent fee (if using a service)

- Potential fees for amendments to the Articles of Organization

- Business taxes, if applicable

- Federal taxes (via personal income tax for members)