Essential Paperwork After a Loved One's Passing

After the loss of a loved one, dealing with the myriad of administrative tasks can feel overwhelming. Beyond the grief and emotional turmoil, there are legal, financial, and practical matters that must be addressed to honor your loved one’s wishes, settle their affairs, and secure your financial future. Here's a comprehensive guide to help you navigate through this difficult time with as much ease as possible.

Legal Documentation and Notification

The first step after a loved one’s passing involves gathering and processing essential legal documents:

- Death Certificate: Obtain multiple copies from the funeral home or local vital records office. This document is crucial for financial institutions, government agencies, and insurance companies.

- Will and Trust Documents: If there was a will or trust, locate these documents. They detail how assets should be distributed and can help avoid disputes or legal complications.

⚠️ Note: If the deceased did not leave a will, the state laws will determine how assets are divided. Consult with an estate attorney for guidance.

Notifying Relevant Parties

Once you have the necessary documents, you’ll need to notify several entities:

- Family and Close Friends: They need to know for both emotional support and to fulfill any personal duties or wishes outlined by the deceased.

- Employers or Pension Providers: This can lead to benefits such as pensions, life insurance payouts, or health benefits for surviving family members.

- Financial Institutions: Banks, credit card companies, and investment accounts need to be updated or closed.

- Government Agencies: The Social Security Administration, VA (if applicable), IRS, and state tax departments need to be informed to stop benefits or adjust tax statuses.

👁️ Note: You might need to provide several copies of the death certificate when notifying these parties.

Managing Debts and Creditors

Handling financial obligations is critical:

- Credit Report Review: Request a credit report to identify all debts. This can help manage or negotiate these debts effectively.

- Pay Outstanding Debts: Use estate funds to pay off secured debts (like mortgages) first, followed by unsecured debts.

Table: Debt Priority and Settlement

| Order of Settlement | Debt Type | Description |

|---|---|---|

| 1 | Funeral Expenses | Immediate costs related to the funeral. |

| 2 | Secured Debts | Debts tied to property like mortgages or car loans. |

| 3 | Administrative Expenses | Costs associated with settling the estate. |

| 4 | Unsecured Debts | Credit cards, personal loans, medical debts. |

Insurance Claims

Notify and file claims with:

- Life Insurance: Policies often need to be claimed within a certain timeframe, and payments can provide financial support or cover funeral costs.

- Health Insurance: This can cover end-of-life medical expenses if not paid already.

Personal Property and Assets

Handling the tangible and intangible belongings:

- Real Estate: Properties should be secured, assessed for value, and potentially liquidated or transferred.

- Personal Items: Jewelry, cars, and personal effects can either be distributed as per the will or auctioned/sold.

- Digital Assets: Passwords, social media accounts, and digital properties need to be addressed. Check for any digital will or instructions.

💡 Note: Keep detailed records of all items for estate tax purposes or potential disputes.

