Essential Paperwork to Keep After a Loved One's Passing

Dealing with the aftermath of losing a loved one can be incredibly challenging. Amidst the grief, there's a necessary task that often falls upon family members or executors: managing the deceased's paperwork. This essential step not only helps in settling their affairs but can also provide a semblance of control in a difficult period. In this comprehensive guide, we'll explore the essential paperwork that needs to be retained, why they're important, and how to organize them effectively.

Why Retain Paperwork?

Legal reasons require retaining certain documents after someone passes away. Here's why:

- Legal and Financial Obligations: Documents like wills and death certificates are critical for settling the estate, distributing assets, and filing taxes.

- Emotional Closure: Keeping records can aid in the process of grief, offering closure as all loose ends are tied up.

- Future Generations: Some documents might be valuable for future family members, providing insights into lineage or financial matters.

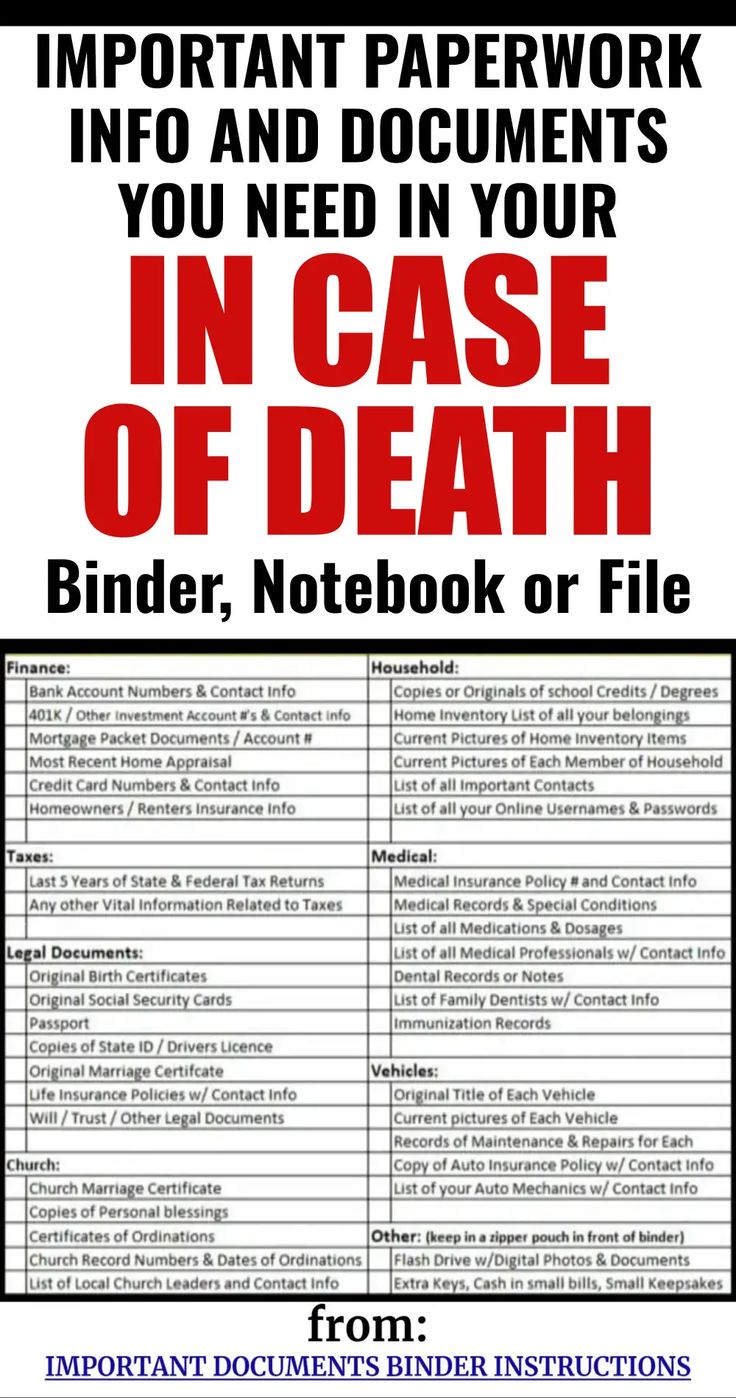

Documents to Keep

Death Certificate

Multiple copies of the death certificate are a must:

- To claim insurance benefits

- To file for estate distribution

- To transfer property

- As proof of death for banks and financial institutions

💡 Note: Ask for at least 10 copies; some requests may be more than what you initially anticipate.

The Will

If your loved one left a will, this becomes the guiding document for their wishes:

- Asset distribution instructions

- Guardianship provisions for minors

- Names of executors and trustees

Life Insurance Policies

Keeping these documents ensures:

- Beneficiaries can claim their benefits.

- You have records of the policy conditions and terms.

Financial Records

These can include:

- Bank statements

- Retirement accounts

- Investment portfolios

- Loan documents or mortgage details

📌 Note: Ensure all account numbers, policy numbers, and contact information for each institution are listed.

Tax Returns

Tax returns provide crucial information:

- To finalize the deceased’s tax affairs.

- To assess any tax liabilities or refunds due to the estate.

Property Documents

Retain:

- Deeds to properties

- Vehicle titles

- Homeowner association agreements

Health and Medical Records

These might be needed for:

- Claiming health-related benefits

- Understanding any genetic conditions for the family’s health awareness

Debts and Outstanding Bills

A list of debts and bills should be kept to:

- Inform creditors of the passing

- Settle outstanding accounts or negotiate settlements if necessary

Organizing the Paperwork

Here's a structured way to organize this important paperwork:

Create a Master List

- List all the documents to be kept.

- Include where they can be found, like in a safe or with an attorney.

Secure Storage

Keep physical documents in a safe place:

- A fireproof safe at home or office

- Safe deposit boxes at banks

Digital Backup

If possible, scan and digitize:

- This provides an easy way to access documents and share them.

- Ensure digital files are secured with encryption or password protection.

Password Manager

Consider using or updating a password manager:

- To keep records of logins for various financial accounts.

- Set up access for trusted individuals in case of emergencies.

Keep a Timeline

- Track when documents need to be reviewed or when certain deadlines fall due.

🔒 Note: Sharing access or granting viewing rights to critical documents with trusted family members or the executor can be beneficial.

Moving Forward

After the initial paperwork is organized:

- Make sure to inform relevant parties like creditors, government agencies, and insurance providers.

- Consider creating a new will or updating your estate plan if the passing of your loved one impacts your own financial situation.

In summary, retaining essential paperwork after a loved one's passing is not just about fulfilling legal obligations; it's an act of love, ensuring their final wishes are honored, their debts settled, and their legacy preserved. By keeping these documents in order, you provide clarity to yourself and future generations, helping them understand and perhaps even follow in the footsteps of the loved one they've lost. Remember, while these tasks are often daunting, they are necessary steps towards healing and gaining peace of mind during a difficult time.

How long should I keep these documents?

+Keep documents like the death certificate indefinitely. Wills and trust documents should be kept permanently. Financial records can be kept for at least 7 years for tax purposes. For property deeds, retain them as long as ownership exists. Medical records might be kept for at least 10 years or as mandated by local laws.

Do I need to keep physical copies or will digital copies suffice?

+Many institutions now accept digital copies, but for critical documents like the will or property deeds, retaining both physical and digital copies is advisable. Ensure digital files are secure.

What should I do if my loved one didn’t leave a will?

+If there’s no will, the estate is distributed according to state laws of intestacy. Consult with an estate attorney to navigate through this process. You might still need to keep similar records to manage the estate effectively.