File Your LLC Paperwork in NC Easily

The process of setting up a Limited Liability Company (LLC) in North Carolina can seem daunting at first glance. However, with a step-by-step guide, you'll find it's quite manageable. Here's how to file your LLC paperwork in NC efficiently:

Understand the Basics of an LLC

Before diving into the paperwork, it’s crucial to understand what an LLC is. An LLC provides its owners, called members, with the advantage of personal asset protection. This means your personal assets are typically shielded from business debts and liabilities. Additionally, LLCs enjoy pass-through taxation where profits or losses are passed directly to members’ personal tax returns, avoiding the double taxation faced by corporations.

Choose a Business Name

Selecting an appropriate name for your LLC is the first practical step:

- It should be unique and not in use by any other registered business in North Carolina.

- The name must include “Limited Liability Company”, “Limited Company”, “L.L.C.”, “LLC”, or “Ltd. Co.”.

- Consider future implications when choosing a name, as it will impact branding and recognition.

Use the NC Secretary of State’s online Business Name Search tool to check for name availability.

Appoint a Registered Agent

You must appoint a registered agent for your LLC. This agent:

- Must have a physical address in North Carolina (a P.O. Box won’t suffice).

- Is responsible for receiving legal and official documents on behalf of the LLC.

- Can be an individual or a company that offers registered agent services.

