Essential Tax Paperwork Guide for Tax Season

As the tax season approaches, it's crucial to have all your documents in order to ensure a smooth and efficient tax filing process. Whether you're a seasoned tax filer or a first-timer, understanding what documentation is required can significantly reduce stress and potential errors. This guide will help you navigate through the essential tax paperwork you need to keep on hand, why you need it, and how to manage it effectively.

Why Proper Documentation is Crucial

Proper documentation is not just a suggestion; it’s a necessity for several reasons:

- Accuracy: Correct documentation helps in filling out tax forms accurately.

- Audit Defense: In case of an audit, having all paperwork in order provides a robust defense.

- Maximize Deductions: Proper records help claim all the deductions you’re eligible for, reducing your taxable income.

- Compliance: Meeting all legal requirements minimizes the risk of penalties.

Essential Tax Documents

Here’s a detailed list of the documents you should gather before you start your tax preparation:

1. W-2 Forms

These forms are issued by employers, detailing your annual wages and the amount of taxes withheld from your paycheck. Every employee should receive one from each employer they’ve worked for during the tax year.

2. 1099 Forms

These forms come in various types:

- 1099-INT: For interest income.

- 1099-DIV: For dividend income.

- 1099-G: For state and local tax refunds, unemployment compensation.

- 1099-MISC: For freelance income, prizes, or other miscellaneous income.

- 1099-B: For proceeds from broker transactions.

- 1099-K: For payment card and third-party network transactions.

💡 Note: Not all freelance work or side gigs require a 1099-MISC; you must still report income even if you don’t receive a form.

3. Form 1095

If you have health insurance through the Affordable Care Act marketplace, you’ll receive Form 1095-A. If covered by employer-sponsored insurance, look for Form 1095-B or 1095-C.

4. Social Security Benefits Statement (SSA-1099)

This document shows the total Social Security benefits you received in the past year if you’re receiving them.

