Essential Paperwork After Mom's Passing: A Checklist

In the wake of losing a beloved parent like your mom, dealing with the subsequent administrative tasks can seem overwhelming. Beyond the emotional turmoil, there are practical steps you must take to manage your mom's affairs legally and smoothly. Here's an essential checklist to help guide you through the paperwork maze after your mother's passing.

Notifying Relevant Institutions

- Social Security Administration (SSA): If your mother was receiving Social Security benefits, you must notify the SSA of her passing to stop the payments. This can be done via an in-person visit, over the phone, or through their website.

- Banks and Financial Institutions: Inform banks, credit unions, and financial advisors to close her accounts or transition them to a surviving spouse or as per her will. Bring copies of her death certificate and any necessary legal documents.

- Insurance Companies: Contact life, health, and property insurance providers to report her death and initiate the claims process if applicable.

- Employer or Pension Fund: If she was working or retired, her employer or pension fund should be notified. This might be to manage benefits or continue pensions for survivors.

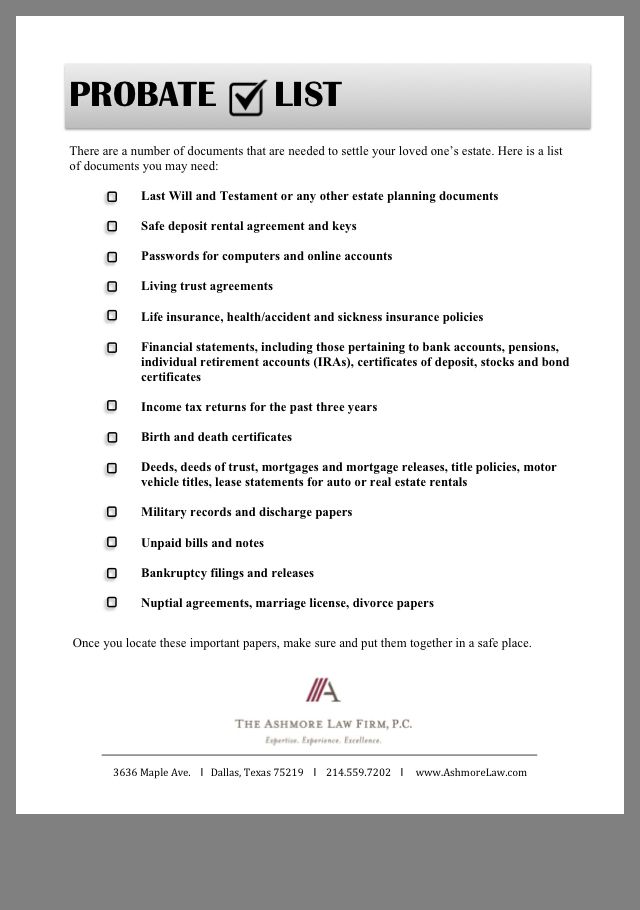

Handling Legal and Estate Matters

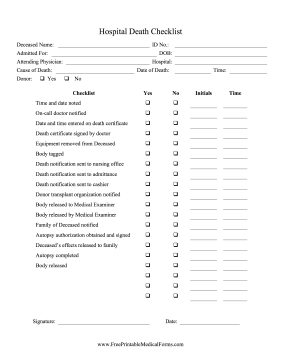

- Obtain Multiple Certified Copies of the Death Certificate: You will need these for various transactions and to prove her passing. Financial institutions, insurance companies, and real estate transfers all require them.

- Probate Court: If your mom had assets, her estate might need to go through probate, a legal process where the court oversees the distribution of the estate. Engage a probate lawyer if her will is complex or her estate is large.

- Executor of Will: If you or someone else was named as executor, take steps to manage the estate, including:

- Assess her assets, debts, and gather all relevant documents.

- Settle debts and taxes from the estate.

- Distribute assets according to the will or, if there is no will, following state laws of intestacy.

Dealing with Property and Assets

- Real Estate: Property must be assessed for transfer or sale. If she owned the property solely, the transfer process involves probate or a simplified affidavit in some states.

- Vehicles: Deal with her vehicles by transferring titles or selling them. The process varies by state, often requiring probate, a notarized affidavit, or direct title transfer to heirs.

- Other Assets: Investments, personal property, and other valuables must be inventoried and handled per the will or state laws.

| Asset Type | Steps to Take |

|---|---|

| Real Estate |

|

| Vehicles |

|

| Investments and Savings |

|

💡 Note: Always consult with a lawyer or financial advisor for complex estates or if legal issues arise. They can provide tailored advice for your unique situation.

Closing Accounts and Canceling Services

- Utilities and Subscriptions: Cancel her utilities, internet, cable, and any ongoing subscriptions to prevent further charges.

- Passports and IDs: Surrender her driver’s license to the DMV. Cancel her passport at a passport acceptance facility or through the State Department.

- Social Media and Online Accounts: Memorialize or delete her social media accounts. Accessing her online accounts might require legal documentation or password sharing from family.

Emotional and Personal Considerations

While managing the paperwork, remember to take care of yourself emotionally. Here are some considerations:

- Reach Out for Support: Grief counseling, support groups, or just talking with friends can help manage emotions.

- Keep a Memento: Choose items that hold sentimental value. Photos, letters, or her favorite book can keep her memory alive.

- Manage Digital Legacy: Organize her digital assets like photos or documents, which can be passed on or memorialized online.

In navigating the aftermath of losing your mother, this comprehensive checklist ensures you cover all necessary steps. The emotional toll might make the process challenging, but taking these steps ensures her affairs are in order, honoring her legacy, and providing peace for your family. Remember, you are not alone in this; seek support where needed, and take each step with care and respect for the person you've lost.

Do I have to go through probate if my mom’s estate was small?

+

Not necessarily. Many states offer simplified procedures or “small estate” affidavits to bypass probate for estates below a certain value. Check with local probate court or a lawyer.

How many death certificates will I need?

+

Plan to obtain at least 10 certified copies initially. You’ll need one for each financial institution, insurance claim, property transfer, and more. Additional copies can be requested later if needed.

What if my mom had debts?

+

Typically, her estate will be responsible for settling her debts. Assets may be sold to cover debts, or heirs might choose to honor debts personally. Consult a probate lawyer or financial advisor for advice.