Navigating Inherited IRA Paperwork: Essential Documents You Need

In the complex world of estate planning and financial management, navigating the paperwork involved with inherited IRAs can be daunting. Whether you're stepping into this realm as a beneficiary of an IRA or as someone preparing for the eventualities of asset distribution, understanding the key documents involved in this process is crucial for ensuring a seamless transition. This blog post dives into the essential documents required when dealing with an inherited IRA, ensuring you're equipped to handle this often-overlooked aspect of financial legacy.

Understanding the Basics of Inherited IRAs

Before delving into specific documents, it’s important to grasp some fundamentals:

- What is an Inherited IRA? - An account opened after the owner’s passing, into which the beneficiary rolls over funds from the deceased’s IRA or 401(k).

- Beneficiary Designations: These are critical as they dictate who inherits the IRA. They often take precedence over wills.

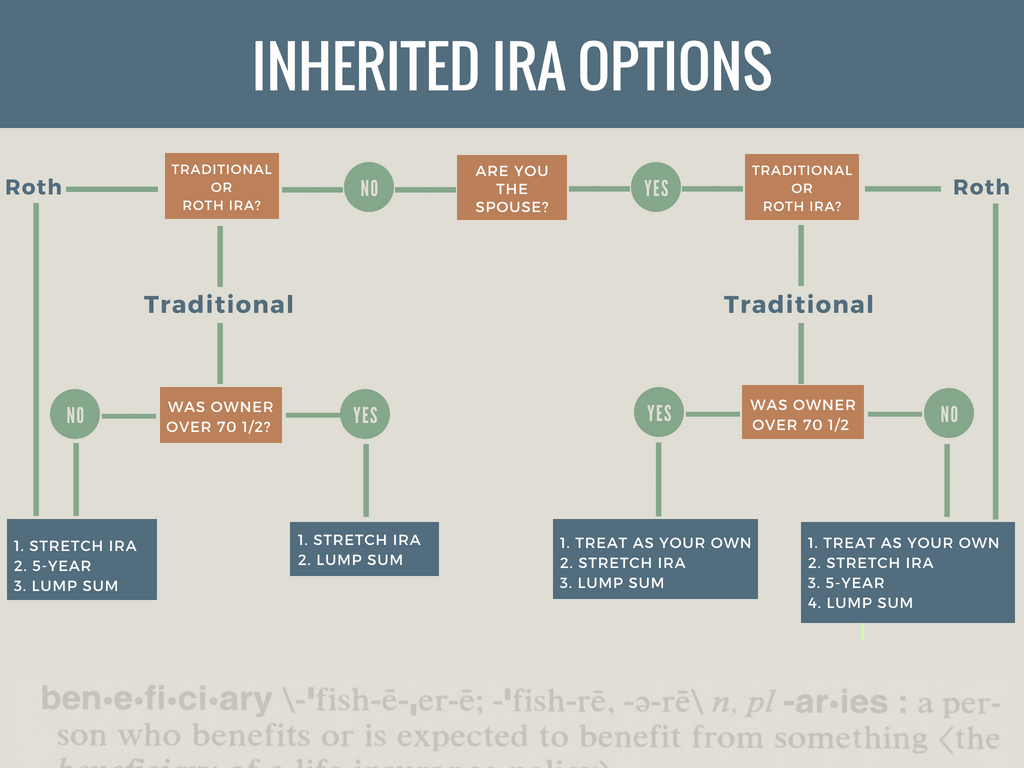

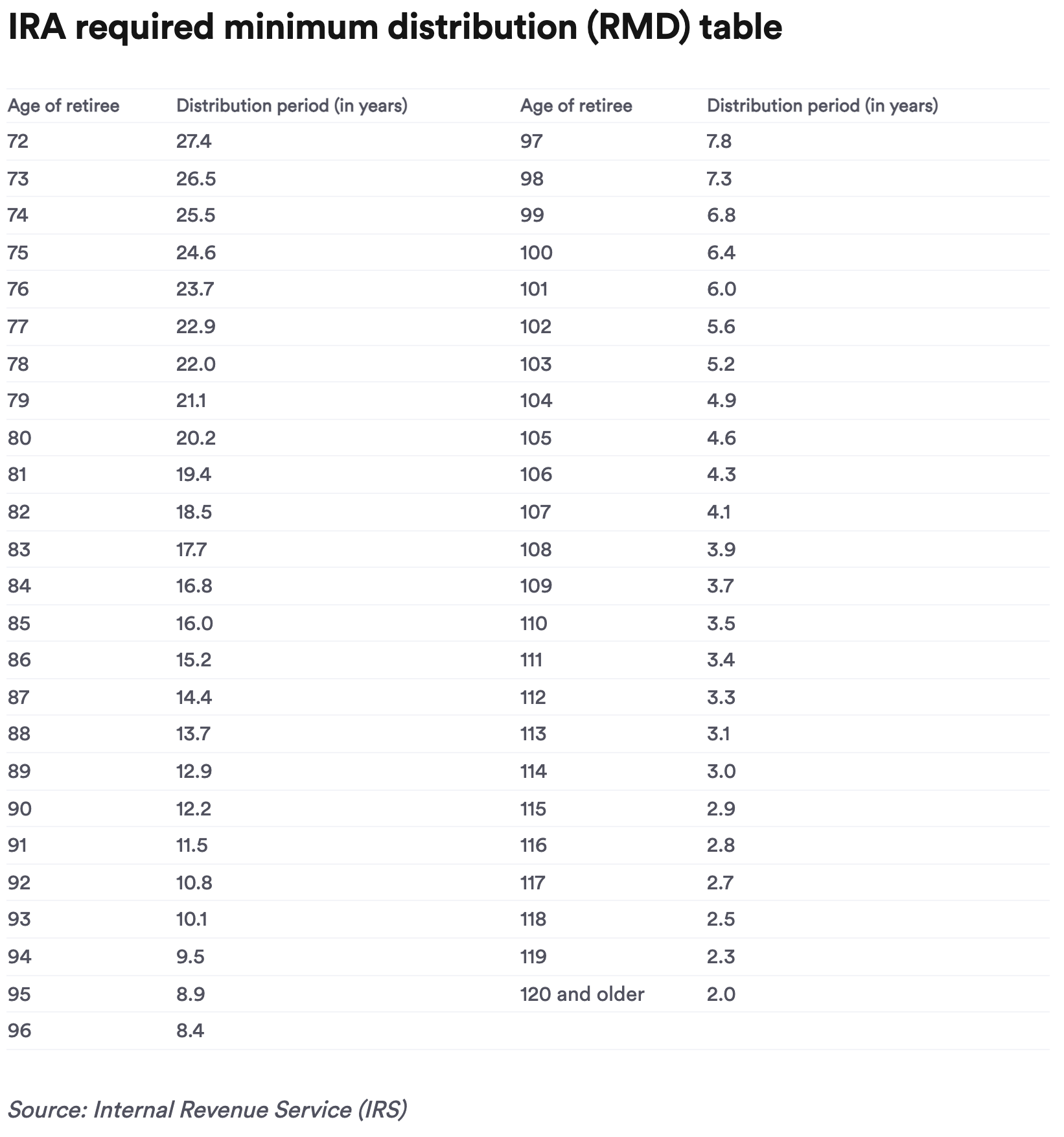

- Tax Implications: The tax treatment of inherited IRAs can vary significantly depending on whether you were the spouse of the deceased, the account type, and how you choose to handle the distributions.

💡 Note: Always consult with a tax advisor to understand the tax implications specific to your situation.

Essential Documents for Managing an Inherited IRA

Death Certificate

The first document you’ll need is the death certificate of the IRA account holder. This certificate is necessary to:

- Verify the deceased’s identity.

- Establish eligibility to inherit assets.

- Process the transfer of assets into an inherited IRA.

Beneficiary Designation Form

This form shows who the IRA owner named as beneficiary:

- It might be a primary beneficiary or contingent beneficiaries.

- Without a beneficiary, funds might go through probate or be disbursed according to state law.

Letter of Instruction

Though not mandatory, a letter of instruction can:

- Provide guidance on the decedent’s wishes.

- Explain specific requests regarding asset distribution.

- Offer personal advice or direction that might not be covered by legal documents.

Trust Document

If the IRA is part of a trust, you’ll need:

- The trust document outlining the terms of the trust.

- The trustee or executor will manage the inherited assets according to the trust’s instructions.

📝 Note: Trusts can add layers of complexity to asset distribution, so understanding the trust’s provisions is vital.

Will and Probate Documents

In the absence of a beneficiary or trust, or if the will names the estate as the beneficiary, you might need:

