5 Essential Documents for SAFT ICO Investment

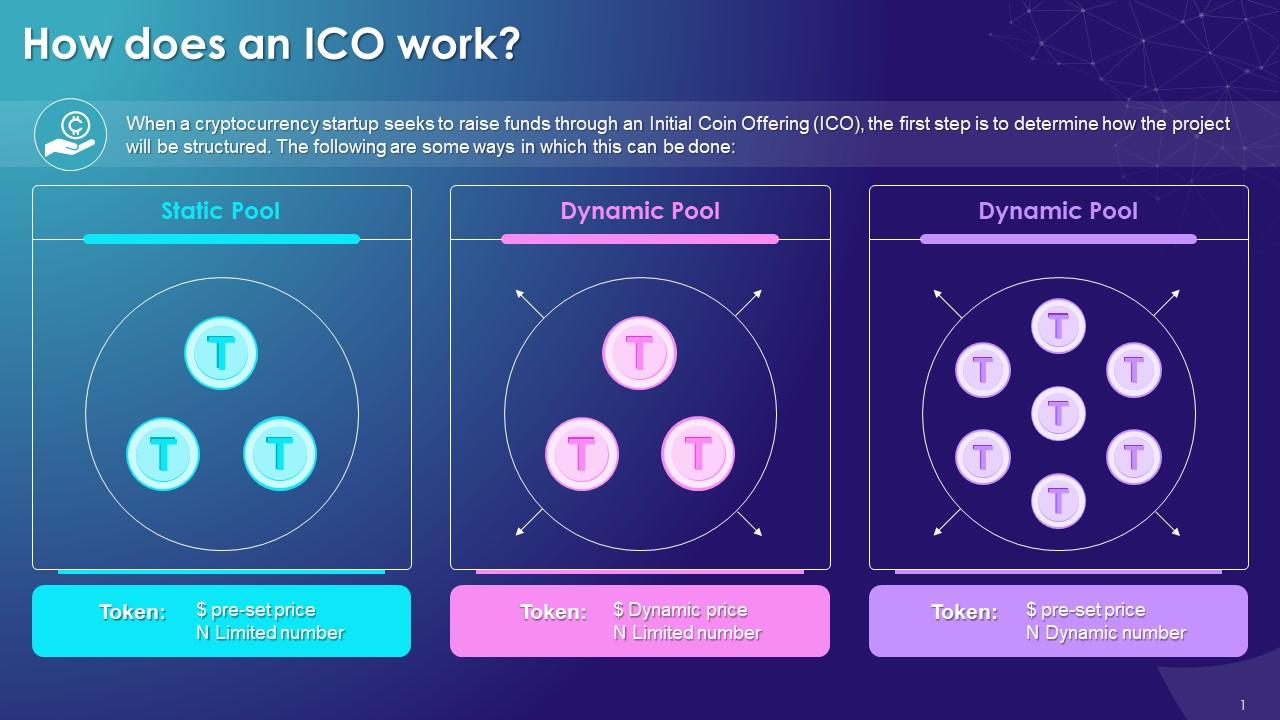

Entering the world of cryptocurrency and blockchain investments can be both thrilling and complex. An essential aspect of navigating this domain includes understanding the initial steps and documentation for participating in a SAFT (Simple Agreement for Future Tokens) ICO (Initial Coin Offering). Here, we outline five essential documents you should be familiar with before diving into a SAFT ICO investment:

1. The SAFT Agreement

The SAFT document is the cornerstone of any SAFT ICO. It is essentially a contract that outlines the agreement between the investor and the issuing company. Here’s what you need to know:

- Purchase Amount: The exact amount of money you are investing.

- Token Purchase Agreement: Details about how and when you will receive your tokens.

- Future Token Delivery: Specifies when the tokens will be delivered to investors.

- Regulatory Compliance: Compliance with securities laws and regulations.

💡 Note: Ensure that the SAFT agreement clearly states that the funds will be returned if the project does not meet certain milestones or if regulatory compliance cannot be achieved.

