When to Expect Your 2017 Medicare Tax Paperwork

Understanding when to expect your 2017 Medicare tax paperwork is crucial for efficient financial planning and accurate tax filing. If you're enrolled in Medicare, the timing of receiving your tax documents can significantly affect your ability to file your taxes on time and ensure your tax withholdings and contributions are correctly accounted for.

What is Medicare Tax?

Medicare tax, also known as the Hospital Insurance Tax, supports the Medicare program in the U.S., which provides healthcare coverage primarily to those over 65, as well as to younger people with certain disabilities or chronic conditions. Here’s a brief overview:

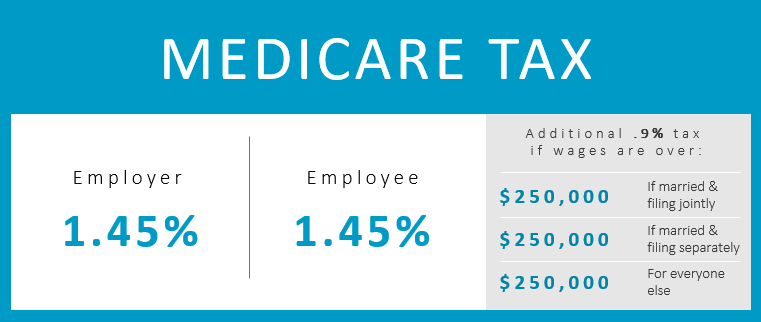

- Medicare Tax: A payroll tax imposed on both employees and employers at 1.45% each, leading to a combined 2.9% tax rate.

- Additional Medicare Tax: An additional 0.9% tax on individuals whose income exceeds certain thresholds.

When Should You Expect Your Medicare Tax Documents?

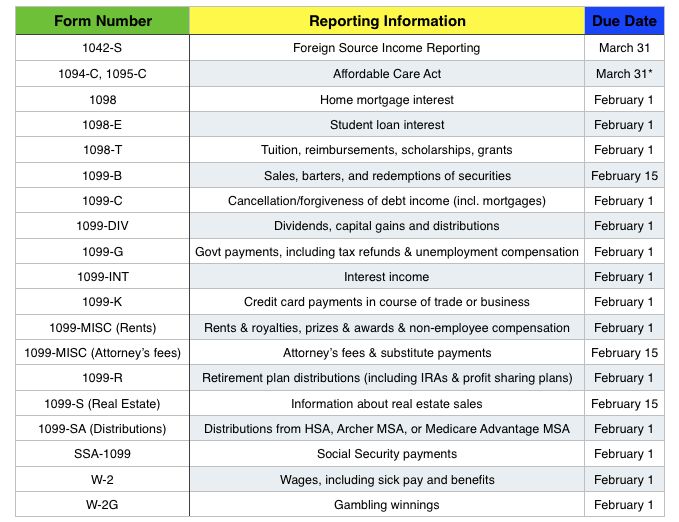

There are several documents you might receive related to your Medicare taxes, and their arrival varies:

- Medicare Summary Notice (MSN): Typically mailed quarterly, showing claims processed by Medicare. This is essential for tracking out-of-pocket expenses.

- Form SSA-1099: Sent by the Social Security Administration (SSA) if you received Social Security benefits in 2017. This form should arrive by January 31st each year.

- Form CMS-L564: You’ll receive this if you were enrolled in a Medicare Advantage or Part D plan. The distribution period can range from January to late February.

What If You Don’t Receive Your Medicare Tax Paperwork on Time?

If your paperwork doesn’t arrive within the expected time frame, take the following steps:

- Contact Social Security: Call the SSA at 1-800-772-1213 to inquire about your Form SSA-1099 or check your My Social Security account online.

- Reach Out to Your Plan Provider: If you’re waiting on Form CMS-L564, contact your Medicare plan directly.

- File for an Extension: If you’re unable to file on time, consider filing for an extension with the IRS.

🔍 Note: Ensure your mailing address is up-to-date with both SSA and your Medicare Advantage/Part D plans to avoid delivery issues.

Important Dates to Remember for 2017 Medicare Tax Paperwork

| Document | Expected Mailing Date | Action If Not Received |

|---|---|---|

| Medicare Summary Notice (MSN) | Quarterly | Contact your local Social Security office |

| Form SSA-1099 | By January 31, 2018 | Call SSA or check online |

| Form CMS-L564 | January to February, 2018 | Contact your Medicare Advantage or Part D plan |

Filing Your Taxes with Medicare Information

Here are steps to correctly file your taxes:

- Gather All Documents: Ensure you have all required forms before you start filing.

- Include Medicare Premiums: Medicare Part B, Part D, and Advantage plan premiums can be deductible from your taxable income.

- Report Medicare Benefits: If you received SSA benefits, report them on your tax return.

- Determine Taxability of Benefits: Depending on your income, part of your Social Security benefits might be taxable.

📝 Note: Keep accurate records of your Medicare contributions and benefits as they can impact your taxable income.

Understanding the Impact of Medicare on Your Taxes

Your Medicare contributions and benefits can influence your tax situation:

- Income-Related Monthly Adjustment Amount (IRMAA): Higher-income beneficiaries might see an increase in Part B and Part D premiums, affecting tax returns.

- Self-Employment: If you’re self-employed, you’re responsible for the full Medicare tax rate of 2.9% on net earnings from self-employment.

In summary, receiving your 2017 Medicare tax paperwork on time is vital for accurate tax filing. By understanding the expected arrival dates and taking the necessary steps if documents are delayed, you can file your taxes promptly and avoid potential penalties or errors. Ensure you're aware of how Medicare impacts your taxes, particularly if you fall into higher income brackets or if you're self-employed. Remember to keep meticulous records of your Medicare-related expenses for future tax purposes.

What if I receive my Medicare paperwork late?

+

If you receive your paperwork late, contact the issuing agency (SSA for SSA-1099, your plan provider for CMS-L564) to request a replacement or check for any delivery issues. You might also need to file for a tax extension if the delay impacts your filing deadline.

Can I file my taxes without the Medicare forms?

+

It’s generally not recommended to file without all your documents. However, if you have all other necessary tax documents, you can file your return without the Medicare forms, but you should amend your return once you receive them to include Medicare-related deductions and report taxable benefits accurately.

What are the implications of not reporting my Medicare benefits?

+

Not reporting Medicare benefits could lead to under-reporting your income, potentially resulting in tax penalties, audits, or delayed refunds. It’s essential to include all income sources on your tax return.