- The deceased’s will.

- Letters testamentary or of administration to establish legal authority over the estate.

IRS Form 8606

If non-deductible contributions were made to the IRA, beneficiaries should file IRS Form 8606 to report the basis of the IRA, avoiding double taxation on these contributions.

Tax Documents

Additionally, you’ll receive various tax forms:

- 1099-R: To report distributions from the inherited IRA.

- 5498: For reporting contributions, conversions, rollovers, or recharacterizations, if applicable.

Steps to Manage Your Inherited IRA

Once you’ve gathered these documents:

- Contact the IRA custodian or financial institution.

- Provide the necessary documentation for verification.

- Decide whether to take distributions, stretch the IRA, or for a spouse, treat it as their own.

- Consider tax implications and possibly consult with a financial advisor.

- Set up a new inherited IRA account if required.

After going through this process, it becomes evident that managing an inherited IRA involves more than just paperwork; it's about understanding the financial implications and making informed decisions to maximize benefits while adhering to legal requirements.

Remember, each case can be unique. If you face complexities or uncertainties in managing an inherited IRA, seeking professional advice from an estate attorney or financial advisor can offer personalized guidance.

Ultimately, dealing with inherited IRAs requires patience, attention to detail, and sometimes, a willingness to learn new financial and legal terminology. By focusing on the essential documents and following the outlined steps, you can ensure a smooth and legally compliant transition of IRA assets, respecting the wishes of your loved one while optimizing your financial future.

What happens if there’s no beneficiary on the IRA?

+

If there is no named beneficiary, the IRA funds might pass to the estate of the deceased, and distribution would then follow the terms of the will or state laws. This often leads to probate, which can be a lengthy and costly process.

Can I roll over an inherited IRA?

+

Generally, you cannot directly roll over an inherited IRA into your own IRA. However, if you are the spouse of the deceased, you can treat the inherited IRA as your own, with certain conditions and tax considerations.

How are taxes calculated on an inherited IRA?

+

The taxation of an inherited IRA depends on several factors including whether you take the distribution as a lump sum, stretch out the distributions, or if you’re the spouse of the deceased. Generally, the entire amount inherited is taxed as ordinary income, but strategies like the stretch IRA can minimize tax impact over time.