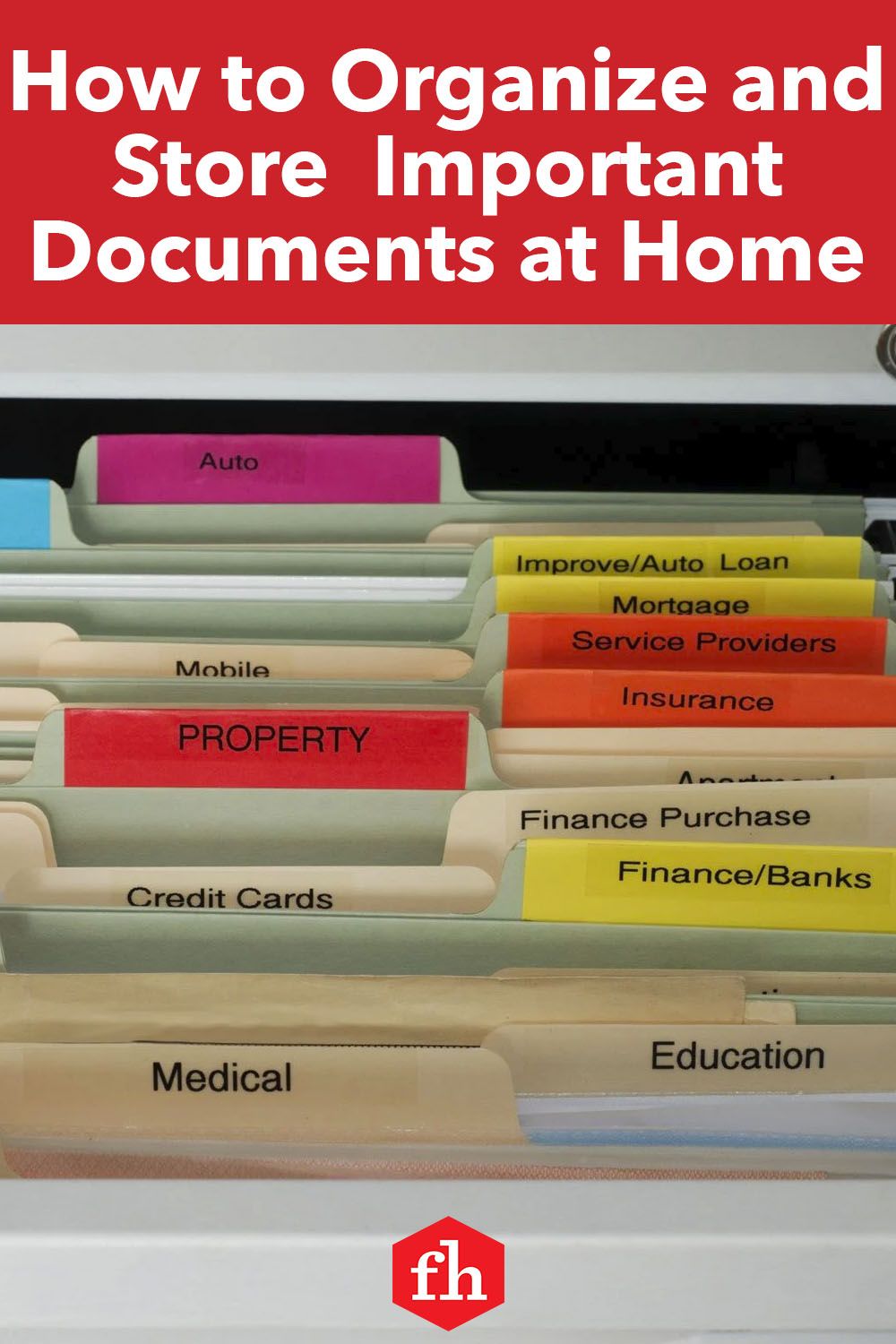

Closing of Accounts

Begin the process of closing or reassigning accounts:

- Bank Accounts: Close or transfer funds following estate settlement.

- Subscriptions and Memberships: Cancel or change any ongoing subscriptions.

- Vehicle Titles: Transfer ownership of cars or sell them.

Emotional and Practical Closure

Finally, take steps towards emotional and practical closure:

- Hold a Memorial or Celebration of Life: This can aid in healing and provide a sense of closure for family and friends.

- Maintain or Update Estate Plan: The passing of a loved one often prompts reviewing your estate planning to ensure your own wishes are clear.

As you navigate through these steps, remember that patience and compassion are essential. Not only are you handling complex legal and financial matters, but you’re also dealing with personal loss. Take the time needed to process your emotions while attending to these practicalities.

What if there is no will?

+

If there is no will, the estate goes through probate, and assets are distributed according to state intestacy laws, which may not align with the deceased’s wishes.

How long does it take to settle an estate?

+

The process can take anywhere from a few months to several years, depending on complexity, disputes, and legal requirements.

Can creditors come after me for my loved one’s debts?

+

Generally, no. Only in specific situations like joint accounts or being a co-signer can you be liable for debts.

What happens to the deceased’s Social Security benefits?

+

The Social Security Administration will adjust or stop benefits upon notification of the death. Surviving spouses or dependent children might be eligible for survivors’ benefits.

Do I need an attorney to settle the estate?

+

While not always necessary, an attorney can guide you through legal nuances, help resolve disputes, and ensure everything is done correctly, potentially saving time and reducing stress.