Proving 501c8 Status: Essential Paperwork Guide

In the diverse landscape of nonprofit organizations, the Internal Revenue Service (IRS) distinguishes between different tax-exempt statuses. For fraternal beneficiary societies, orders, or associations, Section 501(c)(8) provides a unique status that can be incredibly beneficial. This guide explores the paperwork and steps required to prove your organization's 501(c)(8) status.

Understanding 501(c)(8) Status

Before diving into the paperwork, it's critical to understand what qualifies for 501(c)(8) status:

- The organization must operate on the lodge system or provide life, health, or disability benefits.

- It must be an "association or society" meaning it's organized to promote the welfare of its members.

Essential Paperwork for 501(c)(8) Status

1. IRS Form 1024

To apply for recognition of exemption under Section 501©(8), you need to fill out IRS Form 1024:

- Part I of the form requires general information about the organization.

- Part II asks for detailed financial data over the past three years.

- Part III focuses on the specific activities and exemptions.

- You’ll need to prepare statements and affidavits to support your application.

2. Articles of Incorporation

Your organization must present an up-to-date set of Articles of Incorporation. This should include:

- Name of the organization.

- Its organizational purpose, which should align with 501©(8) requirements.

- Any amendments or bylaw changes since incorporation.

3. Organizing Documents

In addition to the Articles of Incorporation, other documents like:

- Constitution and Bylaws detailing the structure, governance, and activities.

- Any relevant trust agreements or partnership agreements.

4. Statement of Purpose

A clear and concise statement that outlines the organization’s charitable, social, or mutual benefit goals. This should:

- Emphasize fraternal or social welfare activities.

- Define the benefits provided to members or the community.

5. Financial Records

Financial transparency is vital. Include:

- Recent financial statements, including balance sheets and income statements.

- Fundraising events, contributions, and how funds are disbursed.

| Document Type | Purpose | Key Information Needed |

|---|---|---|

| Form 1024 | To apply for 501(c)(8) status | Organizational details, financial data, and exempt activities |

| Articles of Incorporation | Establish legal existence | Name, purpose, amendments |

| Organizing Documents | Detail structure and governance | Constitution, bylaws, trust agreements |

| Statement of Purpose | Clarify organizational goals | Charitable, social, or mutual benefit activities |

| Financial Records | Show financial transparency | Income, expenses, fundraising |

📝 Note: Ensure all financial statements are accurate and prepared according to generally accepted accounting principles (GAAP).

Application Process

Filing Form 1024

- Complete and submit Form 1024 electronically or via mail.

- Include any required user fees, which are subject to change.

- Keep copies of all documentation for your records.

