Essential Bankruptcy Paperwork Guide for Snohomish County

The journey towards financial recovery through bankruptcy can be daunting, yet understanding the necessary paperwork is crucial for a successful filing. This guide provides an essential overview of the bankruptcy paperwork required in Snohomish County, ensuring you are well-prepared to tackle this significant step.

Understanding Bankruptcy Types

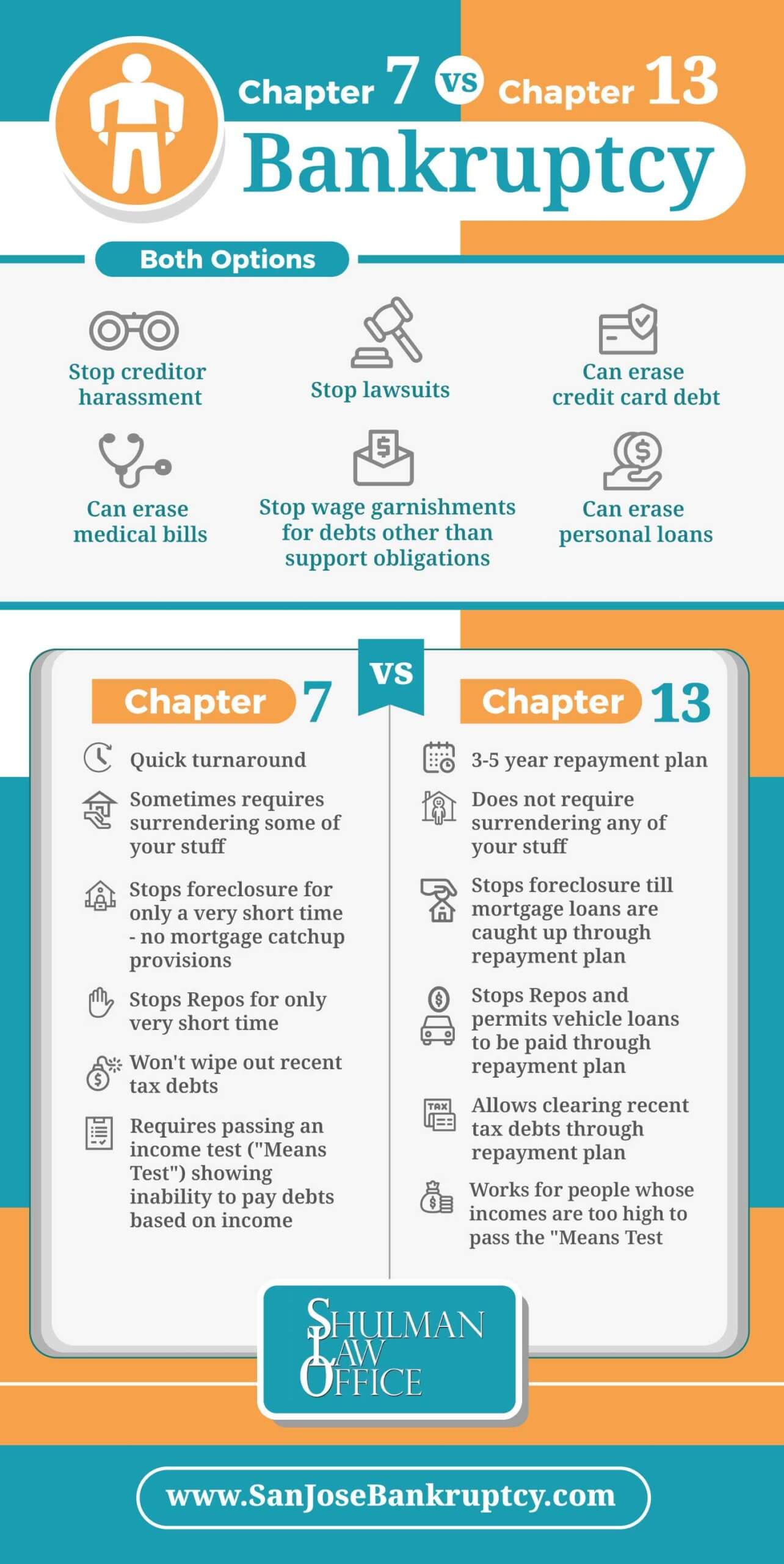

Bankruptcy comes in various forms, with Chapter 7 and Chapter 13 being the most common for individuals:

- Chapter 7: Known as liquidation bankruptcy, this type allows for the discharge of most unsecured debts after non-exempt assets are sold off. It’s typically faster, often taking about three to six months to complete.

