Essential Documents for Filing Taxes: The Checklist You Need

Why Proper Documentation is Crucial

Filing taxes can be a daunting task, especially when you’re not prepared with the right documents. The IRS requires comprehensive documentation to verify the accuracy of your tax return, and having everything in order can streamline the process, reduce errors, and potentially save you money through deductions and credits. This post will guide you through the essential documents you need to gather for a successful tax filing experience.

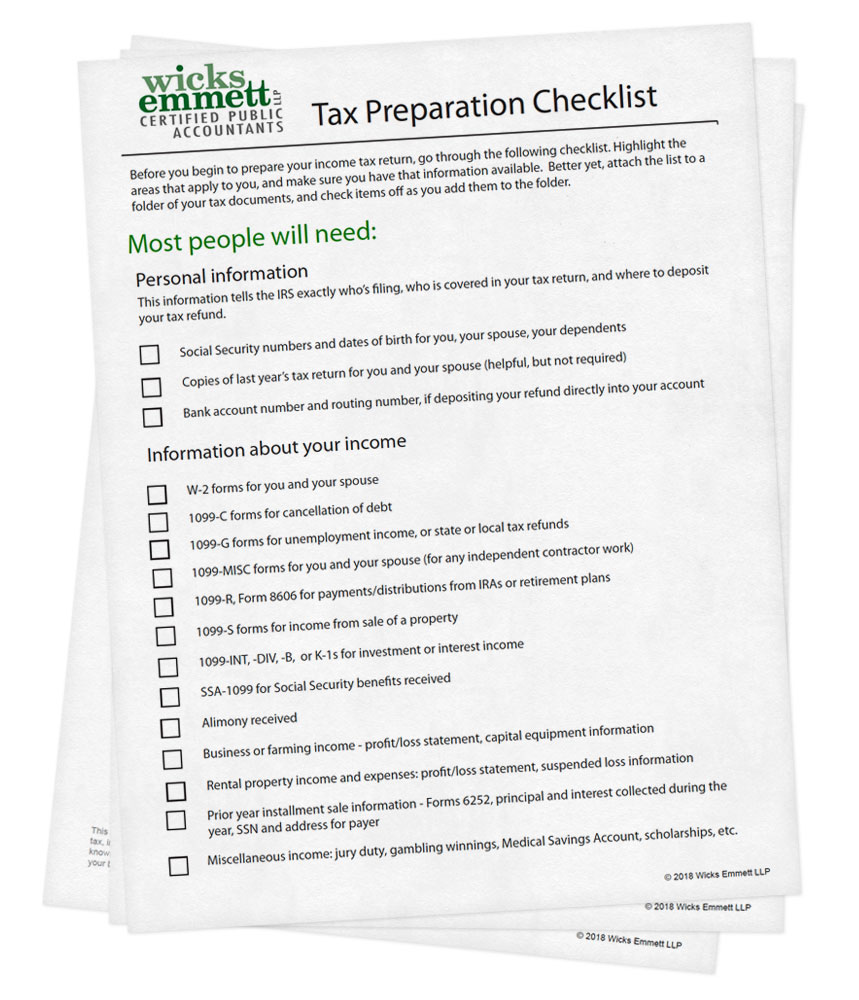

Personal Information Documents

Before diving into the specifics, ensure you have your personal information at hand:

Social Security Numbers (SSNs) or Taxpayer Identification Numbers (TINs) for you, your spouse, and any dependents.

Note: If you’ve lost your Social Security card, apply for a replacement well before tax season to avoid delays.

Previous Year’s Tax Return: Sometimes, you might need information from your last year’s return.

💡 Note: Check if your tax situation has changed significantly since last year, as this could affect what documents you need.

Income Documents

Income verification is a cornerstone of tax filing. Here’s what you need:

W-2 Form: Wage and Tax Statement from each employer, detailing your earnings and withholdings.

1099 Forms:

- 1099-MISC: Non-employee compensation, rent, royalties, or other income not subject to regular income tax withholding.

