VA Funding Fee: Where Does It Appear on Paperwork?

Veterans often use their VA home loan benefits to purchase or refinance their homes with the advantage of having one of the lowest interest rates available. However, one cost that can catch many by surprise is the VA funding fee. This fee is unique to VA loans and understanding where it appears in the loan documentation can help Veterans better prepare for the home buying process.

Understanding the VA Funding Fee

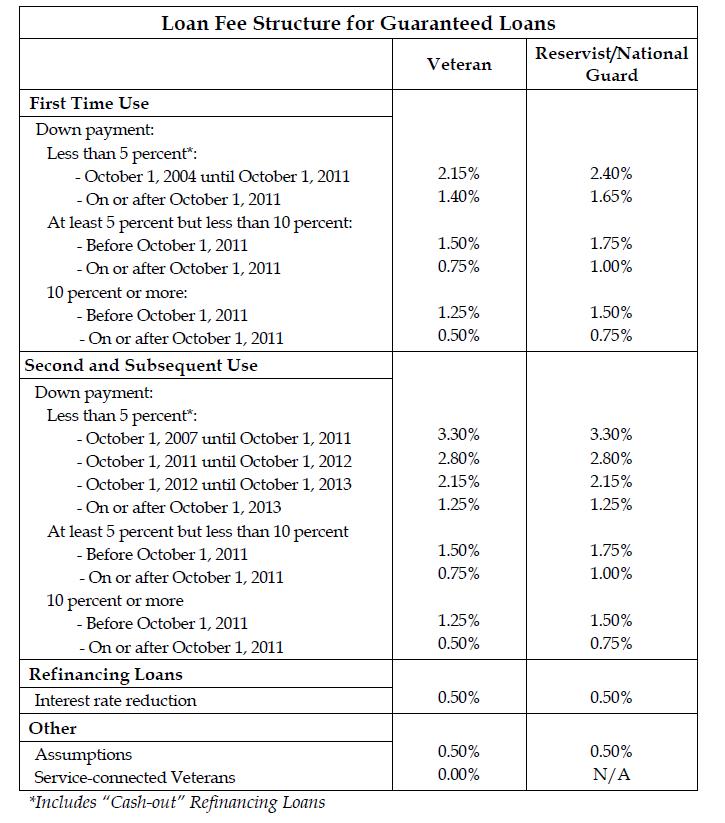

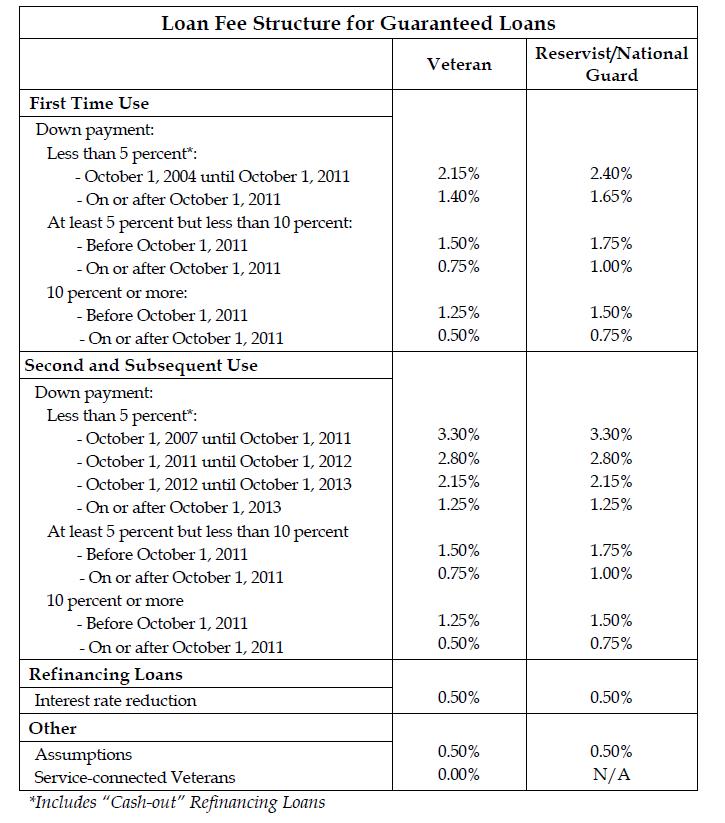

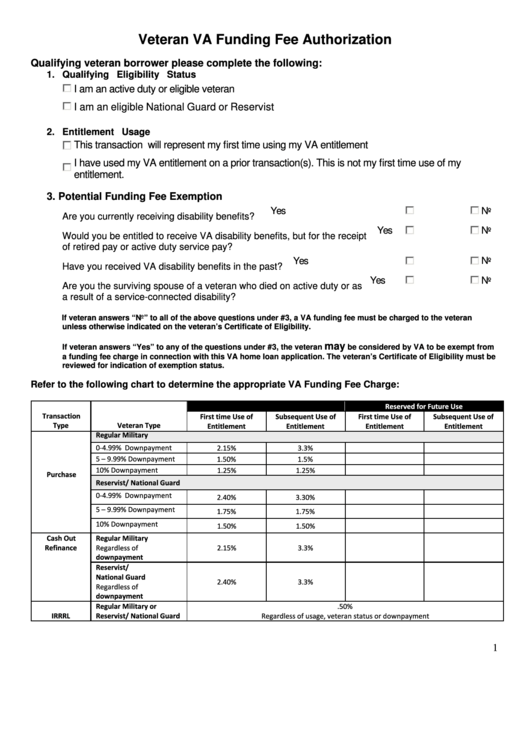

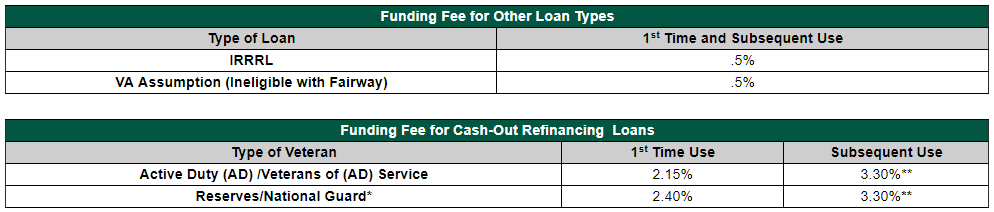

The VA funding fee is a one-time payment designed to help reduce the cost of the loan program for taxpayers. It's a percentage of the total loan amount, which varies based on several factors including:

- The type of loan (purchase, refinance, cash-out refinance)

- The down payment amount or equity in the property

- Whether it's your first time using the VA loan benefit or subsequent use

- Your service categorization (e.g., regular military, reservist, or National Guard)

Where Does the VA Funding Fee Appear?

Here are the places where the VA funding fee is typically documented:

1. Loan Estimate

When you apply for a VA loan, lenders are required to provide you with a Loan Estimate within three business days. This document outlines:

- Loan terms, including the type of loan

- Estimated monthly payment

- Estimated interest rate

- Estimated total closing costs, which includes the VA funding fee.

📝 Note: Make sure to review the Loan Estimate carefully for the VA Funding Fee and any other loan-related fees.

2. Closing Disclosure

The Closing Disclosure is provided at least three business days before you sign the loan documents. This document will contain:

- A final version of the Loan Estimate

- All final loan terms, costs, and line-item charges

Here, the VA funding fee will be detailed under:

- “Loan Costs” - The VA funding fee usually appears under “Origination Charges”

🔍 Note: While most lenders do not allow the funding fee to be financed into the loan, make sure to check with your lender as the policy can vary.

