Essential Paperwork for Filing Income Tax: Your Checklist

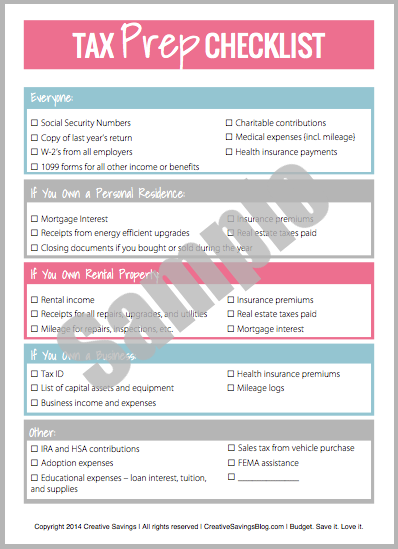

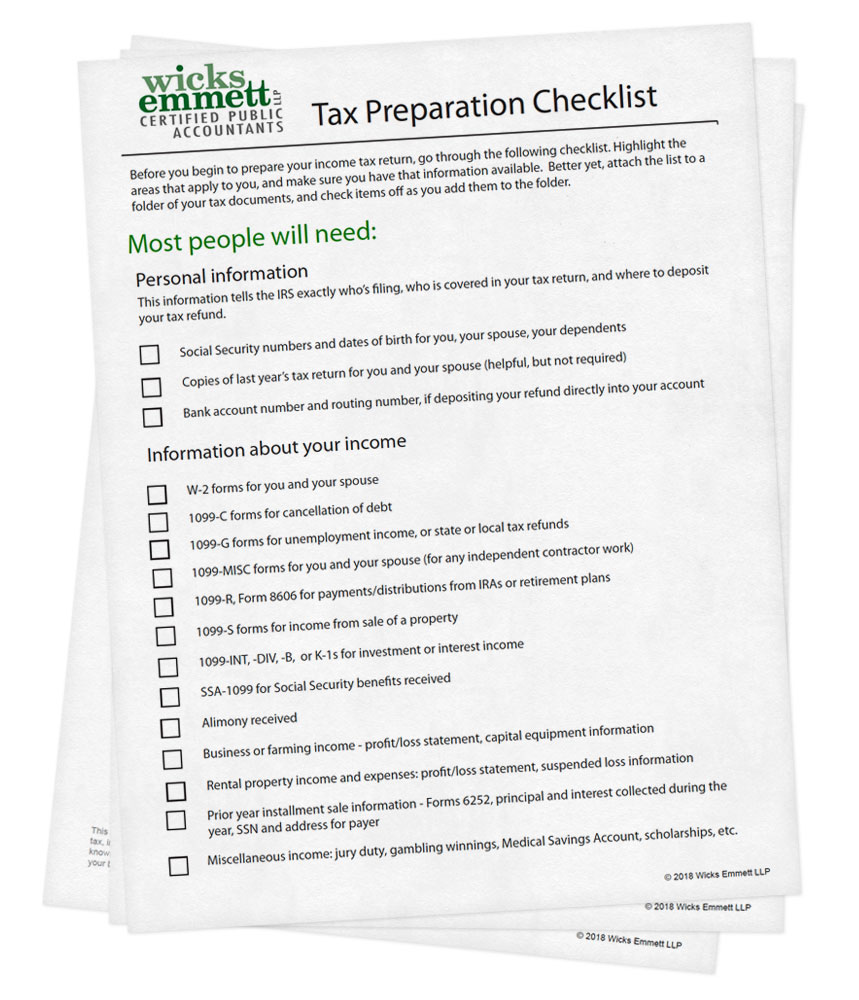

As tax season approaches, ensuring that you have all the necessary documentation in place is crucial for a smooth filing process. Whether you're filing as an individual, a freelancer, or a small business owner, here's an essential guide to help you navigate through the myriad of paperwork required for income tax filing. This checklist will not only streamline your tax preparation but also optimize your tax return.

Personal Information Documents

- Taxpayer Identification Number (TIN) or Social Security Number (SSN): Essential for identification on tax documents.

- Driver’s License: Another form of ID which might be required by some states or for identity verification.

- Passport: Useful for verifying identity especially if you’ve lived or worked abroad.

- Address Proof: Utility bills or rental agreements to validate your current address.

Income-Related Documents

| Document | Description |

|---|---|

| W-2 Forms | Issued by employers showing wages earned and taxes withheld. |

| 1099-NEC Forms | Reports non-employee compensation, commonly used for freelancers. |

| 1099-INT | Details interest income from banks or credit unions. |

| 1099-DIV | Provides information on dividend income. |

| 1099-G | Used for reporting unemployment compensation or state and local income tax refunds. |

| K-1 Forms | Received if you are a partner in a partnership or an S corporation. |

💡 Note: Make sure to check each form for correctness and report any discrepancies to your employer or income provider.

Deduction and Credit Documentation

- Mortgage Interest Statement (Form 1098): For homeowners looking to claim mortgage interest deductions.

- Charitable Contributions: Receipts or acknowledgment from the organizations you’ve donated to.

- Medical Expenses: Receipts, bills, or insurance statements to validate medical deduction claims.

- Education Expenses: Tuition statements or receipts (Form 1098-T).

- Business Expenses: If self-employed, keep records of all expenses like travel, home office, utilities, etc.

- Dependent Information: Social Security numbers, birth dates, and proof of dependency.

- Investment or Retirement Account Statements: For contributions to IRAs, Roth IRAs, or 401(k) plans.

Filing Requirements

Depending on your income level, filing status, and other factors, you might need:

- Form 1040: The standard individual income tax return.

- Schedule C: For reporting income or losses from a business you operated or a profession you practiced as a sole proprietor.

- Schedule A: For itemizing deductions if not taking the standard deduction.

📝 Note: Ensure all forms are filled out completely, signed, and dated before submission.

Having a clear, well-organized checklist like this can significantly reduce stress and potential errors during tax season. With the right documentation in hand, you can maximize deductions and credits, minimize your tax liability, and ensure compliance with IRS regulations. This year, let’s make tax filing as straightforward as possible by being proactive with your paperwork, keeping track of all necessary documents, and understanding the deductions and credits available to you.

What if I haven’t received my W-2 or 1099 forms by the deadline?

+

If you haven’t received your tax forms by mid-February, contact your employer or the payer to ensure they’ve been sent. If issues persist, you can file for an extension or use a substitute W-2 form available from the IRS.

Can I e-file my taxes if I’ve received a paper W-2?

+

Yes, you can e-file your taxes even with a paper W-2. Most tax software allows you to input the information manually. Just make sure to keep your paper W-2 for your records in case of an audit.

Are there any online tools to help with tax filing?

+

Yes, there are numerous online tax filing services like TurboTax, H&R Block, and even free options like IRS Free File if your income is below a certain threshold. These platforms guide you through the filing process, often pulling data directly from your financial institutions or employers.