5 Essential Tax Documents for Buying a Used Car

Buying a used car can be both an exciting and complex process. From finding the right vehicle to navigating through the paperwork, it's crucial to understand the documentation involved to ensure a smooth transaction. One significant aspect that cannot be overlooked is the tax documents required when purchasing a used car. These documents are not only essential for the legal transfer of ownership but also critical for tax reporting and potential deductions. Let's explore the five essential tax documents you need to consider:

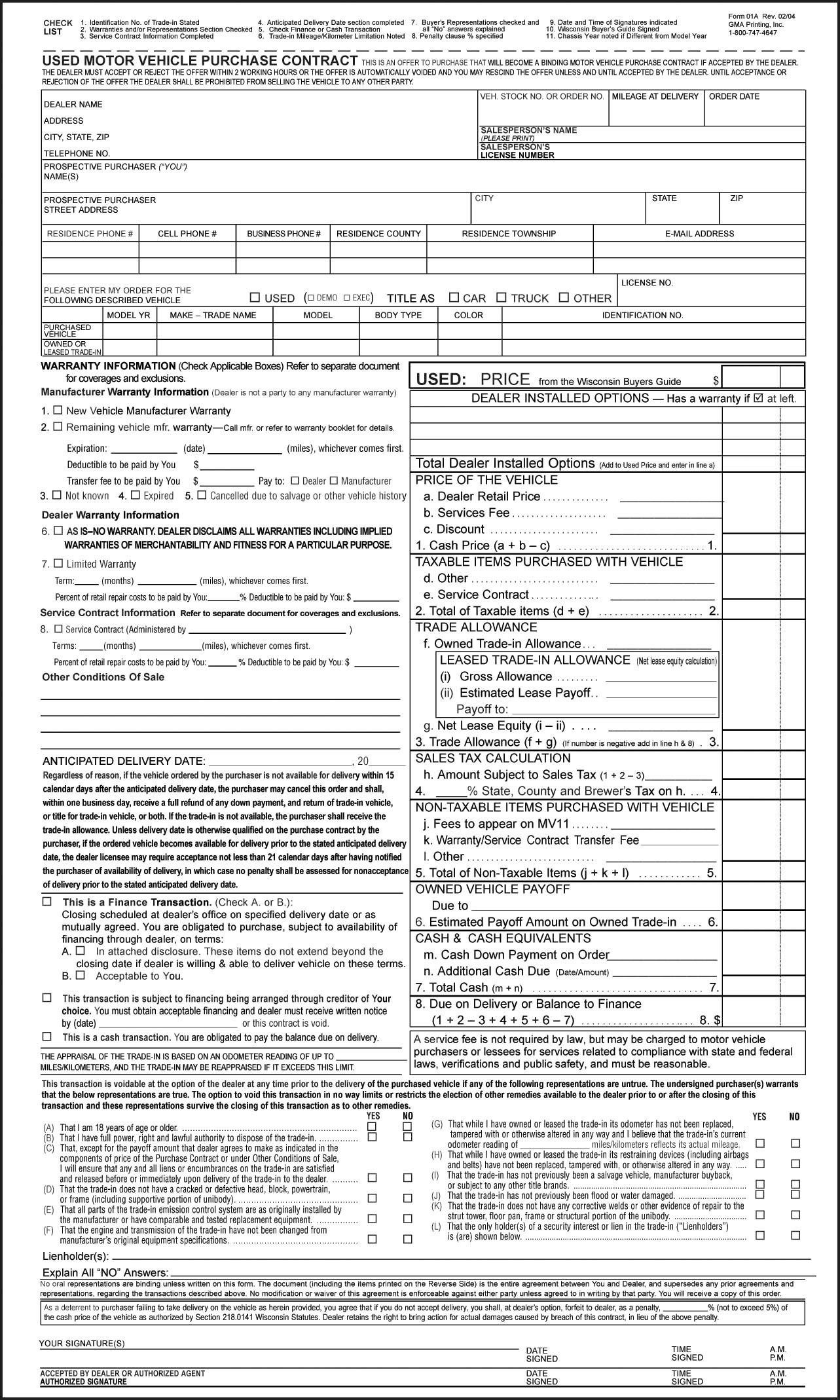

1. Bill of Sale

The Bill of Sale is one of the most straightforward but vital documents when purchasing a used car. This document details the:

- Seller’s name and address

- Buyer’s name and address

- Car’s make, model, year, and Vehicle Identification Number (VIN)

- Sale price

- Date of sale

This information is crucial for both the seller and the buyer for tax purposes, registration, and to establish proof of ownership.

📝 Note: Always ensure the Bill of Sale is signed by both parties. An unsigned document can lead to legal complications later on.

2. Odometer Disclosure Statement

The Odometer Disclosure Statement is required by federal law to prevent odometer fraud. This statement includes:

- The car’s current mileage

- A declaration that the mileage is accurate to the seller’s knowledge

This document is crucial when selling or buying cars with less than 10 years old to ensure the mileage is accurately reported for tax and registration purposes.

3. Title of the Car

The title proves ownership and is critical for tax documentation. Here are the key elements of the car title:

- Name and address of the previous owner

- Car’s details like make, model, year, and VIN

- Brand of title (e.g., salvage, rebuilt, or clean title)

The title must be signed by the seller to transfer ownership legally. You will also need it to register the car in your name, which involves paying taxes and transfer fees.

⚠️ Note: Some states require a notarized signature for title transfer; check your local DMV requirements.

4. Registration and Taxes

When you register a used car, you’re typically required to pay:

- Sales tax or use tax based on the purchase price or appraised value

- Registration fees

The registration receipt you receive after paying these taxes and fees is an important document to keep for your records. It’s proof of payment, which might be needed for future tax returns or for selling the car later.

| Tax or Fee | Description |

|---|---|

| Sales Tax | Based on the sale price of the vehicle |

| Use Tax | For out-of-state purchases or if the car is over a certain age |

| Registration Fee | State-specific fee for registering the vehicle |

5. Form 1098-C

If the car you’re buying was repossessed and being sold by the lender, they might issue you a Form 1098-C. This form is used:

- To report the sale of the vehicle as a result of the repossession

- For tax purposes, especially if there is cancellation of debt income involved

This document informs you of any amounts to include in your income from the vehicle’s sale, which might affect your tax obligations.

In closing, understanding the key tax documents involved in buying a used car not only simplifies the process but also ensures compliance with legal and fiscal requirements. Remember to:

- Secure the Bill of Sale signed by both parties

- Verify the Odometer Disclosure Statement to avoid fraud

- Obtain and sign the car title for ownership transfer

- Pay necessary registration taxes and fees, and keep the receipt

- Watch out for Form 1098-C if the vehicle was repossessed

By paying close attention to these documents, you're not only safeguarding your investment but also ensuring a hassle-free experience with potential tax benefits.

What if the seller does not provide the required documents?

+

Always ensure all necessary documents are provided before finalizing the purchase. If the seller can’t or won’t provide them, consider this a red flag. You might need to look for another car or ask a lawyer for advice on how to proceed legally.

Can I deduct sales tax or registration fees when filing taxes?

+

Yes, in many cases, you can. Sales tax, especially, can often be deducted as an itemized deduction on Schedule A of Form 1040. Registration fees might also be deductible if they are based on the vehicle’s value. Always consult with a tax professional to confirm.

What if the car title is lost or not transferred?

+

If the title is lost, you will need to apply for a duplicate title from your state’s DMV. If it wasn’t transferred properly, you’ll need to contact the seller or go through the process of proving ownership. It can be complex, but it’s better to resolve this immediately rather than deal with legal issues later.