When Will Navy Federal Send Out Tax Paperwork For Mortage

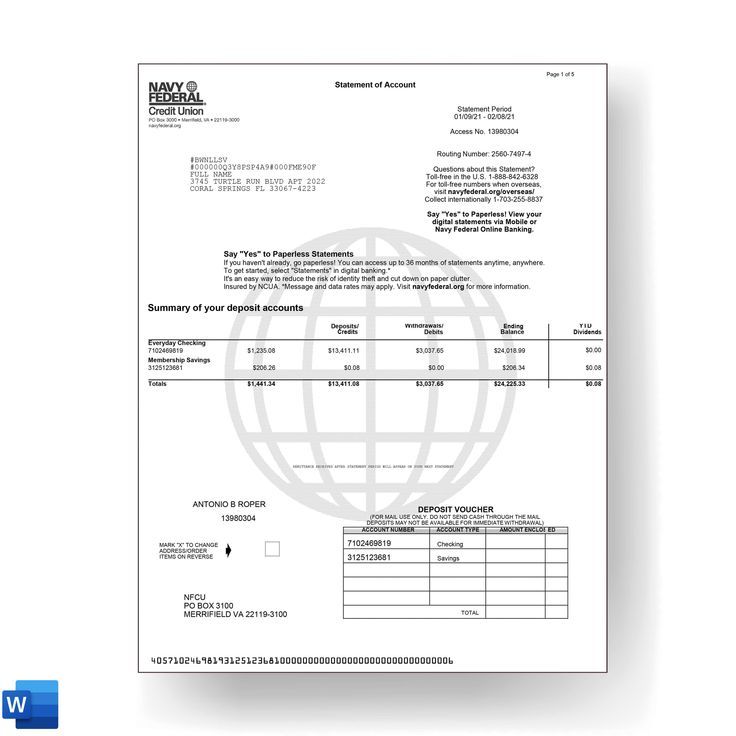

When dealing with mortgage interest statements, it's crucial for homeowners and potential investors to understand when they can expect to receive their tax paperwork from their lending institutions. Navy Federal Credit Union (NFCU), known for its military-focused clientele, follows a relatively standard procedure for distributing tax documents related to mortgages.

The Standard Timeline

Typically, lenders like NFCU aim to send out tax documents by January 31st of each year. This date aligns with the IRS’s requirement for financial institutions to provide certain types of tax statements to their account holders. Here’s a closer look at when you might expect to receive different types of tax paperwork:

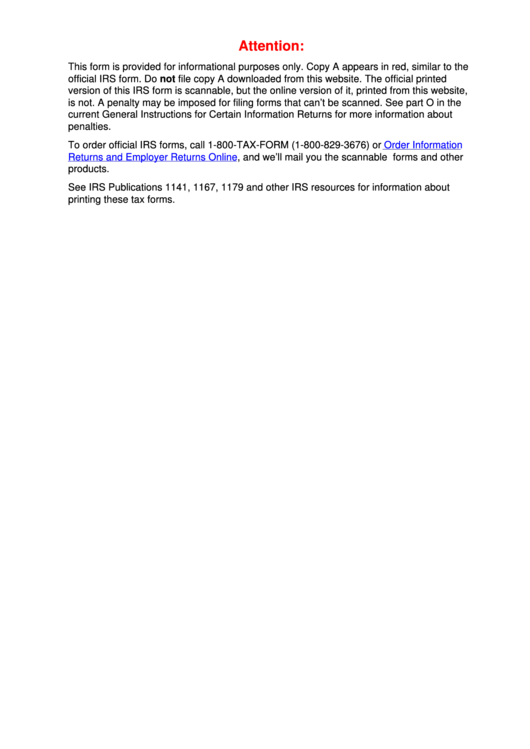

- Form 1098 (Mortgage Interest Statement): This document is crucial for claiming the mortgage interest deduction on your tax return. NFCU generally sends this form out by the end of January, with most members receiving it by the first week of February.

- 1099 Series Forms: If you've earned dividends or interest from your mortgage escrow account, you might receive a 1099-INT form. Similar to Form 1098, NFCU would dispatch these by January 31st.

🛈 Note: This timeline can shift slightly due to holidays, weekends, or operational changes at the financial institution. Always check with NFCU for specific dates if you're concerned about timing.

Factors Affecting the Delivery

Here are several factors that can influence when you might actually receive your tax paperwork from NFCU:

- Mail Delays: Regular postal services might face disruptions due to weather, increased holiday mail volume, or other logistical issues.

- Electronic Delivery: Opting for electronic delivery can significantly speed up the process. NFCU offers e-statements, which means you might get your tax forms faster than those receiving physical mail.

- Account Status: If there are pending changes or issues with your mortgage account (like an address update), it might delay the delivery of your tax documents.

Electronic Delivery vs. Traditional Mail

Choosing between electronic delivery and traditional mail for your tax documents involves several considerations:

| Method | Pros | Cons |

|---|---|---|

| Electronic Delivery |

|

|

| Traditional Mail |

|

|

🛈 Note: When opting for electronic delivery, ensure your email and NFCU account information is current to prevent missing your documents.

What to Do If You Don’t Receive Your Tax Paperwork

If by mid-February you still haven’t received your tax documents from Navy Federal, here are steps you can take:

- Contact NFCU Directly: Call or visit their website to inquire about the status of your documents.

- Check Account Statements: NFCU often provides year-end summaries in your online account, which might suffice for tax preparation.

- Request a Replacement: If lost or delayed, you can request a replacement. NFCU usually has an option to download a replacement 1098 form if necessary.

- Consider an Extension: If delays persist and you're nearing the tax filing deadline, you might need to file for an extension with the IRS.

Final Thoughts

Receiving tax paperwork from Navy Federal for your mortgage is an essential part of preparing your tax returns. Understanding when these documents are issued, the factors affecting their delivery, and the options available to you if there’s a delay can streamline your tax filing process. NFCU strives to adhere to the IRS deadlines, but unforeseen circumstances can impact these timelines. Always keep your account information up-to-date and consider electronic delivery to minimize potential delays.

When will I receive Form 1098 from Navy Federal?

+

Most members receive their Form 1098 from Navy Federal by the first week of February. However, it’s possible to receive it earlier if you opt for electronic delivery.

What should I do if I haven’t received my tax documents by mid-February?

+

Contact Navy Federal directly to inquire about the status of your documents. They can guide you on how to proceed, including providing online access or sending a replacement document.

Can I file taxes without the 1098 form from Navy Federal?

+

Yes, you can estimate your mortgage interest deduction based on your payment history or year-end statements. However, for accurate reporting, it’s recommended to wait for or request your 1098 form if possible.