- 1099-INT: Interest income.

- 1099-DIV: Dividend income.

- 1099-B: Proceeds from Broker and Barter Exchange Transactions.

- 1099-G: Certain government payments like unemployment benefits.

1098 Forms:

- 1098: Mortgage interest you’ve paid, which might be deductible.

- 1098-E: Student loan interest.

K-1 Form: If you’re a partner in a partnership or an S-Corp shareholder, this reports your share of income, deductions, and credits.

Miscellaneous Income: Sales receipts, invoices, or bank statements for any additional income sources like freelance work or online sales.

Expense and Deduction Documentation

Failing to claim deductions can lead to overpaying taxes. Here are some common deductions and their documentation:

Charitable Contributions: Keep receipts, canceled checks, or a written acknowledgment from the charity.

Medical and Dental Expenses: Save bills, statements, insurance Explanation of Benefits (EOBs), and receipts.

Education Expenses: If you’re claiming educational credits, gather tuition statements (Form 1098-T), receipts for course materials, or records of student loan interest paid.

Home Office Deduction: If you’re self-employed or have a business, document your home’s usage for work with a dedicated office space and possibly hire an appraiser to estimate the business use percentage.

Business Expenses: Save all receipts, invoices, and canceled checks for business-related expenses. Keep logs of travel, mileage, and business meal costs.

Retirement Contributions: Records of contributions to IRAs, 401(k)s, and other retirement plans.

Credits and Tax Reductions Documentation

Certain credits can substantially decrease your tax liability:

- Earned Income Tax Credit (EITC): Proof of income, child’s SSNs, and residency if applicable.

- Child Tax Credit: SSNs for children under 17.

- American Opportunity Credit / Lifetime Learning Credit: School records, tuition paid, and Form 1098-T.

Tax Payment Records

For those who owe taxes:

- Estimated Tax Payments: Keep records of any quarterly payments you’ve made to avoid penalties.

Investment and Real Estate Documents

If you’ve sold property or assets:

- Sales Records: Documentation of sales of stocks, mutual funds, or real estate to calculate capital gains or losses.

Divorce or Separation Agreements

If your marital status has changed:

- Copies of Divorce Decrees: Ensure to include any alimony or child support agreements.

Foreign Assets or Income

If you have foreign investments or income:

- FBAR: Records for filing FinCEN Form 114 if you own foreign financial accounts exceeding $10,000.

- Foreign Earned Income Exclusion: Documentation for foreign housing expenses if you’re a U.S. citizen or resident living abroad.

Organizing Your Tax Documents

The key to a hassle-free tax season:

- Organize Chronologically: Arrange all documents by date to ensure nothing slips through the cracks.

- Create a Checklist: Follow a detailed checklist like this one to ensure you’ve covered everything.

- Utilize Technology: Software can help you digitize your documents and keep them secure and accessible.

💡 Note: Keeping digital copies of your documents can be a lifesaver in case of loss or damage.

As we move towards the end of tax season, understanding the importance of having all necessary documents in place cannot be overstated. Proper documentation ensures accuracy, compliance with IRS regulations, and can potentially uncover overlooked deductions and credits. By following this checklist, you’re setting yourself up for a smooth tax filing experience.

What if I can’t find one of my tax documents?

+

If you can’t find a document like a W-2 or 1099, contact your employer or the issuer of the form for a replacement. Alternatively, you can use IRS Form 4852 to estimate the missing information for filing purposes. Remember, you’ll still need the correct document when it becomes available.

Do I need to keep receipts for everything?

+

You should keep receipts for expenses that you plan to deduct. This includes business expenses, medical expenses, charitable contributions, and more. The IRS might request substantiation for deductions, so retaining records for at least three years is recommended.

How do I handle foreign income?

+

Report all foreign income on your U.S. tax return. You might qualify for the Foreign Earned Income Exclusion if you meet specific requirements like residency, income source, and time spent abroad. Additionally, consider filing FBAR if your foreign financial accounts exceed $10,000.