3. HUD-1 Settlement Statement

Although less common since the introduction of the Closing Disclosure, some might still receive a HUD-1 Settlement Statement. Here, the VA funding fee is typically listed under:

- “800 Series” (Items Required by Lender to be Paid in Advance) - Look for the line item “VA Funding Fee.”

Examples of How VA Funding Fee Appears

| Document | Section | Example Entry |

|---|---|---|

| Loan Estimate | Closing Costs Details | VA Funding Fee: $2,700 |

| Closing Disclosure | Loan Costs, Origination Charges | VA Funding Fee: $2,700 |

| HUD-1 Settlement Statement | 800 Series | 801. VA Funding Fee $2,700 |

Importance of Identifying the VA Funding Fee

Identifying the VA funding fee in your loan paperwork is crucial because:

- It allows you to verify that the fee is calculated correctly.

- You can prepare for this upfront cost or explore exemption possibilities.

- Understanding this fee helps you to make informed financial decisions regarding your VA loan.

Wrapping Up

Navigating the VA loan process involves understanding various fees, with the VA funding fee being one of the most significant. Knowing where to find this fee in your loan documentation helps in verifying its accuracy, planning your finances, and ensuring a smoother transaction process. By reviewing your loan estimate, closing disclosure, and if applicable, the HUD-1 statement, you can stay informed and better manage this unique aspect of VA home loans.

Can the VA funding fee be waived?

+

Yes, the VA funding fee can be waived for Veterans with service-connected disabilities or those receiving VA compensation for a pre-discharge disability.

Is the VA funding fee the same for everyone?

+

No, the fee varies based on the type of VA loan, down payment or equity, whether it’s your first or subsequent use of the benefit, and your military service category.

What happens if I disagree with the VA funding fee on my documents?

+

You should discuss it with your lender. If necessary, they can provide detailed documentation or submit a request to the VA for verification.