- Chapter 13: Also known as reorganization bankruptcy, this type involves creating a three-to-five-year repayment plan to deal with debts while retaining your assets.

Key Documents Required for Bankruptcy in Snohomish County

The first step in preparing for bankruptcy involves gathering all necessary documents. Here is a checklist:

| Document | Description |

|---|---|

| Bankruptcy Petition | Your initial filing, detailing personal information, debts, assets, and your income. |

| Means Test | Determines if you qualify for Chapter 7 by comparing your income to the median in Washington. |

| Credit Counseling Certificate | You must complete a pre-filing credit counseling course from an approved agency. |

| List of Creditors | Detailed information about all your creditors, including their contact details and debt amounts. |

| Income & Expense Statement | Summary of your monthly income and expenses for the past six months. |

| Tax Returns | Copies of your federal tax returns for the last two years. |

| Bank Statements | Last six months' statements from all your financial accounts. |

| Property Leases or Deeds | All documents proving ownership or lease agreements for real property. |

| Pay Stubs | Pay stubs for the last 60 days before filing. |

| Retirement Account Statements | Statements showing retirement plan balances. |

| Vehicle Registration and Valuation | Documents for any vehicles you own or lease, including their estimated value. |

| Personal Property Inventory | A detailed list of your household goods, clothing, jewelry, etc. |

Notes:

📝 Note: Ensure all documents are complete, accurate, and reflect the current financial situation. Missing or incorrect information can delay the process or even lead to case dismissal.

Completing the Bankruptcy Process

After you’ve gathered your documents, here’s what follows:

- File the Bankruptcy Petition: This is your official filing with the bankruptcy court.

- Meeting of Creditors (341 Meeting): You’ll meet with the trustee and creditors, where you answer questions about your financial status and paperwork.

- Debtor Education Course: You must complete a post-filing financial management course before discharge.

- Confirmation Hearing: For Chapter 13 filers, this hearing confirms your repayment plan with the court.

- Discharge: Once you’ve met all requirements, the court issues your discharge, releasing you from personal liability for certain debts.

Navigating Legal Fees and Costs

Filing for bankruptcy involves various fees and costs:

- Filing Fee: This is the court fee for filing, which varies based on the type of bankruptcy.

- Attorney’s Fee: Legal representation can be expensive, but it’s crucial for navigating complex bankruptcy laws.

- Additional Expenses: Costs for credit counseling, debtor education courses, and any necessary copies or certifications.

🔔 Note: In some cases, the court may allow you to pay the filing fee in installments or waive it entirely if you're unable to pay.

Post-Bankruptcy Steps

Bankruptcy does not end with discharge; there are steps to follow:

- Manage Credit: Rebuild your credit slowly with secured credit cards, credit builder loans, or other strategies.

- Reaffirmation Agreements: Decide whether to reaffirm debts you wish to keep.

- Revise Financial Plans: Establish a budget and consider professional financial advice to prevent future financial distress.

Summary

Navigating bankruptcy in Snohomish County requires understanding your case type, gathering extensive documentation, completing necessary courses, and following through with legal proceedings. With diligent preparation, you can reduce stress and increase the likelihood of a successful bankruptcy filing, paving the way for a fresh financial start.

What happens if I forget to include a creditor in my bankruptcy filing?

+

Forgotten creditors can sometimes be included after filing through a process known as an amendment. However, consulting with your attorney can provide clarity on how to proceed in this situation.

Can I keep my car or home in bankruptcy?

+

Yes, in Chapter 13, you can keep your property by paying it off through your repayment plan. Chapter 7 allows for exemptions that might enable you to retain certain assets, but selling non-exempt assets may be necessary.

How long does a bankruptcy affect my credit score?

+

Chapter 7 bankruptcy can stay on your credit report for up to 10 years, whereas Chapter 13 remains for seven years. However, with responsible financial management post-bankruptcy, you can begin rebuilding your credit immediately.