Loan Paperwork: When to Get It Before Closing

The process of securing a mortgage can be a labyrinth of paperwork, requiring a keen eye on details and timeliness. One critical aspect often overlooked by eager homebuyers is understanding when to get loan paperwork before closing. Getting your documents in order early can save you from last-minute hitches and ensure a smoother transition to homeownership. In this comprehensive guide, we'll delve into:

- Types of documents needed for a mortgage

- The timeline for gathering these documents

- Strategies to ensure you have all paperwork ready on time

- Common pitfalls to avoid

Types of Documents Required for Mortgage

Before diving into when to gather your documents, let's first understand what you might need:

- Income Verification: Pay stubs, W-2 forms, tax returns, and bank statements.

- Credit Reports: Lenders will pull your credit report, but knowing your credit score in advance can help.

- Employment Verification: A letter from your employer stating your job stability and income.

- Asset Information: Statements showing savings, investments, or other assets.

- Personal Documents: Social Security Number, driver's license, and proof of citizenship or legal residence.

- Property Details: Purchase agreement, property appraisal, homeowners insurance, and preliminary title report.

- Down Payment Details: Source of funds statement or gift letter if applicable.

🚫 Note: Some lenders might require additional documents depending on your loan type or personal circumstances.

When Should You Start Gathering Documents?

It's a good idea to start collecting documents well before you begin your home search. Here's a timeline:

- 6-8 Weeks Before Application: Begin assembling your financial documents. Update your personal documents if any are outdated.

- 4-6 Weeks Before Application: Request and review your credit report for any discrepancies or issues. Start gathering property-related documents if you've identified potential homes.

- 1-2 Weeks Before Application: Finalize your asset information, employment verification, and have any necessary explanations ready.

📅 Note: Timelines can vary based on your preparedness and lender requirements, but starting early is always beneficial.

