Tax Prep Made Simple: Essential Paperwork Guide

The Importance of Tax Preparation

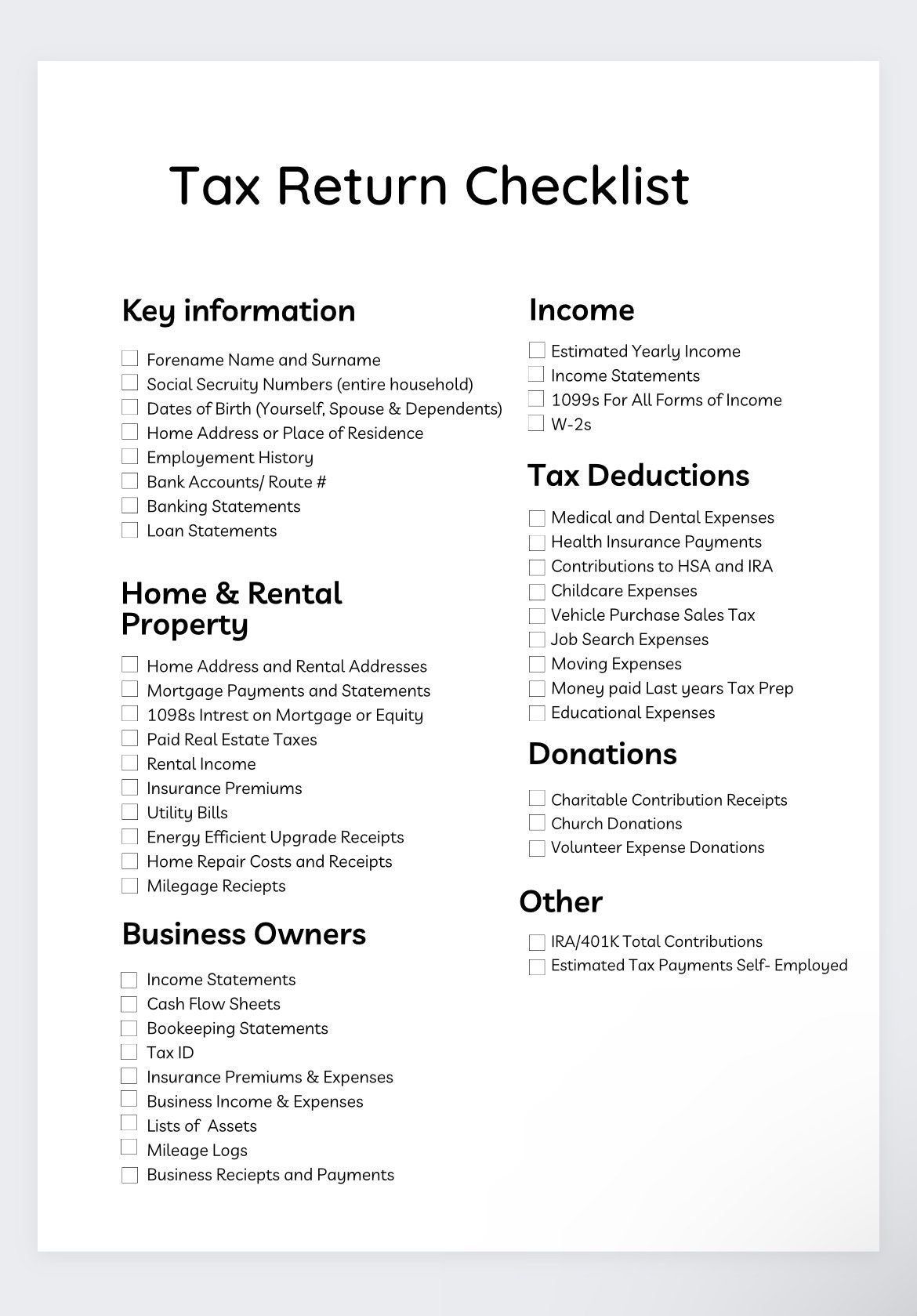

Preparing your taxes can often seem like a daunting task, but with the right organization and understanding of the essential paperwork, it becomes manageable and straightforward. Whether you’re a freelancer, a small business owner, or an employee, knowing what documents you need and how to organize them is crucial for an efficient and stress-free tax filing experience. In this guide, we’ll delve into the key pieces of paperwork every taxpayer should be familiar with, offering tips on how to manage them effectively.

