Tax Prep Essentials: Necessary Paperwork for Filing

Embarking on the journey of tax preparation can seem daunting, especially with the myriad of documents required. To ease this burden, we'll walk you through the essential paperwork needed for filing your taxes accurately and efficiently.

Tax Forms

Understanding the various forms is crucial to filing your taxes. Here’s what you need:

- Form W-2: If you are an employee, this form summarizes your annual earnings and the taxes withheld.

- Form 1099: This form comes in various types (1099-NEC, 1099-MISC, 1099-INT, etc.) depending on the type of income you’ve received (freelance work, interest, dividends).

- Form 1040: The backbone of your tax return, where all income and potential deductions are reported.

Income Documentation

All income must be reported, which means you need documentation for:

- Wages: Your W-2 or pay stubs.

- Freelance or Self-Employment Income: 1099 forms, invoices, and bank statements.

- Investment Income: 1099-B, 1099-INT, 1099-DIV.

Remember, even if you don’t receive a form for some income, it must be reported.

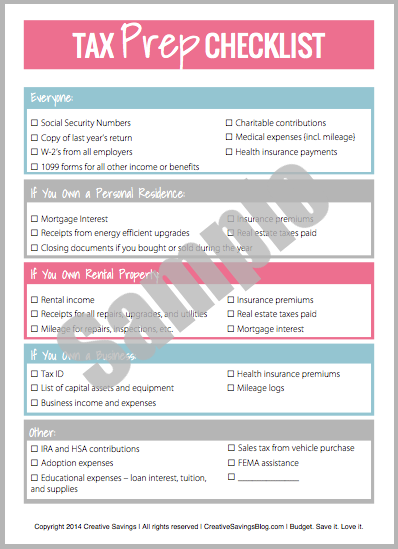

Deductions and Credits

To claim deductions and credits:

- Itemized Deductions: Receipts or proof of payment for medical expenses, charitable contributions, mortgage interest, etc.

- Education Credits: Form 1098-T for tuition payments, student loan interest statements.

- Child Care Credits: Provider’s Tax ID, payment receipts.

Proper documentation is key to maximizing your deductions.

Other Essential Documents

- Health Insurance Documentation: Forms 1095-A, 1095-B, or 1095-C for the Affordable Care Act compliance.

- Social Security Number: For yourself, your spouse, and dependents.

- Prior Year Tax Return: Useful for reference and certain deductions.

Having these documents organized can save time and reduce errors.

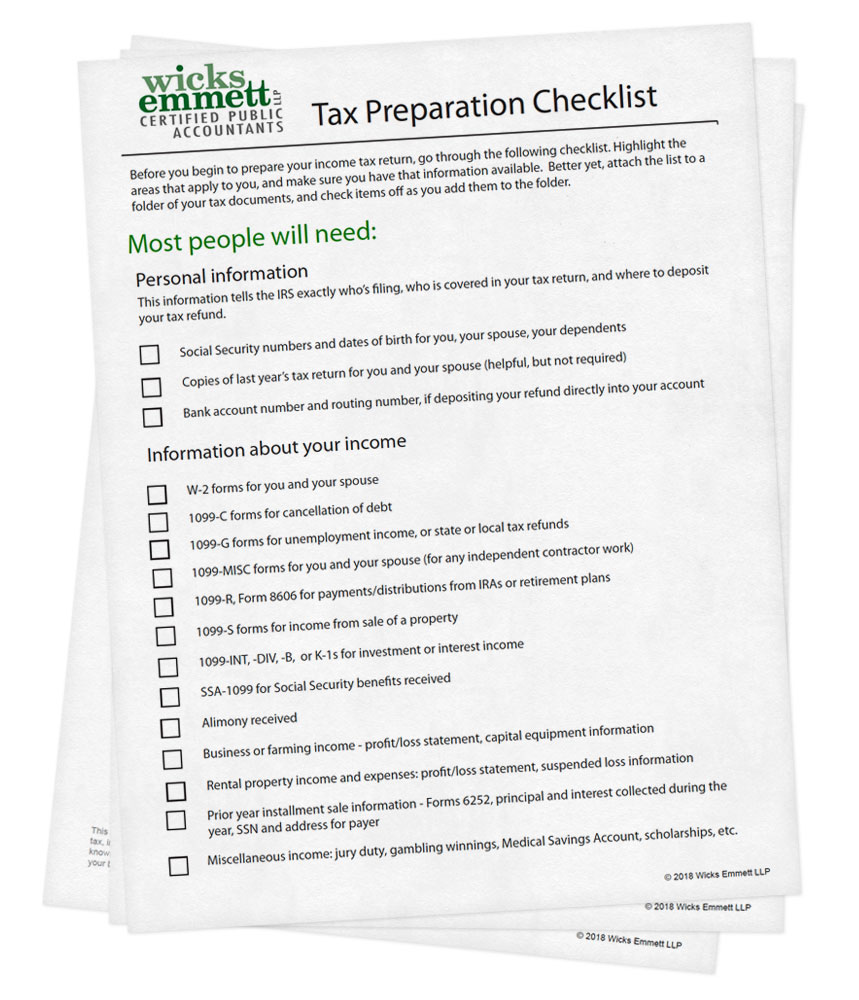

Organizing Your Documents

Organizing your tax documents can be a game-changer:

- Categorize Your Documents: Income, Expenses, Deductions, Credits, and Identifying Information.

- Use Digital Tools: Consider using apps or cloud storage to keep digital copies.

- Keep Physical and Digital Records: Ensure you have both for security.

Good organization leads to a smoother filing process.

Final Preparation Tips

- Check for Updates: Tax laws change; make sure your documents match current requirements.

- File Early: Filing early can prevent last-minute stress and errors.

- Backup: Always have a backup of all documents, digital or physical.

As you gather these tax documents, remember that organization is your ally in making tax season less taxing.

📌 Note: Even if you're using tax software or hiring a professional, having all your documents in order is beneficial.

Preparing for tax filing is about more than just knowing which forms to fill out; it's about having the right documents at your fingertips to ensure you're taking advantage of all possible deductions and credits. Organizing your paperwork helps streamline the process, ensuring accuracy and potentially saving you from the headaches of last-minute filings or audits. As you conclude this year's tax journey, take a moment to reflect on the importance of documentation, and consider how this organization can benefit you in future filings, making the process smoother and less stressful each year.

What if I can’t find a necessary tax document?

+

Try contacting the issuer of the document or use available online portals to retrieve missing documents. You can also request a transcript from the IRS if needed.

Do I need to keep all tax documents?

+

Yes, keep tax documents for at least three years from the date you filed your return or the return due date, whichever is later, in case of an audit.

Can I file taxes without all my documents?

+

It’s highly recommended not to, as missing documents can lead to errors or incomplete returns. However, if necessary, you can file for an extension, but this only delays the filing, not the payment of taxes.