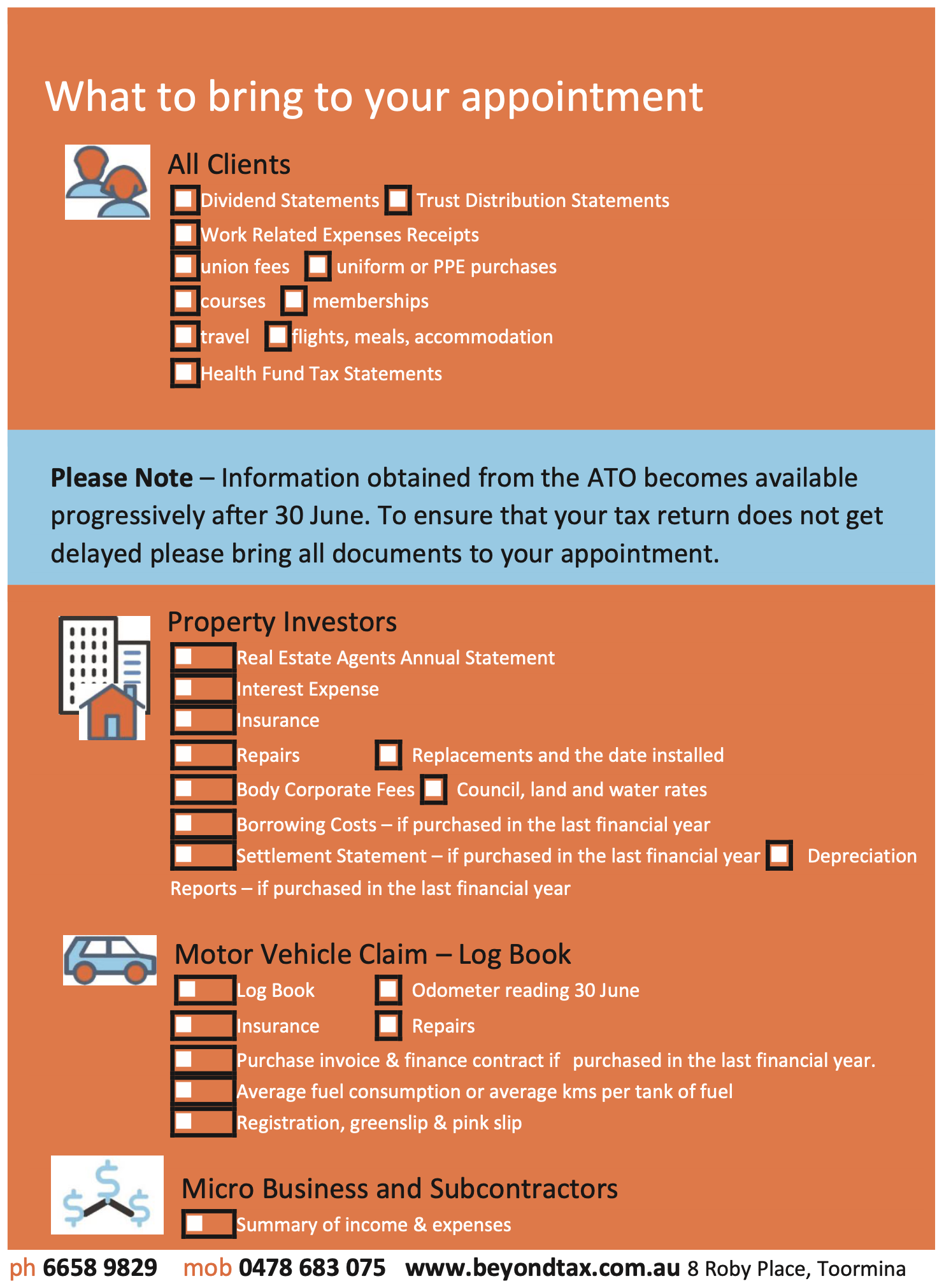

5. Records for Deductions and Credits

These include:

- Receipts for medical expenses, home mortgage interest, real estate taxes, charitable donations, etc.

- Bills or invoices for energy-efficient home improvements (for energy credits).

- Documentation for child or dependent care expenses, educational expenses (for tax credits).

6. Records of Estimated Tax Payments

Any estimated tax payments you made during the year should be noted as they reduce your tax liability.

7. Proof of Expenses for Business Owners

If you’re self-employed or have a business:

- Keep all receipts for business expenses like travel, office supplies, utilities, etc.

- Maintain records of business use of your vehicle.

- Track home office expenses if applicable.

8. Records of Any Cryptocurrency Transactions

With the rise of cryptocurrency, documenting all your transactions, gains, and losses has become essential.

Here's a table to help you organize your documents:

| Document Type | Description | Where to Look |

|---|---|---|

| W-2 Forms | Details annual wages and taxes withheld | From employers |

| 1099 Forms | Various types for different income | From financial institutions, businesses, etc. |

| 1095 Forms | Health insurance coverage | Marketplace or employer |

| SSA-1099 | Social Security benefits received | Social Security Administration |

| Deduction Receipts | Medical, home improvement, charity, etc. | Personal records |

🔍 Note: Keeping documents organized can not only make filing easier but also ensure you're not missing out on any deductions or credits.

Organizing Your Documents

The key to a stress-free tax season is organization:

- Gather: Collect all your tax-related documents in one place.

- Organize: Use folders or digital folders for different document types. Date documents to maintain chronological order.

- Scan: Digitize your physical receipts and documents. Services like Evernote or Dropbox can help keep these organized.

- Verify: Cross-check all amounts reported with your records to ensure accuracy.

As we approach the wrap-up of this guide, remember that thorough preparation can make all the difference. The key points to take away include understanding why proper documentation is essential, knowing which documents you need to gather, and organizing these documents effectively. With this approach, you'll be well-equipped to navigate tax season with ease.

What should I do if I haven’t received my W-2 form by mid-February?

+

If your employer doesn’t provide your W-2 by the deadline, you should contact them directly. If that fails, you can contact the IRS for assistance.

Do I need to save all my tax documents?

+

It’s wise to keep your tax records for at least 3 years after filing your return, but in some cases, keeping them for up to 7 years or indefinitely might be necessary.

What if I miss a document?

+If you realize you’re missing a document, contact the issuer to get a duplicate. If possible, estimate the missing amounts and amend your tax return later if necessary.