5 Essential Documents for Guarantors

Stepping into the role of a guarantor is a significant commitment that involves both legal and financial responsibilities. Whether you're backing a loan, a rental lease, or another type of contract, having the right documentation in place can help clarify the terms and obligations for all parties involved. Here's a comprehensive guide to the essential documents a guarantor should have to ensure a smooth and legally sound process:

1. Guarantor Agreement

At the core of any guarantor arrangement is the Guarantor Agreement. This document:

- Outlines the terms of the guarantee.

- Specifies the guarantor’s obligation to cover any defaults by the principal debtor.

- Defines the scope of liability, including maximum amount or duration of the guarantee.

- States the conditions under which the guarantor can be released from their obligation.

- Clarifies the rights of the guarantor, like right to notice of default.

⚠️ Note: Always review the Guarantor Agreement with a legal professional to ensure all clauses are clearly understood.

2. Credit Report

While not a document that the guarantor provides, obtaining a Credit Report for the principal debtor is crucial:

- It helps assess the debtor’s creditworthiness and potential risk to the guarantor.

- Lenders often require this to evaluate both parties involved.

- The guarantor should check for any history of defaults, bankruptcies, or outstanding debts.

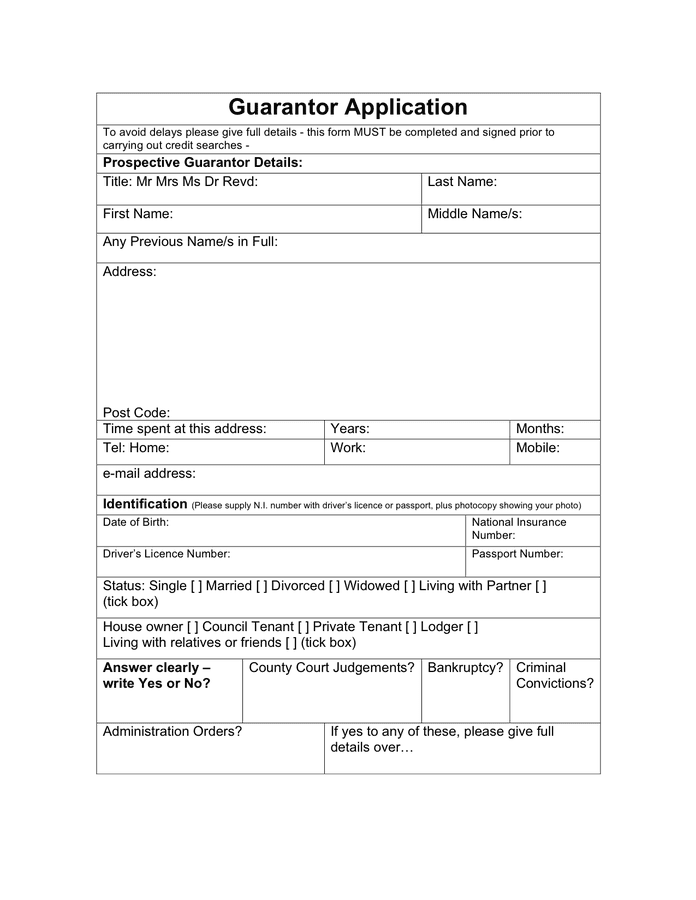

3. Identification Documents

Identification documents such as passports or driver’s licenses are needed for:

- Verifying the identity of the guarantor.

- Meeting legal requirements for official records or notarization.

- Confirming residency and legal status for international agreements.

4. Proof of Income and Financial Stability

| Document Type | Purpose |

|---|---|

| Pay Stubs | Show regular income to support the ability to cover potential debts. |

| Bank Statements | Reflect financial stability and ability to guarantee the loan. |

| Investment Portfolio | Indicate additional assets that could be used if the guarantor needs to fulfill the guarantee. |

5. Deed of Personal Guarantee

This legal document formalizes the personal guarantee, detailing:

- The guarantor’s promise to pay if the principal debtor cannot.

- Any conditions of this commitment.

- Limitations on the guarantor’s liability.

✅ Note: This document might require legal notarization or witnessing.

In the journey of supporting a friend, family member, or business partner as a guarantor, having these documents in place is more than just a formality; it's a safeguard. They offer clarity, legal protection, and ensure all parties know their responsibilities and rights. Keep in mind that being a guarantor can significantly impact one's credit and financial health, so it's worth taking the time to prepare and understand the documents involved.

What happens if the principal debtor defaults?

+

If the debtor defaults, the guarantor becomes responsible for paying off the debt or fulfilling the obligations as outlined in the guarantor agreement.

Can the terms of a guarantee be negotiated?

+

Yes, terms like the duration of the guarantee, the maximum amount, and conditions for release can often be negotiated before signing the agreement.

Is it necessary for a guarantor to have a lawyer review the documents?

+

While not strictly necessary, having a lawyer review the documents can provide legal protection and clarity on your obligations and rights.