Essential Tax Documents

Personal Identification

The very first thing you’ll need is your personal identification. This includes:

- Social Security Number (SSN) - For individuals.

- Employer Identification Number (EIN) - For business owners.

Having these details on hand ensures that your tax returns are accurately filed.

Income-Related Documents

Income documents are the backbone of your tax return. Here’s what you should collect:

- W-2 Forms - For wages and salaries from an employer.

- 1099 Forms - For freelance income, interest, dividends, and more.

- 1099-G - If you’ve received unemployment compensation.

- K-1 Forms - For income from partnerships, S corporations, estates, or trusts.

Each form provides specific details about your earnings which are crucial for accurate tax reporting.

Deductions and Credits

Maximizing deductions and credits can significantly reduce your tax liability. Here are documents to look out for:

- Mortgage Interest Statement (Form 1098) - For home loan interest deductions.

- Charitable Contribution Receipts - For donations that can be itemized.

- Medical and Dental Expenses Receipts - For potential medical expense deductions.

- Receipts for Work-Related Expenses - If you’re self-employed or have expenses unreimbursed by your employer.

These documents allow you to claim expenses, potentially lowering your taxable income.

Health Insurance Documentation

With changes in health care laws, having the following health insurance documentation is vital:

- Form 1095-A, B, or C - To verify your health insurance coverage.

🔍 Note: These forms are essential for proving compliance with the Affordable Care Act’s minimum essential coverage requirement.

Retirement and Investment Documents

If you have investments or retirement accounts, keep these documents handy:

- IRA, 401(k), Pension Contribution Statements - To report your contributions.

- Investment Income Statements - Including dividends, interest, and capital gains.

These documents help in reporting income from investments and claiming tax benefits for retirement contributions.

Education Expenses

Documents related to education expenses can yield tax credits like the American Opportunity Tax Credit:

- Form 1098-T - Provided by educational institutions for tuition payments.

- Receipts for Educational Expenses - For books, supplies, and equipment.

Business Expenses for Self-Employed

If you’re self-employed, you’ll need:

- Business Expense Receipts - For office supplies, travel, utilities, etc.

- Mileage Log - If you use your vehicle for business purposes.

Tax Planning and Organization Tips

To streamline your tax preparation process, consider these tips:

- Use digital tools for tracking expenses and income.

- Keep all documents in a designated physical or electronic folder for easy access.

- Regularly update your records throughout the year, not just during tax season.

Organizing Your Documents for Efficiency

Efficiency in tax preparation often boils down to how well you organize your documents:

| Category | Documents to Organize |

|---|---|

| Identification | SSN, EIN, Driver’s License |

| Income | W-2, 1099s, K-1 |

| Deductions | 1098, Charitable Receipts, etc. |

Having a system can save hours and reduce the stress of tax filing.

Final Thoughts

While tax preparation might initially seem overwhelming, with the right set of documents organized and accessible, the process can be significantly simplified. Remember, every piece of paperwork has a purpose, and understanding this can help in ensuring you’re not missing out on deductions or credits that could reduce your tax bill. By organizing your documents systematically, maintaining records throughout the year, and planning ahead, you’re setting yourself up for a smooth tax filing process. This preparation ensures compliance, maximizes returns, and possibly reduces the risk of audits. Keep your documents accessible, understand what each one means, and you’ll master the art of tax prep in no time.

What should I do if I lose my W-2?

+

If you lose your W-2, contact your employer immediately to request a reissue. You can also request a wage and income transcript from the IRS if your employer is uncooperative.

Can I file my taxes without a Social Security number?

+

Generally, no. However, if you’re not eligible for an SSN, you might qualify for an Individual Taxpayer Identification Number (ITIN) which can be used for filing.

How long should I keep my tax documents?

+

The IRS recommends keeping tax records for at least three years from the date of filing or two years from the date the tax was paid, whichever is later.