5 Essential Documents Needed After Someone Dies

Handling the responsibilities that arise after someone passes away can be emotionally and administratively overwhelming. Knowing what essential documents are required can help streamline this process, making it more manageable during a difficult time. Here, we discuss five crucial documents you'll need to gather or obtain in the aftermath of a loved one's death.

1. Death Certificate

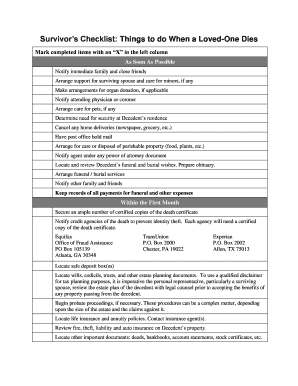

The death certificate is undoubtedly the most critical document when someone dies. This official document records the fact, time, place, and cause of death. Here are key steps to obtain it:

- Report the death to local authorities or medical facilities where the death occurred. They will then issue an interim or final death certificate.

- Usually, a family member or the executor needs to apply for copies of the death certificate. Multiple copies are often necessary for various administrative tasks.

- In some cases, you might need to provide identification or other personal information to get certified copies.

2. Will

If the deceased left a will, it dictates how their estate should be handled:

- Locate the original or the most recent copy of the will. This document is often kept with a solicitor, bank, or in a safe deposit box.

- The will outlines the executor’s responsibilities, beneficiaries, and how the estate should be distributed.

- If there’s no will, the estate falls under intestate laws, which can complicate the distribution process.

3. Trust Documents

A trust is a legal entity set up by an individual (the grantor) for the benefit of another (the beneficiary). Here’s what you need to know about trust documents:

- Identify any trusts the deceased had established, which may include Living Trusts, Revocable Trusts, or Irrevocable Trusts.

- Trust documents will guide how assets are to be managed, distributed, or preserved.

- Unlike wills, trusts generally avoid probate, streamlining the transfer of assets.

4. Life Insurance Policies

Life insurance policies provide financial support to surviving family members:

- Locate all life insurance policies, including group policies through employers.

- The beneficiary(ies) will need to file a claim with the insurance company. This often requires copies of the death certificate and policy documentation.

- Insurance payouts can be used to cover funeral expenses, debts, or supplement income.

5. Financial Account Details

Accounts and assets need to be managed or settled:

- Gather details on bank accounts, investment accounts, retirement plans, and any debts or loans.

- Notify financial institutions of the death to freeze or reassign accounts as needed.

- Credit cards, loans, and mortgages need to be addressed to avoid interest accumulation and potential damage to credit scores.

💡 Note: Estate planning can significantly ease the process for your survivors. Discussing and organizing these documents in advance is recommended.

As you navigate through this challenging period, understanding what documents are needed and how to access them is essential for a smooth transition. Whether it's settling an estate, claiming life insurance benefits, or simply ensuring all legalities are in order, these documents serve as the backbone for addressing everything that follows a loved one's departure.

Where can I get a death certificate?

+

After reporting the death, you can obtain the death certificate from the local registrar or the funeral home. They usually provide copies; however, certified copies might require an additional request to the state’s vital records office.

What if I can’t find the will?

+

If you’re unable to locate the will, you can conduct a search through the courts, lawyers, or with friends and family. If still not found, the estate will be administered according to the laws of intestacy.

Do I need to notify banks immediately after a person’s death?

+

Yes, you should notify banks and financial institutions as soon as possible to prevent unauthorized access to accounts and to start the process of transferring assets or paying off debts.