2. The Whitepaper

The whitepaper serves as a detailed blueprint of the project:

- Project Description: An in-depth explanation of what the project aims to achieve.

- Tokenomics: Information about token distribution, utility, and economics.

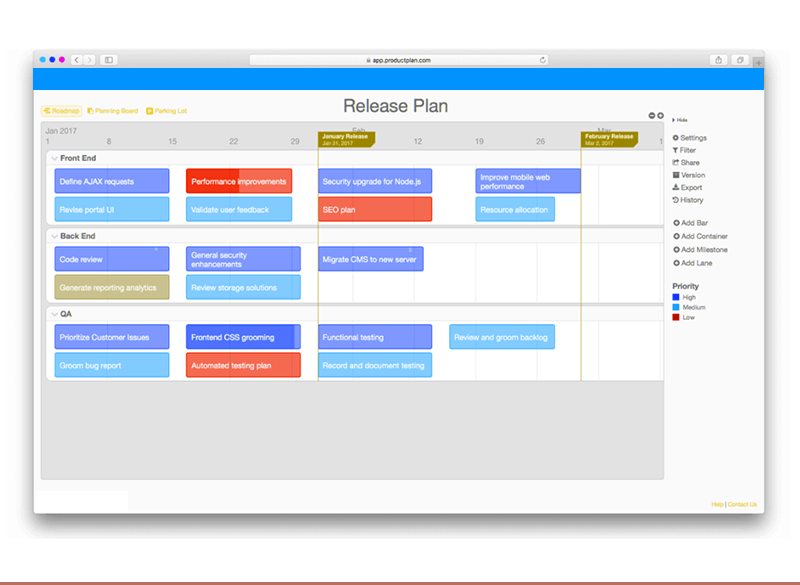

- Roadmap: A timeline of project development stages.

- Team Background: Credentials and experience of the team behind the project.

- Risk Factors: Detailed risks associated with the investment.

3. Legal Opinion

This document is often provided by a law firm, offering insights on:

- Regulatory Compliance: How the ICO will adhere to local and international securities laws.

- Investor Rights: Legal protections and rights for investors.

- Token Classification: Whether the tokens are classified as securities or utility tokens.

4. KYC/AML Documents

Anti-money laundering (AML) and Know Your Customer (KYC) documents are essential to prevent fraud and ensure compliance:

- Verification Requirements: What documents you need to provide for verification.

- Process Timeline: Expected time for verification completion.

- Privacy Measures: How your information will be protected and used.

5. Token Distribution Plan

This document details:

- Token Allocation: How tokens are distributed among founders, team, investors, and other entities.

- Lock-up Periods: Any mandatory waiting periods for team and investor tokens.

- Vesting Schedules: How tokens will be gradually released over time.

In the complex landscape of cryptocurrency investments, having a clear understanding of these essential documents can make the difference between a sound investment and a risky venture. By reviewing each document, you not only educate yourself on the legal, operational, and financial aspects of the ICO but also protect your investment against potential scams or regulatory issues. Investing in SAFT ICOs requires a thorough due diligence process. By examining the SAFT agreement, whitepaper, legal opinion, KYC/AML policies, and token distribution plans, you ensure that you are well-informed about the project's vision, risks, and regulatory stance. This proactive approach not only maximizes the chances of a successful investment but also positions you to make strategic decisions in an often volatile market.

What is the difference between a SAFT and an ICO?

+

A SAFT (Simple Agreement for Future Tokens) is an investment contract where investors receive tokens in the future, often at a discount, after the project achieves certain milestones. An ICO (Initial Coin Offering) is a fundraising method where tokens are sold directly to investors for immediate use or trade.

Can you invest in a SAFT ICO without a legal opinion?

+

While it’s not legally required, a legal opinion can offer crucial insights into the compliance and regulatory aspects of the ICO, making it highly recommended to review one before investing.

Why is KYC/AML important in a SAFT ICO?

+

KYC/AML checks are vital to prevent fraud, money laundering, and terrorist financing. They help maintain the integrity of the project and protect both the investor and the platform from legal repercussions.