Essential Paperwork for Renting an NYC Apartment

Embarking on the journey to rent an apartment in New York City (NYC) can be exhilarating yet daunting due to its bustling real estate market. Amidst the excitement, understanding the paperwork involved is crucial for a seamless experience. Here, we will cover every essential piece of documentation you'll need, guiding you through the application process with ease.

Understanding the NYC Rental Market

NYC's rental market is dynamic, with high demand and a varied inventory of rentals from pre-war buildings in the historic neighborhoods to modern high-rises in the financial district.

- Competition: The city's popularity leads to intense competition for desirable apartments.

- Pricing: Rental prices can fluctuate based on season, demand, and location. Studios might start at around $2,500, while luxury apartments in prime areas can be significantly higher.

- Documentation: Landlords require extensive documentation due to the competitive market to ensure applicants are credible and financially stable.

Essential Documents for Renting in NYC

Proof of Income

Demonstrating your financial capability to meet rent obligations is one of the first steps in securing an apartment. Here’s what you need:

- Pay Stubs: Provide the last two or three months of pay stubs to show a steady income.

- Bank Statements: Recent statements from your bank to reflect financial stability.

- Tax Returns: Copies of your federal tax returns for the past two years, including all relevant schedules and W-2 forms.

- Offer Letter: If you've recently started a new job, a letter stating your start date, salary, and other compensations.

Credit Report

A good credit score can significantly boost your application:

- Most landlords will check your credit report through major credit bureaus like Equifax, Experian, or TransUnion.

- If your score is less than ideal, consider a guarantor or providing a larger security deposit.

Employment Verification

Proof of stable employment adds credibility:

- Employers often need to verify your employment through a phone call or email.

- Your lease application might include a form for your employer to fill out.

References

Personal and professional references are often requested to vouch for your reliability and character:

- Personal References: Friends or family who can speak to your character.

- Professional References: Colleagues or supervisors who can verify your employment and provide a work-related character reference.

Identification

Identification to prove your identity and age:

- A valid driver's license, passport, or state-issued ID.

Security Deposit

Landlords require a security deposit, which is usually one or two months’ rent:

- This deposit protects landlords from potential damages and unpaid rent.

Application Fee

Covering the cost of background checks, this fee is typically non-refundable:

- Average application fees in NYC range from $20 to $100 per applicant.

⚠️ Note: Collecting and providing the required documents early can speed up your application process.

