USDA Fee on Home Paperwork: Where to Look?

📢 Note: USDA, the United States Department of Agriculture, oversees many programs that impact homeownership, including loans for rural development.

What is the USDA Fee?

The USDA (United States Department of Agriculture) offers various loan programs to facilitate homeownership, especially in rural areas. One critical aspect of these programs is the fee associated with the paperwork involved in obtaining these loans. Understanding these fees is crucial for prospective homeowners to manage their finances effectively.

Purpose of USDA Fees

USDA fees are charged to cover: - Administrative Costs: Processing and managing the loan applications. - Guarantee: Ensuring a portion of the loan is guaranteed against default.

These fees ensure the sustainability and continuation of USDA programs, providing affordable housing options for people in eligible rural areas.

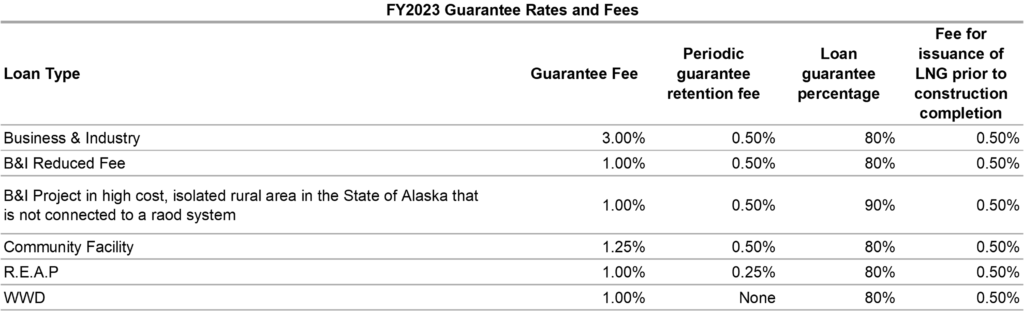

Breakdown of USDA Fees

The fees associated with USDA loans are primarily in two forms:

- Guarantee Fee: A one-time fee paid at closing, similar to mortgage insurance, which covers potential loan defaults.

- Annual Fee: An annual fee, calculated as a percentage of the remaining loan balance, for the life of the loan.

USDA Loan Guarantee Fee

- Current Rate: The guarantee fee can fluctuate, but as of the most recent guidelines, it is around 1% of the loan amount.

- Example: For a 200,000 loan, the guarantee fee would be approximately 2,000.

USDA Annual Fee

- Current Rate: This fee, often likened to private mortgage insurance (PMI), is typically around 0.35% to 0.50% of the average annual scheduled unpaid principal balance.

- Example: If you have a remaining balance of 180,000 on your loan, and the annual fee is 0.50%, you would pay an additional 900 annually or $75 monthly.

📌 Note: The rates for both the Guarantee Fee and Annual Fee can change based on USDA policies. Always verify current rates before applying for or closing on a USDA loan.

Finding USDA Fees in the Paperwork

When navigating through the paperwork for a USDA loan, here’s where you might look to find these fees:

- Loan Estimate: Provided at the outset, it will list the USDA Guarantee Fee under “Services You Cannot Shop For.”

- Closing Disclosure: Issued at least three days before closing, this document includes:

- The guarantee fee within the “Loan Costs” section.

- The annual fee might be mentioned in the “Projected Payments” section under “Taxes, Insurance & Assessments.”

- Loan Amortization Schedule: This shows how much you’ll pay monthly, including principal, interest, and annual fees.

Other Documents to Check

- USDA Property Eligibility Document: Ensures the property qualifies for USDA loans.

- USDA Loan Application: Contains the estimate of fees and charges.

- HUD-1 Settlement Statement: For older loans, this document would detail the USDA fees, but for recent loans, the Closing Disclosure replaced it.

📢 Note: USDA loans have strict property eligibility criteria, so ensure your home is located in an eligible rural area before applying.

Impact of USDA Fees

While USDA fees help keep the program running, they do have several impacts:

- Increase Monthly Payments: The annual fee adds to your monthly mortgage expense.

- Higher Initial Costs: The guarantee fee is part of your closing costs, which might mean you need to bring more money to the table at closing.

- Long-term Financial Planning: Consider these fees when budgeting for homeownership as they affect both short-term and long-term finances.

To offset the fee’s impact:

- Shop Around: Compare different lenders for the best rates and fees.

- Lender Credits: Some lenders might offer credits to offset some costs, lowering your upfront expense.

- Down Payment Assistance: If you qualify, this can reduce the amount needed for closing, indirectly helping with the guarantee fee.

Key Points to Remember

Understanding where to find USDA fees in your loan paperwork is crucial:

- Look for them in the Loan Estimate, Closing Disclosure, and the Loan Amortization Schedule.

- The fees ensure the sustainability of USDA’s housing programs but impact your immediate and long-term costs.

- Always verify the latest rates from USDA and compare offers from various lenders to minimize costs.

By being diligent about these details, you can make informed decisions about USDA loans, ensuring you’re prepared for all aspects of homeownership in rural areas.

What is the USDA Rural Development loan guarantee fee?

+

The USDA Rural Development loan guarantee fee is a one-time fee paid at closing to cover the cost of the guarantee USDA provides on the loan.

How does the annual USDA fee work?

+

The annual USDA fee is calculated as a percentage of your outstanding loan balance and is added to your monthly mortgage payments to cover the cost of the program.

Can USDA fees be waived or negotiated?

+

No, USDA fees are set by the government and cannot be waived or negotiated. However, you can manage their impact through strategic planning or lender credits.

Do USDA fees increase the total cost of homeownership?

+

Yes, USDA fees increase both the initial closing costs and the monthly payments, thereby affecting the overall cost of owning a home with a USDA loan.

Where can I find the USDA fees in my paperwork?

+

You can find the USDA fees in the Loan Estimate, Closing Disclosure, and possibly within the Loan Amortization Schedule provided by your lender.