5 Essential Documents for Homestead Exemption Application

The homestead exemption offers homeowners a fantastic opportunity to reduce their property taxes significantly. However, to reap the benefits of this tax reduction, there are several crucial documents you need to prepare and submit accurately. Here’s an in-depth guide to the five essential documents you'll need for your homestead exemption application:

1. Proof of Ownership

First and foremost, you must prove that you own the property for which you are seeking the homestead exemption. Here’s how:

- Title Deed: This is the primary document showing ownership. Make sure it includes your name as the owner.

- Mortgage Statement: If there’s a mortgage on the property, a statement from your lender can also serve as proof of ownership.

2. Identification Documents

Your identity needs verification to ensure that you are the rightful applicant:

- Driver’s License or State ID: These should reflect the same address as your homestead property. Many states require your ID to be updated to this address within a certain timeframe before you can apply for the exemption.

- Passport: If you don’t have a driver’s license, a passport serves as a valid ID.

- Birth Certificate or Social Security Card: These might be required to establish your identity in conjunction with other documents.

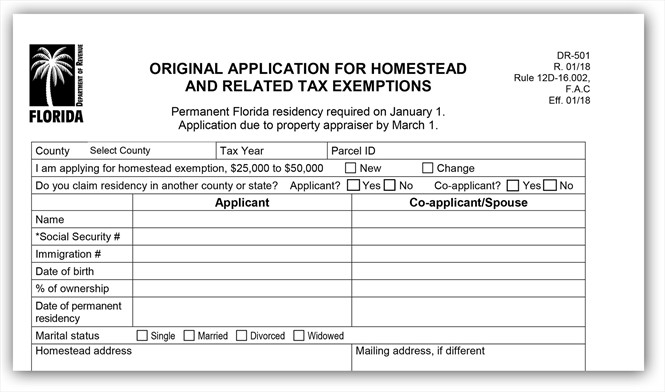

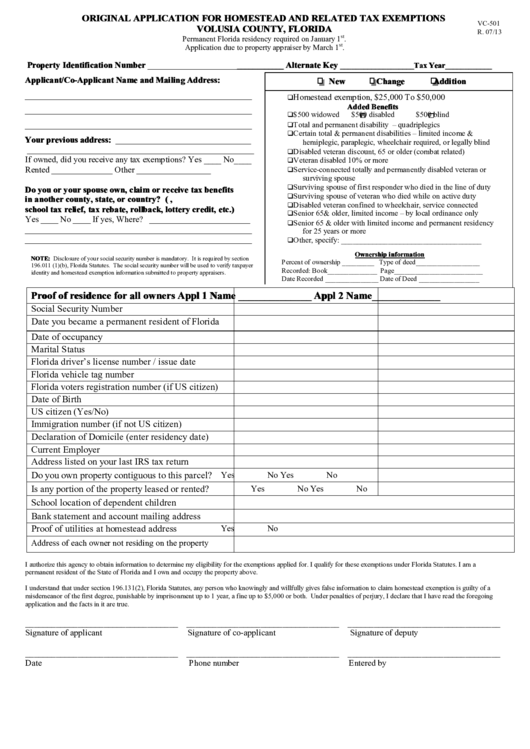

3. Proof of Residency

You must live in the home to claim a homestead exemption. Proof of residency can be established with:

- Utility Bills: Recent utility bills like electricity, water, or gas in your name are strong proof of residency.

- Voter Registration: Documentation showing you are registered to vote at the homestead address.

- Rental Agreements or Leases (if applicable): If you rent part of your home, this might also be considered as part of your occupancy evidence.

🏠 Note: Some states might require you to have lived in the property for a set period before you qualify for the exemption. Check local regulations for specifics.

4. Tax Returns

Your tax situation can also influence your eligibility:

- Income Tax Returns: These are needed to verify your income. Some exemptions have income caps, especially for senior citizens or individuals with disabilities.

- Homestead Tax Credit Form: Some states require a specific form that might be filed with your income tax return.

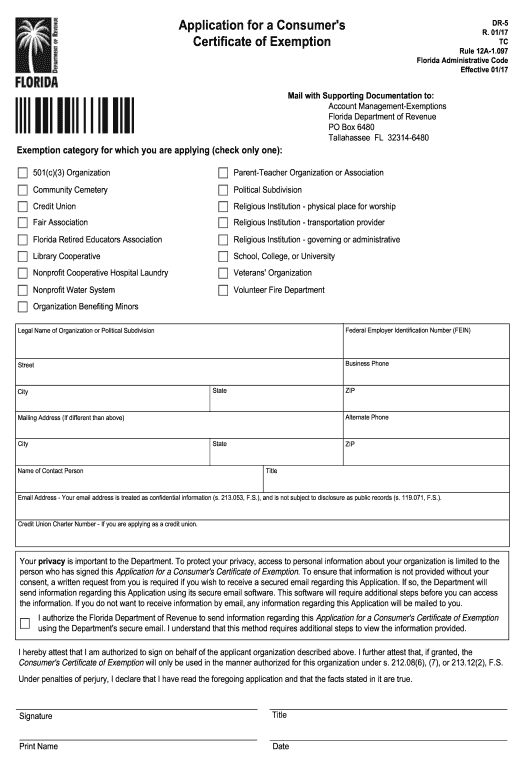

5. Application Form

Lastly, you need to fill out the homestead exemption application:

- Application Form: This document, provided by your local tax assessor’s office, is where you formally request the exemption.

It’s also worth noting that different states and local jurisdictions might have additional requirements:

| State | Additional Requirements |

|---|---|

| Florida | Requires a Declaration of Domicile and a Notary Public seal on your application. |

| Texas | You must sign the application in the presence of the appraisal district, or your signature must be notarized. |

📝 Note: Always check with your local tax assessor's office for any additional documents or information they might need for your specific homestead exemption application.

Applying for a homestead exemption is a smart move for any homeowner looking to save on property taxes. It's not just about filling out forms; it’s about understanding the documentation needed to prove your eligibility. By preparing the essential documents highlighted above, you are taking the first steps towards reducing your tax burden significantly. Remember, each state has its nuances regarding homestead exemptions, so staying informed and ready with the necessary paperwork will streamline your application process and help secure your exemption.

What if I don’t have all the necessary documents?

+

Contact your local tax assessor’s office. They can guide you on what alternatives might be acceptable. Sometimes, different forms of documentation can be used to establish residency or ownership.

Can I still apply if I’m not a U.S. citizen?

+

Yes, many states allow non-citizens to apply for homestead exemptions as long as they legally reside in the home and meet all other requirements.

How long does the homestead exemption last?

+

Once approved, a homestead exemption generally continues annually as long as you maintain your eligibility. However, you might need to reapply if you significantly change your property or if there are changes in ownership or residency.

What happens if my homestead exemption application is denied?

+

If your application is denied, you will receive a notice explaining why. You can then provide additional documentation or appeal the decision within the time frame specified by your local tax authority.

Can multiple owners apply for homestead exemptions?

+

In many cases, only one exemption per household is allowed, even if there are multiple owners. However, check with your local regulations as some might offer provisions for multiple exemptions.