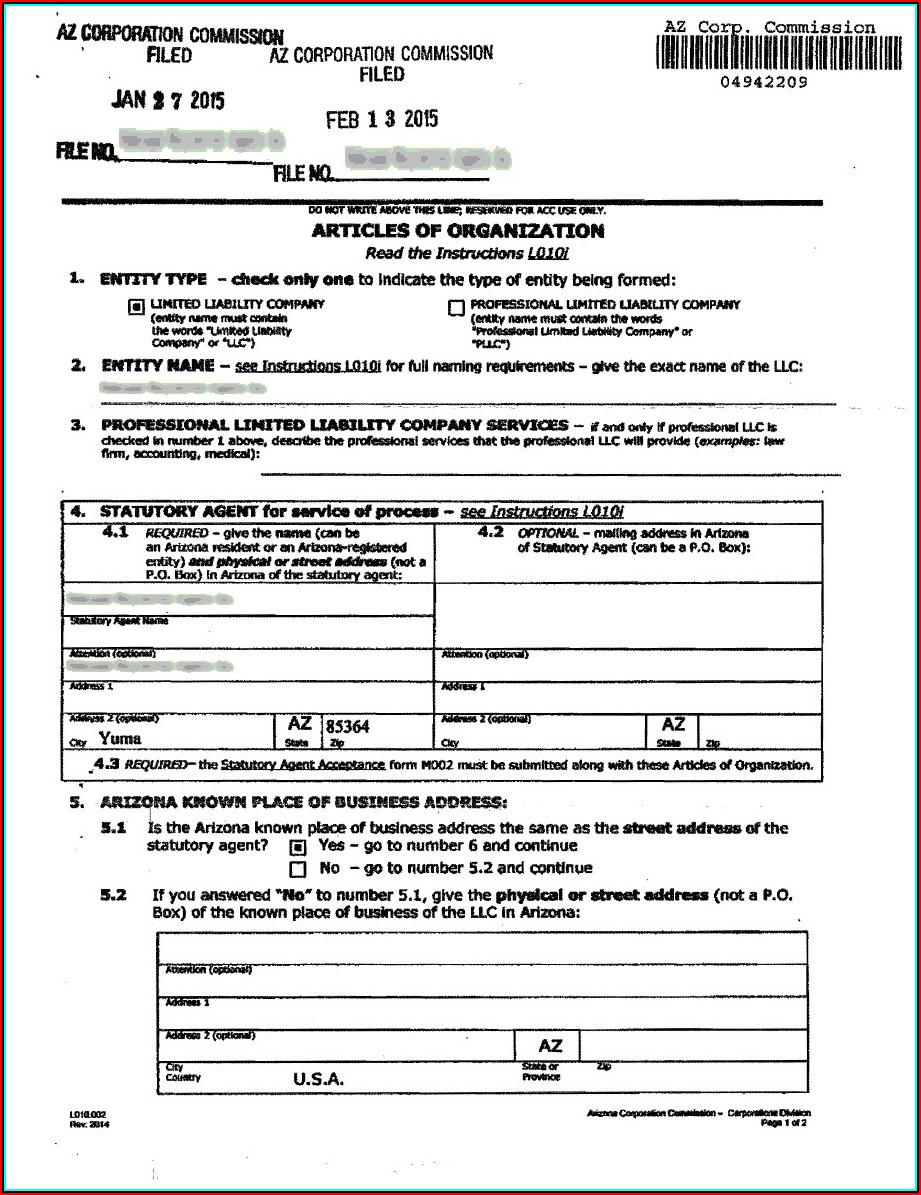

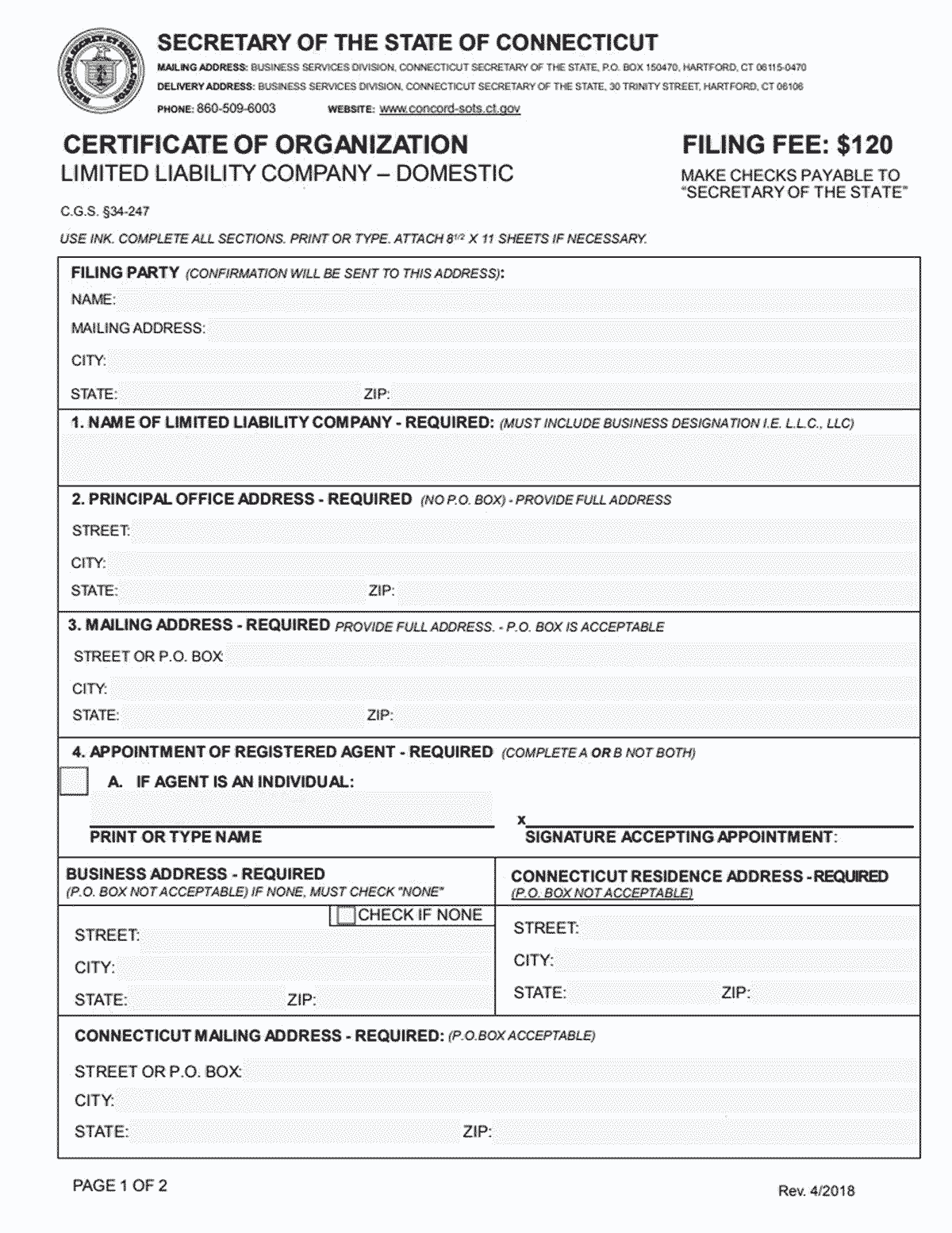

Prepare and File Articles of Organization

This is the official formation document you submit to the state:

- The form is available on the North Carolina Secretary of State’s website.

- Complete the form with all necessary details including the LLC name, your registered agent’s information, and the LLC’s address.

- File online or by mail along with the $125 filing fee.

Here’s how to fill out the key sections of the Articles of Organization:

| Section | Description |

|---|---|

| Item 1 | LLC Name |

| Item 2 | Effective Date (optional) |

| Item 3 | Principal Office Address |

| Item 4 | Registered Agent Information |

🎯 Note: Ensure all details are accurate to avoid delays or rejections.

Create an Operating Agreement

While not legally required, an operating agreement outlines the operational and financial rules for your LLC:

- It helps prevent internal disputes by setting clear guidelines.

- Defines ownership percentages, voting rights, profit distribution, and member responsibilities.

This document, even if not mandatory, can provide clarity and security to the LLC’s internal operations.

Secure Business Permits and Licenses

Depending on your business activities, you might need specific permits or licenses:

- Check with local government offices or use the NC Business Navigator for comprehensive information.

- Common licenses include sales tax permits, zoning permits, or professional licenses if applicable.

Obtain an EIN

An Employer Identification Number (EIN) is crucial for several reasons:

- It’s necessary for tax purposes if you have employees or choose to be taxed as a corporation.

- It’s used for opening business bank accounts, filing tax returns, and applying for business credit.

- You can apply for an EIN free of charge through the IRS website.

Open a Business Bank Account

Opening a business bank account:

- Separates your personal and business finances, which is crucial for legal protection and accounting purposes.

- Requires your EIN, Articles of Organization, and possibly an Operating Agreement.

