6 Essential Documents for Filing Form 1065

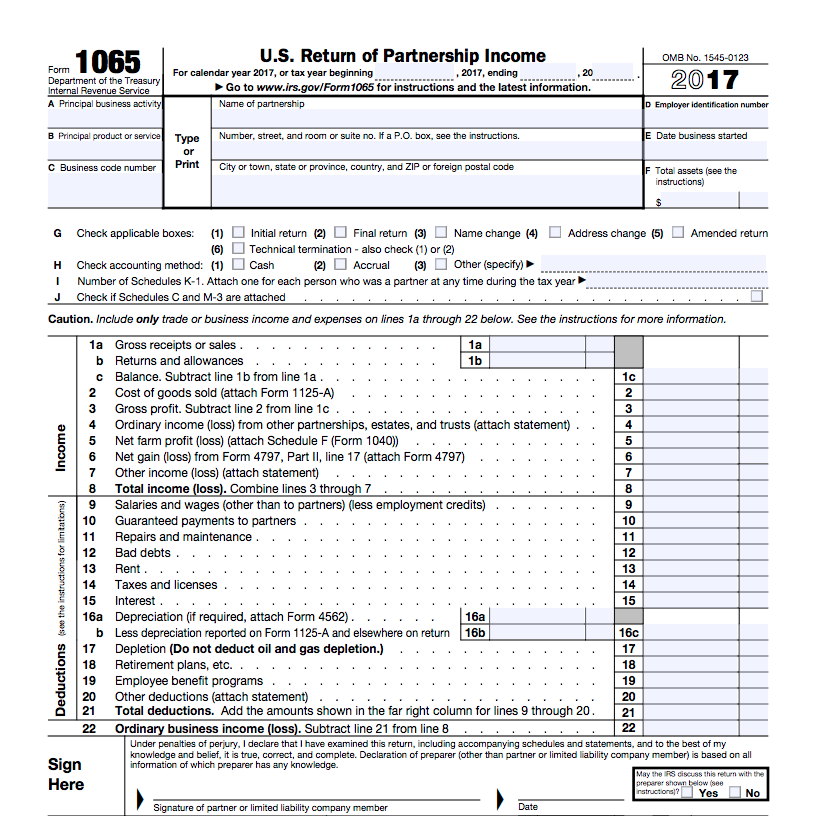

Small business owners and partnerships might find filing their taxes a daunting task, especially when it comes to IRS Form 1065, which is the U.S. Return of Partnership Income. Understanding what documents are necessary to file this form can streamline the process and help ensure compliance with tax laws. In this post, we'll explore the six essential documents you need for filing Form 1065 effectively.

1. Partnership Agreement

The foundation of any partnership is the partnership agreement. This document outlines:

- The partnership’s business structure.

- The roles, rights, and responsibilities of each partner.

- How profits and losses are shared.

- Details on capital contributions and future investments.

- What happens if a partner wants to leave or in case of dissolution.

While not directly required to file Form 1065, having this agreement in hand can provide clarity on numerous tax-related decisions.

🔑 Note: This document should be readily accessible to verify critical information and decisions made about partnership taxes.

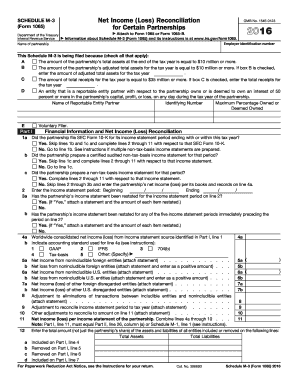

2. Schedule K-1

Each partner must receive a Schedule K-1 form that shows their share of the partnership’s income, credits, deductions, and other items for their personal tax returns. Here’s what you need:

- The partnership’s EIN (Employer Identification Number).

- Each partner’s name, address, and SSN or EIN.

- The partner’s profit, loss, and capital account balances.

The Schedule K-1 must accompany Form 1065 when filing taxes.

