FHA Loan Paperwork: What You Need to Know

When you're ready to dive into the world of home ownership, securing a loan can be a complex and daunting task. Among the plethora of mortgage options, FHA loans stand out due to their favorable terms for borrowers, especially first-time buyers. This guide walks you through the paperwork involved in an FHA loan application, helping you understand what you need and how to prepare.

Understanding FHA Loans

FHA loans are mortgages insured by the Federal Housing Administration, a division of the U.S. Department of Housing and Urban Development. This insurance reduces lender risk, allowing borrowers with lower credit scores or smaller down payments to qualify for loans. Here’s what you need to know:

FHA loans are mortgages insured by the Federal Housing Administration, a division of the U.S. Department of Housing and Urban Development. This insurance reduces lender risk, allowing borrowers with lower credit scores or smaller down payments to qualify for loans. Here’s what you need to know:

- Lower Down Payment: FHA loans typically require a down payment as low as 3.5% of the home’s purchase price.

- Credit Requirements: While a higher credit score can get you better rates, FHA loans are more forgiving with lower credit scores.

- Loan Limits: There are caps on the amount you can borrow, which vary by location.

- Mortgage Insurance Premium (MIP): FHA loans require both an upfront and an annual MIP payment.

The FHA Loan Application Process

Applying for an FHA loan involves several steps, all of which require careful attention to detail:

1. Pre-Qualification and Pre-Approval

- Pre-Qualification: Get a rough estimate of how much home you can afford based on your income and expenses.

- Pre-Approval: Lenders will verify your credit, income, and assets to provide a more precise loan amount.

During this stage, you’ll need to provide documents like W-2s, recent pay stubs, bank statements, and possibly tax returns.

2. Choosing a Lender

Once pre-approved, select an FHA-approved lender to proceed with your application. Here are some considerations:

- Interest rates

- Lender’s reputation

- Loan terms

- Fees and closing costs

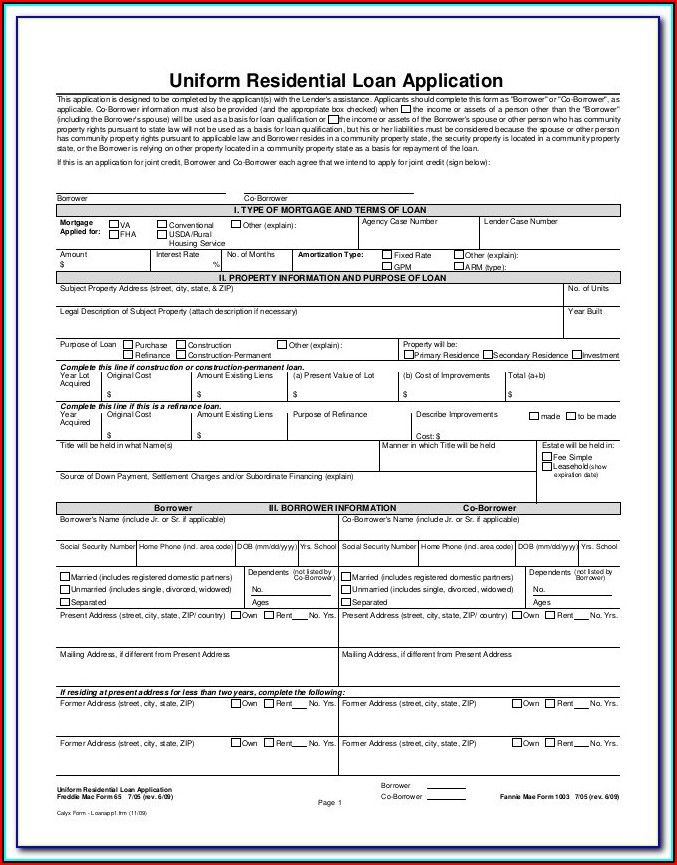

3. Loan Application

Submit your formal application, which requires detailed paperwork:

| Document | Why It’s Needed |

|---|---|

| Social Security Number | To check your credit history and for the mortgage approval process |

| W-2 Statements | To verify your employment income |

| Recent Pay Stubs | To confirm your current earnings |

| Bank Statements | To assess your financial stability and savings |

| Tax Returns | To provide an overview of your financial situation over the last few years |

| Employment Verification | Letter from your employer or contact information for verification |

| Down Payment | Proof of funds for the down payment and closing costs |

| Credit Report | To review your credit score and credit history |

Paperwork Tips

- Organize: Keep all documents in one place, ideally in chronological order.

- Accuracy: Check for any errors or discrepancies. Inaccurate information can delay or derail your application.

- Communication: Keep in touch with your lender. They’ll guide you through additional requirements or documentation needed.

⚠️ Note: Lenders might require additional documents depending on individual situations or if you are self-employed. Be proactive in asking what you'll need.

After Submission

Once your application is submitted:

- Wait for Underwriting: The underwriter will review your application and documents to assess the risk involved.

- Possible Requests: Be prepared to provide additional information or documents during this phase.

- Appraisal: An FHA appraisal to verify the value of the property and ensure it meets HUD’s Minimum Property Standards.

- Approval or Conditional Approval: If approved, you might still need to meet conditions before final approval.

- Closing: Sign the final documents, pay any closing costs, and finalize your home purchase.

📝 Note: FHA loans require that the home being purchased meets specific safety and livability standards. Keep this in mind when choosing a property.

Securing an FHA loan involves thorough preparation and understanding of what documentation is necessary. By ensuring all your paperwork is in order, you streamline the process, increasing your chances of a smooth loan approval. Remember, this journey is as much about preparing for the application as it is about preparing for homeownership. Understand the process, gather your documents, and engage with your lender to navigate this path successfully.

What if I’ve had credit issues in the past?

+

FHA loans are designed to help people with less than perfect credit. You can still qualify, but lenders might require additional conditions like a larger down payment or proof of stable employment.

How long does the FHA loan application process take?

+

The process can vary but typically takes between 30 to 60 days. This depends on how quickly you provide documentation, the complexity of your case, and the lender’s efficiency.

Can I use gift funds for my down payment?

+

Yes, FHA loans allow you to use gift funds for your down payment. However, you need to provide a gift letter stating the gift is not a loan and has no expectation of repayment.

What if my loan is denied?

+

If your loan is denied, review the reasons with your lender. It could be due to incomplete or incorrect documentation, credit issues, or high debt-to-income ratio. Working on these areas or considering different loan options might help.