File Annual Reports and Taxes

Compliance with state requirements includes:

- Filing an Annual Report every year with the NC Secretary of State, starting on the first anniversary of your LLC’s formation.

- Paying any relevant franchise and excise taxes, as well as income taxes if your LLC has earnings.

Keeping up with these requirements ensures your LLC remains in good standing with the state.

Setting up an LLC in North Carolina might seem like a mountain of paperwork, but with careful preparation and attention to detail, you can file your LLC paperwork easily. Remember to:

- Choose a unique and compliant business name.

- Ensure your registered agent has a physical address in North Carolina.

- Fill out the Articles of Organization accurately and submit on time.

- Create an operating agreement to establish internal governance.

- Secure any necessary permits or licenses.

- Obtain an EIN and open a business bank account.

- Stay compliant with annual filings and tax obligations.

In closing, the formation of an LLC provides a robust legal framework for your business, combining the operational flexibility of a partnership with the limited liability protection of a corporation. By following this guide, you've taken a significant step toward protecting your personal assets, streamlining your tax responsibilities, and setting up a business structure poised for growth.

What are the benefits of forming an LLC?

+

The primary benefits include limited liability protection, pass-through taxation, operational flexibility, and credibility in the marketplace.

Do I need an attorney to file LLC paperwork?

+

While it’s not mandatory, hiring an attorney can help navigate more complex issues or ensure compliance with specific business structures or industry requirements.

How long does the LLC filing process take in NC?

+

If filing online, processing times can be quick, often within a couple of weeks, while mailing the paperwork can take longer.

Is an operating agreement necessary for an LLC in NC?

+

Though not legally required, having an operating agreement is highly recommended to clarify internal governance and protect members’ interests.