Essential Paperwork for Buying a Home: 7 Must-Know Documents

Why Documentation Matters

When you embark on the journey of buying a home, it's not just about choosing the right house, but also about dealing with a lot of paperwork. This paperwork is crucial because it not only protects your investment but also ensures that the transaction is legally sound. Here's a comprehensive guide to the essential documents you need to know when buying a home:

1. Mortgage Application

The mortgage application is your first step into the world of home financing. This document requires detailed personal and financial information including:

- Your employment status and income

- Your current debts and monthly expenses

- Details of the property you wish to purchase

- Down payment amount

💡 Note: Ensure all the information provided in the mortgage application is accurate to avoid delays or complications.

2. Pre-Approval Letter

Before you even start looking for a home, securing a mortgage pre-approval can give you an edge. Here’s what this document offers:

- It confirms the amount a lender is willing to loan you.

- It gives you an idea of what monthly payments you can afford.

- It makes you a more serious buyer in the eyes of sellers.

3. Purchase Agreement

The Purchase Agreement is your formal offer to buy the home. This document should include:

- The property address and legal description

- Your offer price, earnest money deposit, and closing date

- Any contingencies like inspections or financing

| Contingency | Description |

|---|---|

| Home Inspection | Allows you to back out if significant issues are discovered. |

| Appraisal | Confirms the property's value matches or exceeds your offer. |

| Financing | Permits you to withdraw if you cannot secure financing. |

📌 Note: Review this document with your real estate agent or lawyer to ensure all terms protect your interests.

4. Property Disclosure Statement

This document lists any known issues with the property, such as:

- Defects or damages

- Past or current repairs

- Information about renovations or alterations

It's crucial to read this document carefully to understand what you're buying into.

5. Title Report

The title report is critical to ensure the home you're buying has a clear title. It includes:

- A history of ownership

- Any liens or claims on the property

- Public records affecting the property

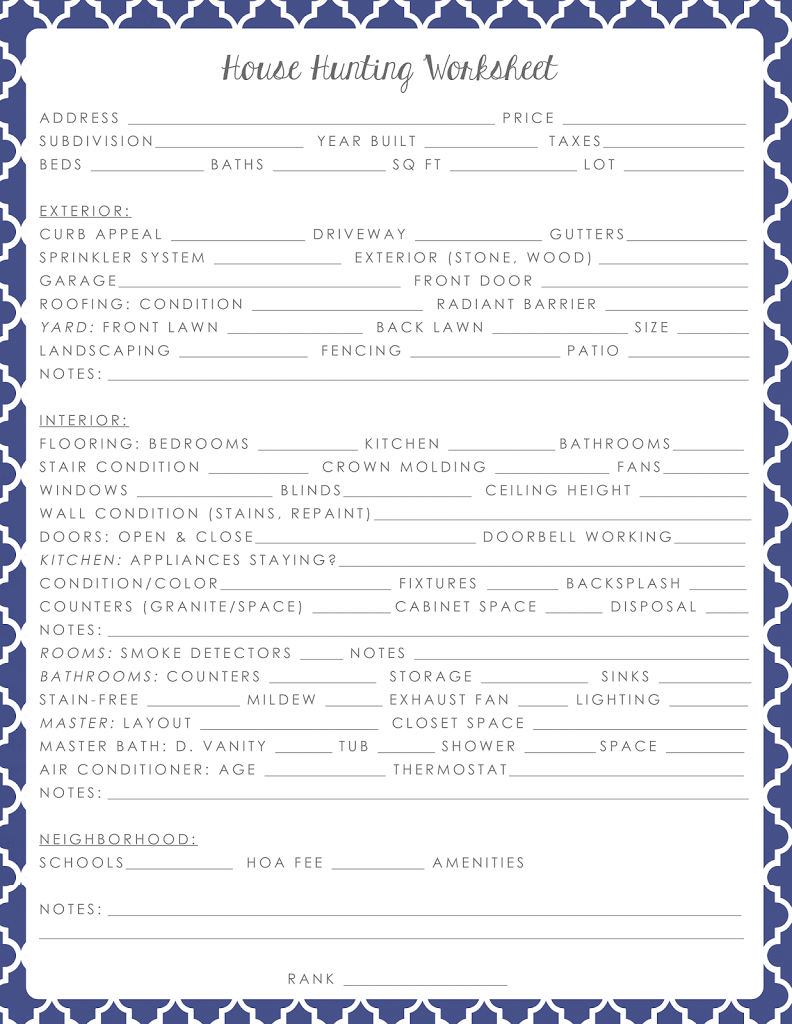

6. Home Inspection Report

Having a home inspection is a wise choice. The report will detail:

- Structural issues

- Roof condition

- Electrical and plumbing systems

- HVAC systems

- Potential environmental hazards

With this information, you can make an informed decision or negotiate repairs.

7. Closing Disclosure

The Closing Disclosure provides:

- Loan terms

- Loan costs

- Transaction details

- Cash to close

This must be received at least three business days before closing to allow you time to review.

Knowing about these documents and understanding their importance can streamline the home buying process, ensuring you have all the necessary information to proceed confidently. Keep track of these documents, ask questions, and stay proactive to safeguard your investment.

Frequently Asked Questions

What happens if I can’t find some documents?

+

If you’re missing some documents, inform your lender or real estate agent immediately. They can provide guidance or alternatives. Sometimes documents can be recreated or verified through other means.

Can I back out of a purchase after signing documents?

+

Yes, you can back out of a deal if you have contingencies that protect you, like a financing contingency. However, backing out without reason might result in losing your earnest money.

How long does it take to close after all documents are ready?

+

The closing process can vary, but once all documents are ready, it typically takes between 30 to 45 days to close. This can be influenced by factors like lender processing times, title issues, or appraisal delays.