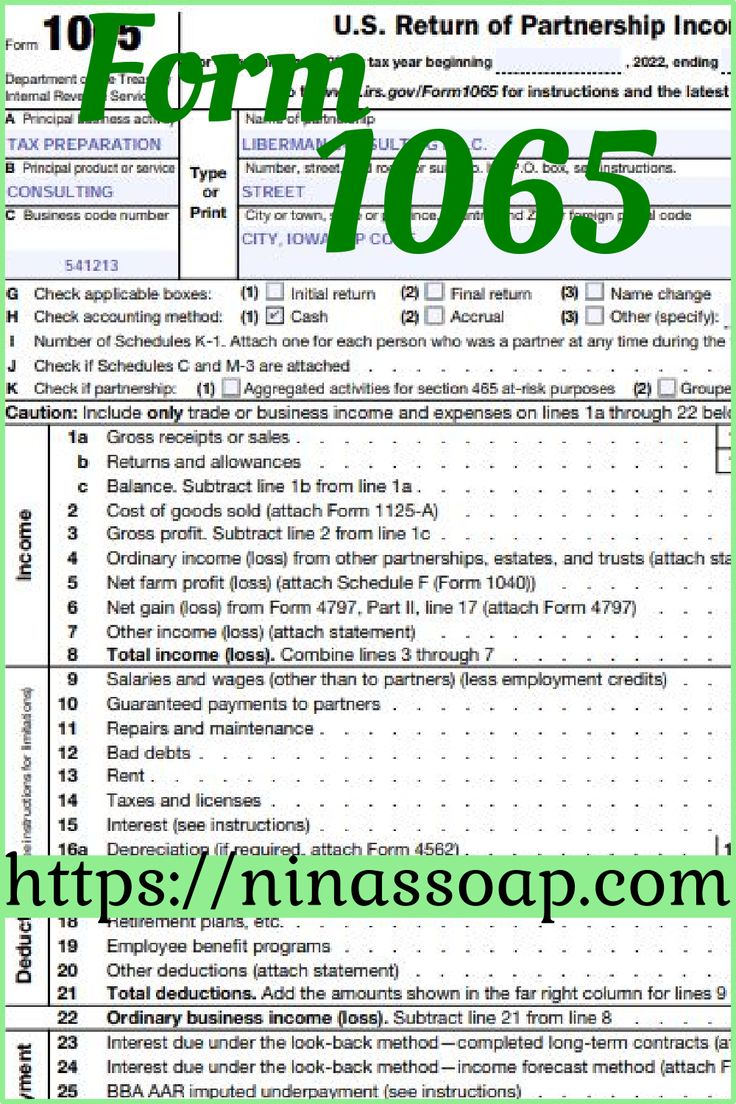

3. Financial Records

A detailed ledger of the partnership’s financial activities is crucial. This includes:

- Income statements: Detailing revenue, cost of goods sold, and other income.

- Balance sheets: To show assets, liabilities, and partner equity.

- Cash flow statements: Tracking how cash moves in and out of the business.

- General ledgers: Complete with all transactions throughout the tax year.

These records should be reviewed for accuracy to ensure Form 1065 reflects the partnership’s financial position correctly.

4. Inventory Records

If your partnership sells or manufactures products, keep detailed inventory records. Here’s what you should prepare:

- Beginning and ending inventory balances.

- Documentation for purchases, sales, and cost of goods sold.

- Changes in inventory methods, if any.

🔍 Note: Inventory records help in accurately computing the Cost of Goods Sold (COGS), which affects the partnership’s taxable income.

5. Expense Receipts and Records

Every partnership incurs expenses, and having records of these can lead to significant tax deductions. Collect:

- Rent or lease agreements.

- Utility bills.

- Payroll and contractor invoices.

- Travel, entertainment, and business meals documentation.

These expenses should be itemized and appropriately categorized on the return to maximize deductions.

6. Asset Acquisition and Depreciation Schedules

If the partnership has purchased or sold assets during the tax year:

- Records of asset acquisition and disposal.

- Depreciation schedules for all relevant assets.

- Any Section 179 expense deduction or Bonus Depreciation elections.

Understanding how to report these assets correctly can impact the partnership’s tax liability significantly.

Having these documents ready for filing Form 1065 not only simplifies the process but also helps in substantiating any claims made on the return in case of an audit. By keeping your records up to date and organized, you can ensure a smoother tax season and potentially reduce the risk of penalties or delays. Keep these documents for at least three years, as the IRS typically has up to three years to audit a return, though this can be extended in certain circumstances.

What happens if we miss reporting an item on Form 1065?

+

Missing information or incorrect reporting can result in an audit, potential penalties, and delays in processing the return. It’s crucial to double-check all entries before filing.

Can we file Form 1065 electronically?

+

Yes, partnerships can e-file Form 1065. Electronic filing is often faster and less error-prone than paper filing.

Do all partners need to sign the Form 1065?

+

No, only one partner needs to sign Form 1065. However, it’s a good practice to keep all partners informed about the return’s content.