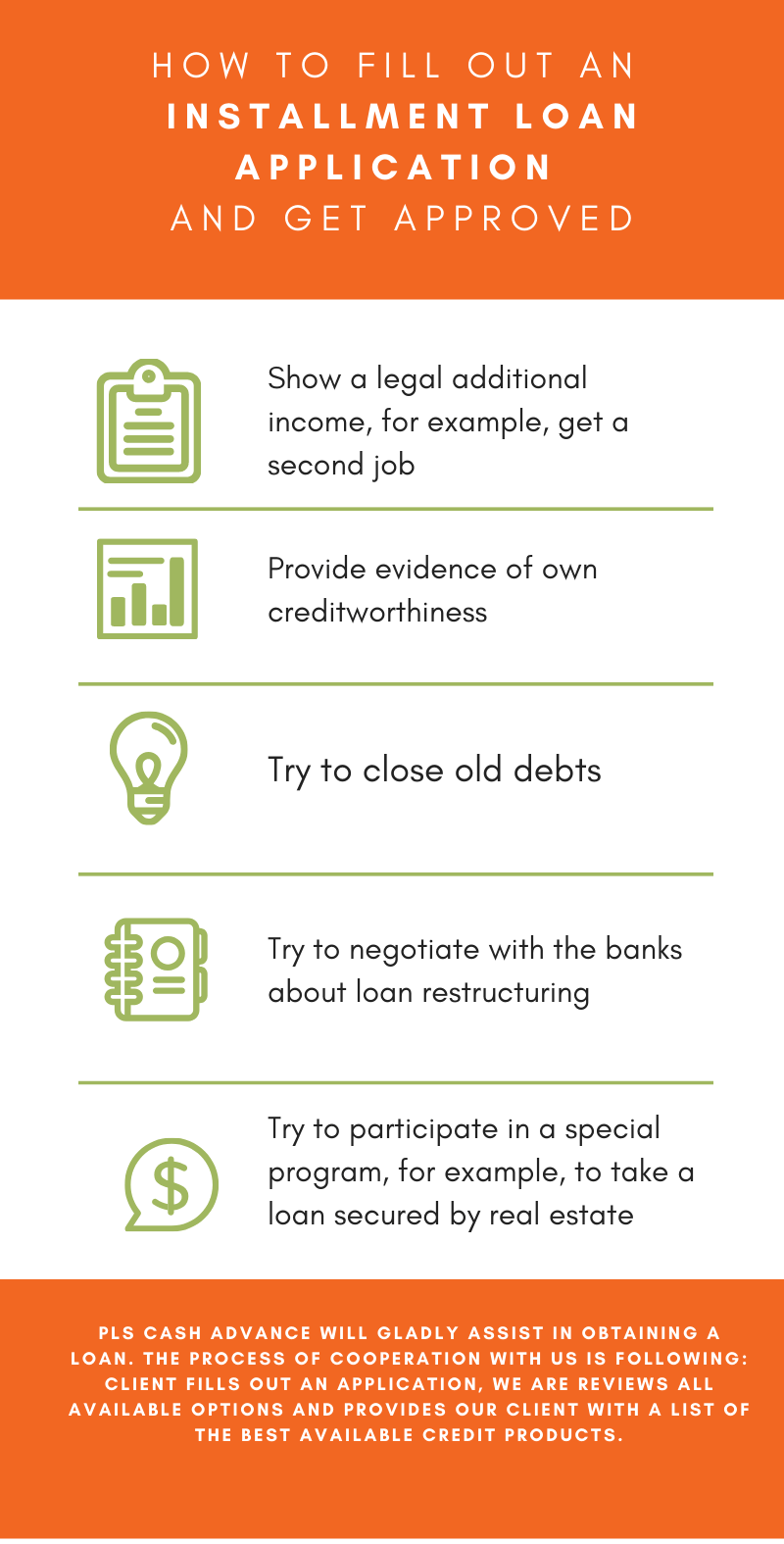

Strategies for Efficient Document Collection

Collecting paperwork can be daunting, but with the right approach, you can manage it effectively:

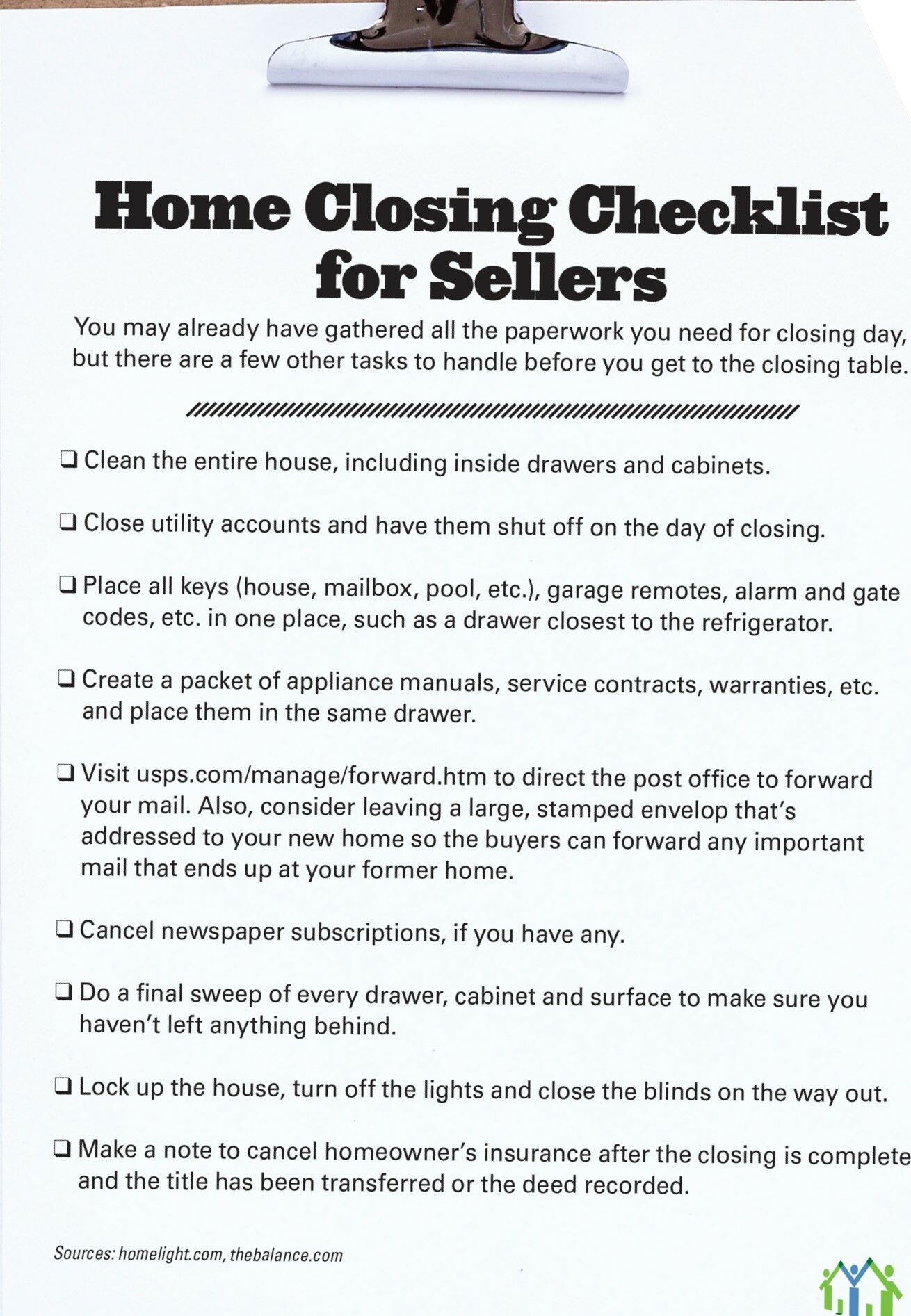

- Create a Document Checklist: Use a template or create your own list tailored to your situation.

- Organize Documents: Keep digital and physical copies in folders, labeled by document type.

- Set Reminders: Schedule reminders for when documents need to be updated or gathered.

- Communication with Lender: Regularly update your lender on your progress to ensure they're aware of any potential delays or issues.

- Professional Help: Consider a loan officer or mortgage broker to guide you through the paperwork process.

| Document Type | Responsibility | Typical Turnaround Time |

|---|---|---|

| Income Verification | Borrower | 2-3 days |

| Credit Reports | Lender | Immediate |

| Employment Verification | Employer/Borrower | 2-5 days |

| Asset Information | Borrower | 1-2 days |

⚠️ Note: Lenders may request additional verification if there are red flags or discrepancies in the submitted documents.

Common Pitfalls to Avoid

Even with the best preparation, certain mistakes can derail the loan approval process:

- Missing Documents: Ensure every document on your list is submitted. Incomplete sets can delay closing.

- Outdated Information: Review documents to make sure they reflect current circumstances (like job changes or new financial assets).

- Changes in Financial Status: Avoid making major purchases or changes in employment during the loan process.

- Lack of Communication: Keep your lender in the loop regarding any changes or issues with document collection.

The journey to homeownership is paved with paperwork, but by knowing when to get loan paperwork before closing, you can significantly reduce the stress involved. Starting early, staying organized, and communicating with your lender can pave the way for a successful mortgage approval. Remember, your preparedness not only reflects well on your loan application but also positions you as a responsible borrower in the eyes of your lender.

When should I start gathering my mortgage documents?

+

Start 6-8 weeks before you plan to apply for a mortgage. This gives you ample time to gather, review, and update any necessary documents.

Can I use electronic copies of my documents for mortgage application?

+

Yes, many lenders now accept electronic documents, but verify with your lender as some may still require physical copies or notarized originals for certain documents.

What happens if I can’t gather all the documents on time?

+

If you’re struggling to gather documents, communicate with your lender as soon as possible. They might be able to extend deadlines or provide alternatives. Delaying could push back your closing date.