USDA Loan Paperwork Guide: What You Need

If you're considering a USDA loan for your home purchase, understanding the paperwork requirements can make the difference between a smooth application process and a stressful one. USDA loans, designed to assist low to moderate-income homebuyers in rural areas, come with their own set of documents and eligibility criteria. Here's a comprehensive guide to help you navigate through the necessary paperwork:

USDA Loan Eligibility Documents

The first step in securing a USDA loan is to prove your eligibility. This involves providing several key documents:

- Income Verification: Pay stubs, W-2 forms, or if self-employed, tax returns for the last two years.

- Credit Report: Although USDA loans are more flexible with credit scores, a credit report is necessary to assess your creditworthiness.

- Employment Verification: Recent letters of employment or any documentation proving consistent employment.

- USDA Loan Application: The application form itself, which can be filled out online or obtained from a USDA-approved lender.

📝 Note: Ensure all documents are current, and if self-employed, make sure your tax returns show stable or increasing income.

Property Documents

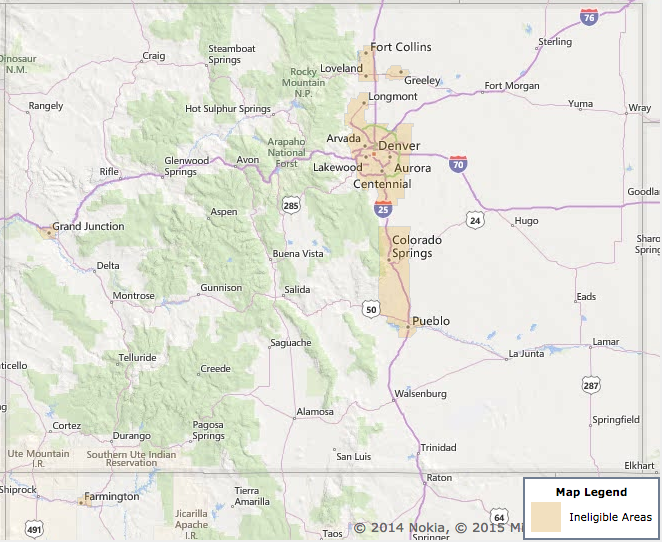

Since USDA loans are location-specific, the property you intend to purchase must meet the following criteria:

- Eligibility Area Proof: Verify the property’s location via the USDA’s online eligibility map.

- Property Appraisal: A USDA appraiser will check if the home meets their guidelines for safety, soundness, and value.

- Home Inspection Report: Some lenders might require an inspection to ensure the property is in good condition.

| Document | Why You Need It |

|---|---|

| Property Deed | To establish ownership. |

| Property Survey | To confirm the property boundaries. |

| Environmental Report | To ensure no environmental hazards exist. |

Financial Documentation

Beyond proving your income, lenders need to assess your financial health:

- Bank Statements: Usually 2-3 months to verify liquid assets.

- Investment Records: To show additional assets, if applicable.

- Gift Letters: If part of your down payment comes as a gift, documentation from the gift provider.

- Disability Income Documentation: If applicable, provide proof of disability payments.

💡 Note: Keep these documents organized and within easy reach as lenders might need them throughout the application process.

Additional Documentation

Depending on your situation, here are other documents that might be required:

- Divorce Decree or Child Support Orders: If applicable, to verify child support income.

- Additional Identity Documents: A driver’s license or passport.

- Legal Residency Proof: For non-U.S. citizens, documentation proving legal status.

In wrapping up, knowing what documents you need for a USDA loan can streamline the home buying process. Ensuring you have all the necessary paperwork in order not only speeds up the approval but also increases your chances of loan approval. Keep in mind, USDA loans offer attractive benefits like no down payment and low-interest rates, but the application process requires meticulous attention to detail.

Do I need a co-signer for a USDA loan?

+

While not always necessary, having a co-signer can help if your income or credit isn’t strong enough to meet USDA loan requirements.

What if I’m self-employed?

+

Self-employed applicants need to provide two years of tax returns to verify income. This shows income stability and trends, which is crucial for loan approval.

Can I get a USDA loan if I already own a home?

+

Generally, USDA loans are for first-time homebuyers, but exceptions exist for homes not meeting USDA standards or if selling current home isn’t feasible.