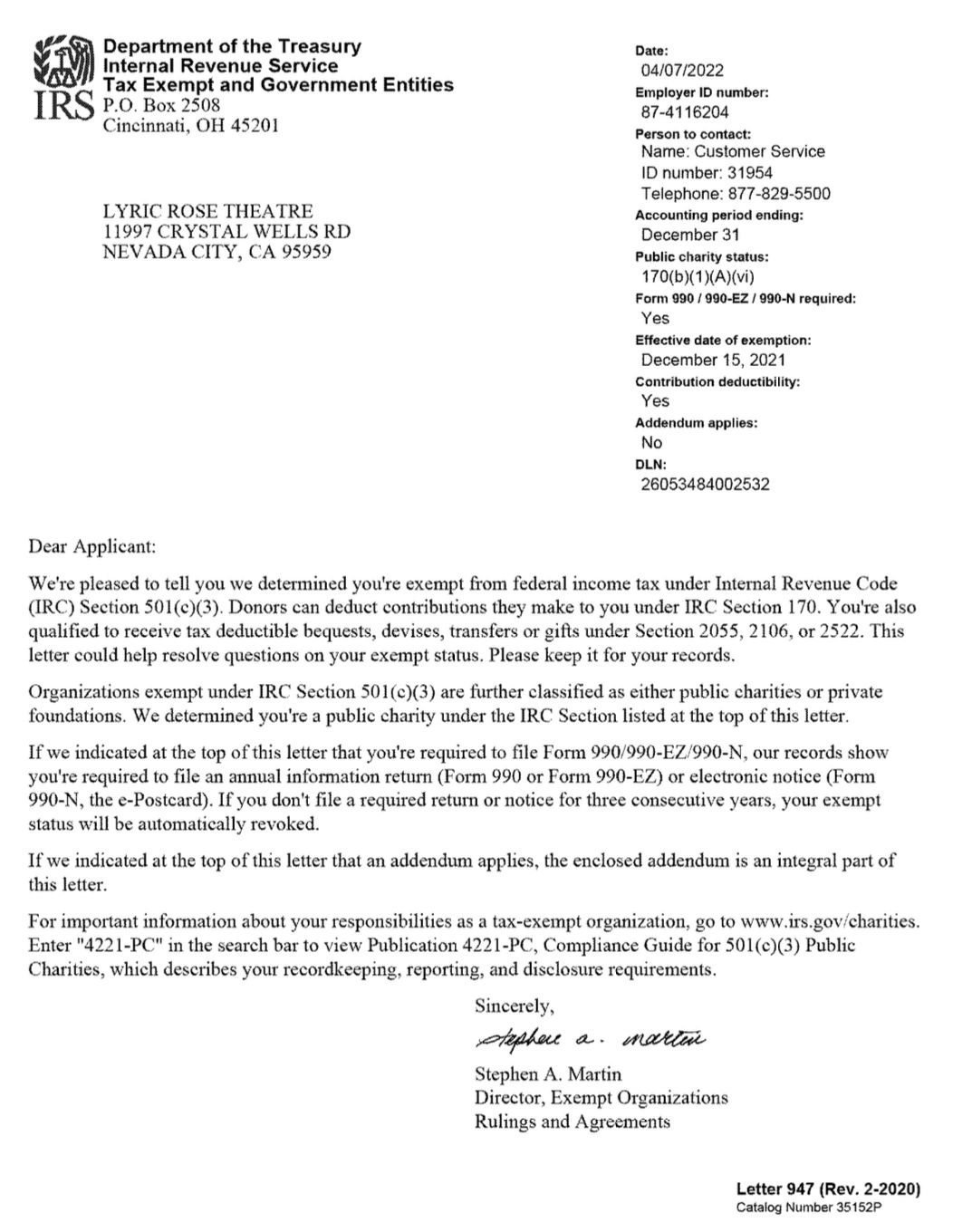

Review and Communication

- The IRS will review your application, which might take several months.

- Prepare for potential requests for additional information.

- Stay responsive to IRS inquiries to expedite the process.

📋 Note: An IRS determination letter is not automatically issued if you receive an advanced ruling. Contact the IRS if you don't receive a letter after applying.

The process to secure 501(c)(8) status can seem daunting, but with the right paperwork and attention to detail, your fraternal organization can be well on its way to this tax-exempt status. Remember, proving your 501(c)(8) status involves much more than simply filing an application form. It's a testament to your organization's commitment to promoting fraternal bonds, providing welfare to its members, or fostering community engagement. By ensuring that you have all the necessary documents in order, you're not just fulfilling regulatory requirements but also enhancing the credibility of your organization.

What is the difference between 501©(3) and 501©(8) status?

+

A 501©(3) is designated for charitable, religious, educational, or scientific organizations, while a 501©(8) specifically benefits fraternal beneficiary societies, orders, or associations. The latter focuses on fraternal activities, providing life, health, or disability benefits, and mutual aid.

Can a fraternal organization apply for both 501©(3) and 501©(8) status?

+

Typically, organizations are limited to one IRS tax-exempt status. However, some fraternal organizations might engage in charitable activities that could qualify for a 501©(3) exemption separately from their fraternal activities under 501©(8).

How long does it take for the IRS to approve a 501©(8) application?

+

The approval time can vary significantly, but expect a processing time of at least three to six months. This duration can be influenced by the completeness of your application, the complexity of your organization, and IRS workload.