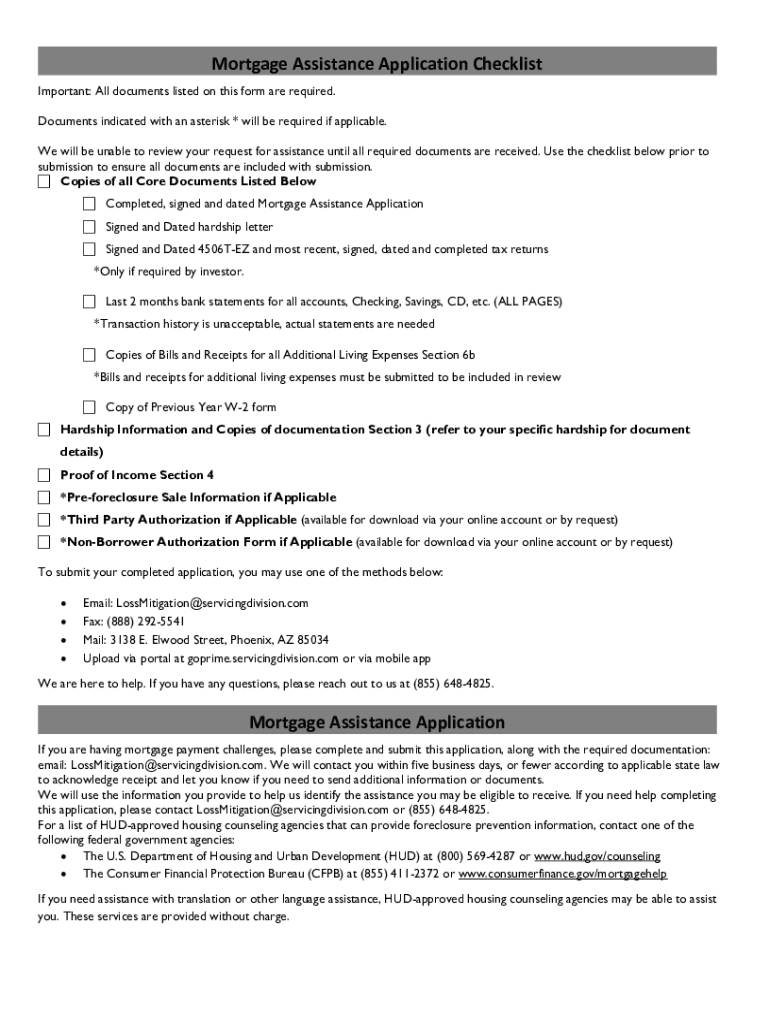

Essential Documents for Mortgage Application: Your Guide

The process of securing a mortgage can be intricate and time-consuming, but proper preparation can streamline the journey. As prospective homebuyers, understanding which documents are required for a mortgage application is crucial for a swift approval. This post delves into the essential documents you'll need when applying for a mortgage, ensuring you're well-prepared to navigate through your home purchasing experience with ease.

Mortgage Application Documents Overview

When embarking on the mortgage application process, gathering the right documents is your first step towards homeownership. These documents help lenders assess your financial stability, creditworthiness, and capacity to repay the loan. Here’s a breakdown:

- Personal Identification

- Income Verification

- Employment Verification

- Assets

- Liabilities

- Property Information

Personal Identification

The first set of documents you’ll need to establish your identity includes:

- Driver’s license, passport, or state ID

- Social Security number

These are crucial to confirm your identity and protect against fraud.

Income Verification

Your income will largely dictate how much mortgage you can afford. Provide:

- Pay stubs for the last 30 days: To demonstrate consistent income.

- W-2 forms for the last two years: To verify historical earnings.

- Tax returns for the past two years: Including all schedules for a full financial picture.

- Profit and Loss Statement: If you’re self-employed or have income from rental properties.

💡 Note: Lenders might also require you to provide additional information about employment history if your income has recently changed significantly.

Employment Verification

Your lender will want to confirm your employment status through:

- Employer’s contact information: Including HR or payroll department details.

- Pay stubs: They’ll look for recent employment status.

Assets

Your assets showcase your financial health. Include:

- Bank statements: For the last two months for all accounts.

- Investment account statements: If you’re using investments to bolster your down payment.

- Retirement account statements: Including 401(k), IRA, etc.

Liabilities

Your lender will review all your outstanding debts to evaluate your debt-to-income ratio:

- Recent mortgage, HELOC, or rent payment statements: To assess your housing expense history.

- Credit card statements: To check current balance and minimum payments.

- Auto loan statements: To review regular payments.

- Student loans: Show payment details and remaining balance.

Property Information

For the property you wish to purchase:

- Purchase agreement: A legal document outlining terms of the sale.

- Appraisal report: Shows the home’s market value for loan purposes.

- Title information: To check for any liens or issues.

📝 Note: If you're buying a property that's not yet built, different documents like a construction loan agreement will be necessary.

As we've outlined, the journey to homeownership involves detailed preparation with specific documentation. By providing these documents promptly and accurately, you increase your chances of a smooth mortgage application process. Remember, lenders are looking for signs of financial stability and a history of responsible credit management. Use this guide as a checklist to ensure you're ready for your mortgage application, minimizing delays, and moving closer to the dream of homeownership.

Can I get pre-approved with only my credit score?

+

While your credit score is significant in the pre-approval process, lenders need more information like income and employment details to provide a comprehensive pre-approval. This preliminary approval helps set expectations for how much you might borrow.

What if I’m self-employed?

+

Self-employed borrowers need to provide additional documentation. This includes two years of tax returns, profit and loss statements, and sometimes business bank statements to verify income.

Do I need to provide all documents at once?

+

While it’s helpful to gather all your documents simultaneously, some lenders might accept them in stages. Check with your lender for specific document submission guidelines.

How long is the mortgage application process?

+

The mortgage process can range from 30 to 60 days or more, influenced by factors like lender’s turnaround time, property type, and the completeness of your application.

What if there are discrepancies in my credit report?

+

If there are discrepancies, address them with the credit bureaus to ensure your credit report accurately reflects your financial standing. This might involve a dispute or providing documentation to clarify the issues.