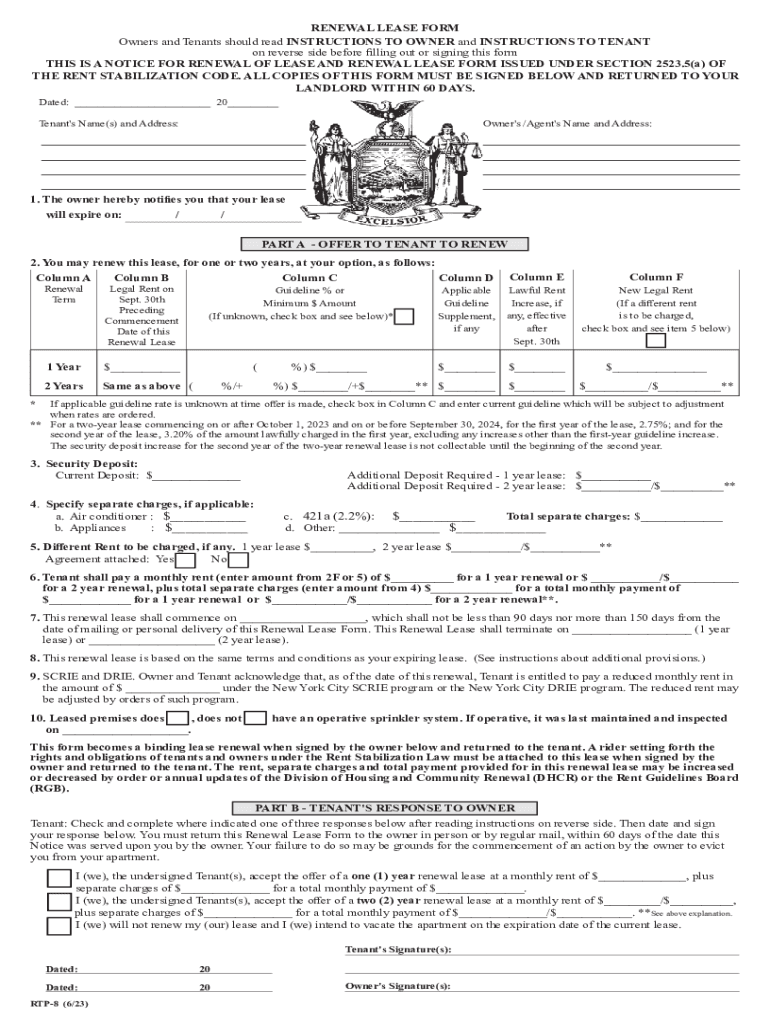

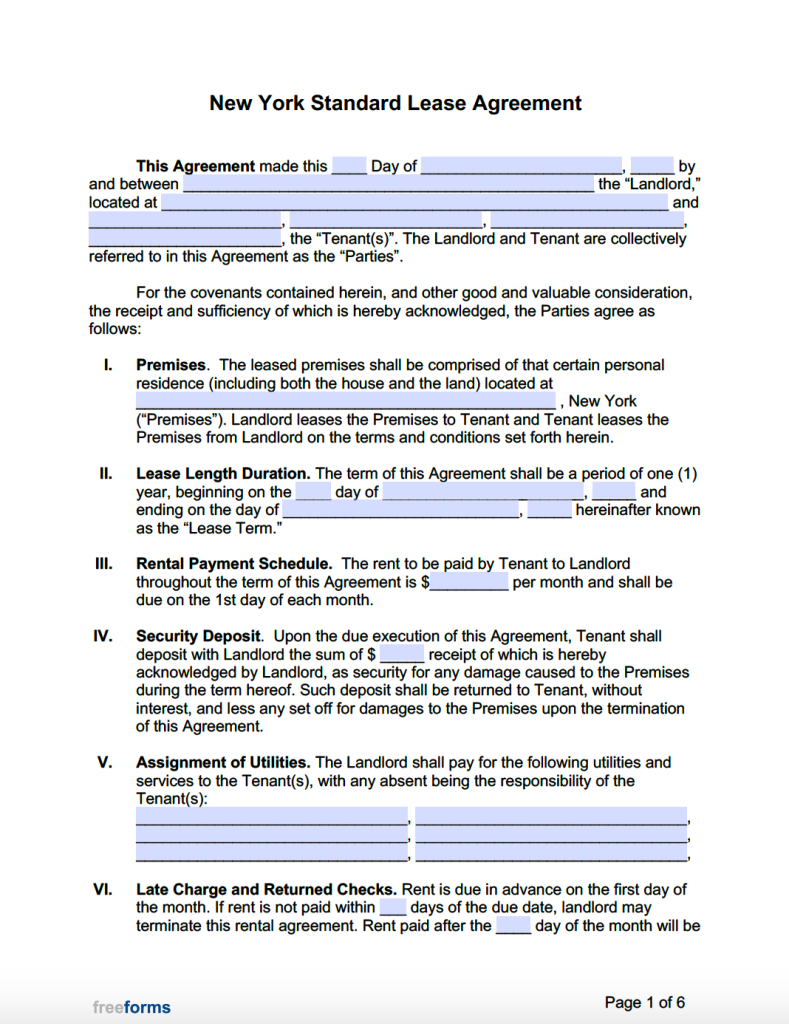

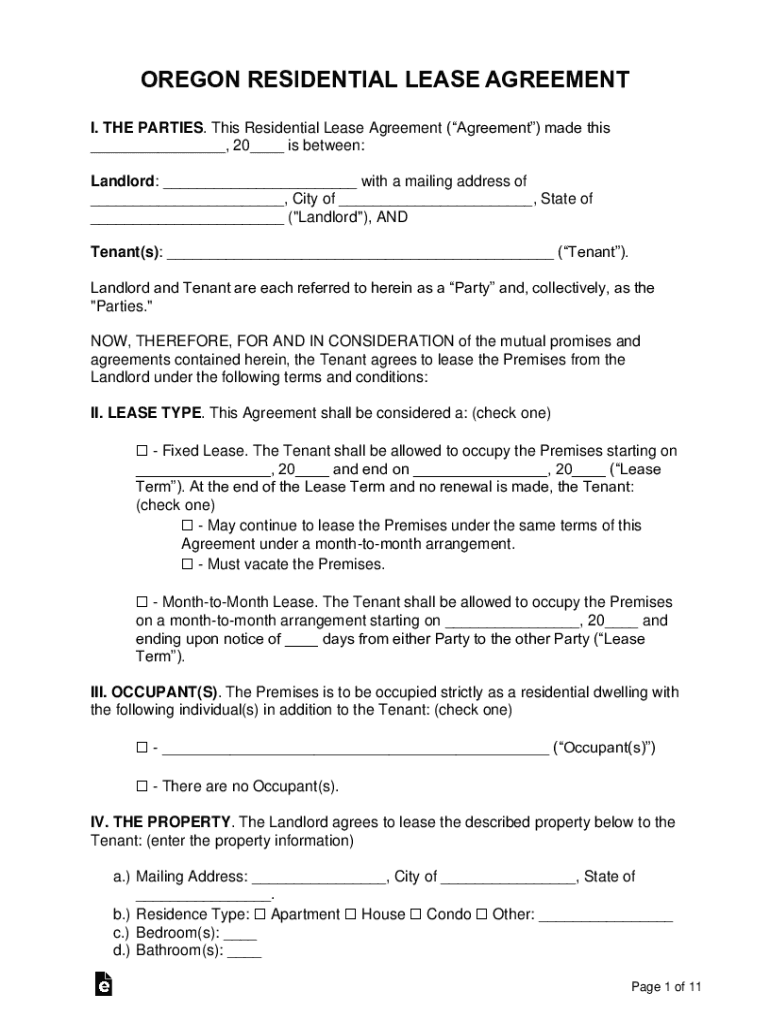

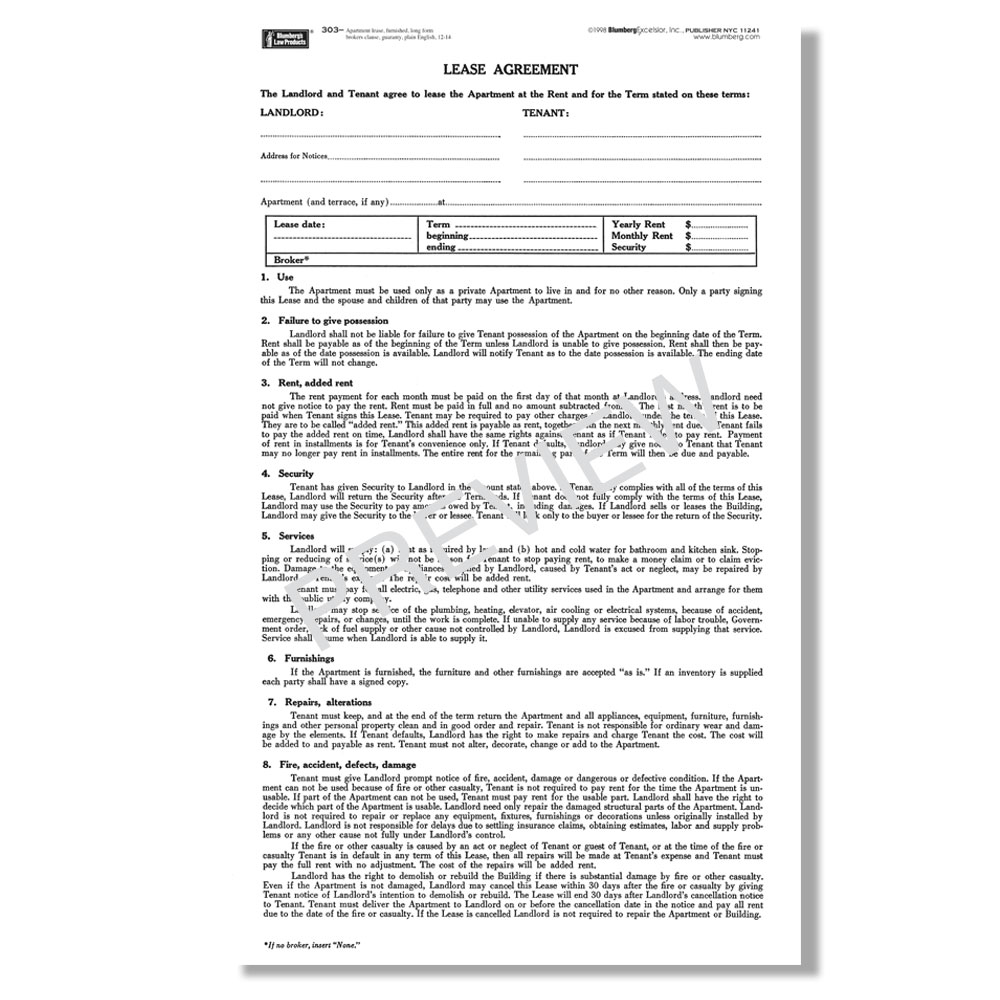

Lease Agreement

A key document defining the terms of your tenancy:

- Review rent, lease duration, renewal options, maintenance duties, and potential early termination fees.

Broker Fee (If Applicable)

If using a broker, their fee is often one month’s rent or a percentage of the annual rent:

- Ensure you understand if this fee is negotiable or split between you and the landlord.

🔍 Note: Thoroughly review all lease agreements with a fine-tooth comb, considering legal consultation if necessary.

Navigating the Application Process

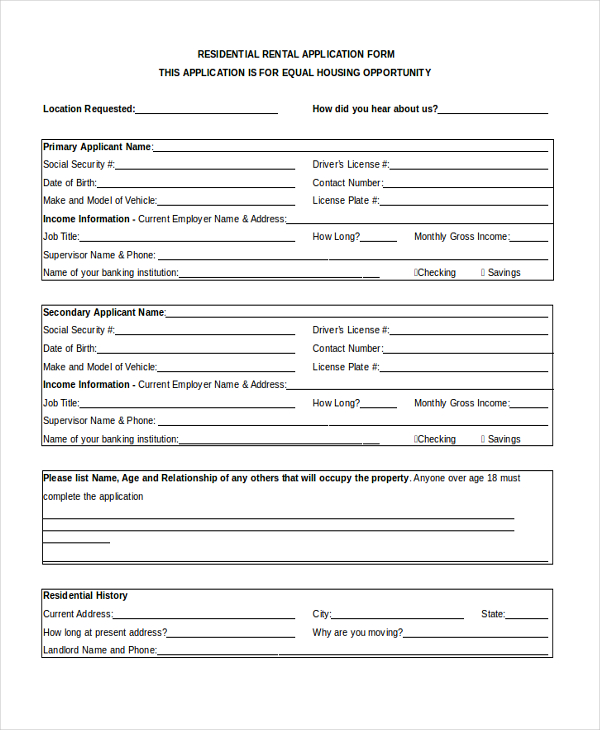

Filling out the Application

Each landlord or management company might have a specific application form:

- Fill it out completely and accurately, double-checking for any errors.

Submitting Documents

Organize your documents in a digital or physical folder:

- Submitting them together ensures a smooth application process.

Background Check

Most landlords conduct background checks to evaluate your financial, criminal, and credit history:

- Be prepared to provide additional information if discrepancies arise.

Awaiting Approval

Understand the decision-making timeline:

- Approval might take several days to a couple of weeks.

🔎 Note: Stay in touch with your landlord or broker throughout the approval process to address any concerns promptly.

Alternative Solutions

Guarantors or Cosigners

If your financial profile isn’t strong enough, a guarantor or cosigner can help:

- They typically need to earn at least 80 times the monthly rent and provide the same documentation as you.

Renters Insurance

Some landlords require renters insurance for protection:

- Insurance might be mandated or can provide added peace of mind.

To wrap it up, the process of renting an apartment in NYC can be streamlined by ensuring you have all the necessary documents well-prepared. Remember, thorough preparation, prompt document submission, and clear communication with landlords or brokers are your keys to unlocking your new apartment's door. Each application tells a story, and with the right paperwork, yours will be one of financial stability, reliability, and success in securing a great place to live.

Why do landlords in NYC ask for so many documents?

+The competitive rental market in NYC requires landlords to ensure prospective tenants can meet rent obligations, hence the need for extensive documentation.

What if my income doesn’t meet the landlord’s criteria?

+Consider securing a guarantor or cosigner who can meet the income requirements. Alternatively, you might negotiate a higher security deposit.

How can I speed up my apartment rental application?

+Prepare all documents in advance, maintain communication with your landlord or broker, and submit your application quickly.