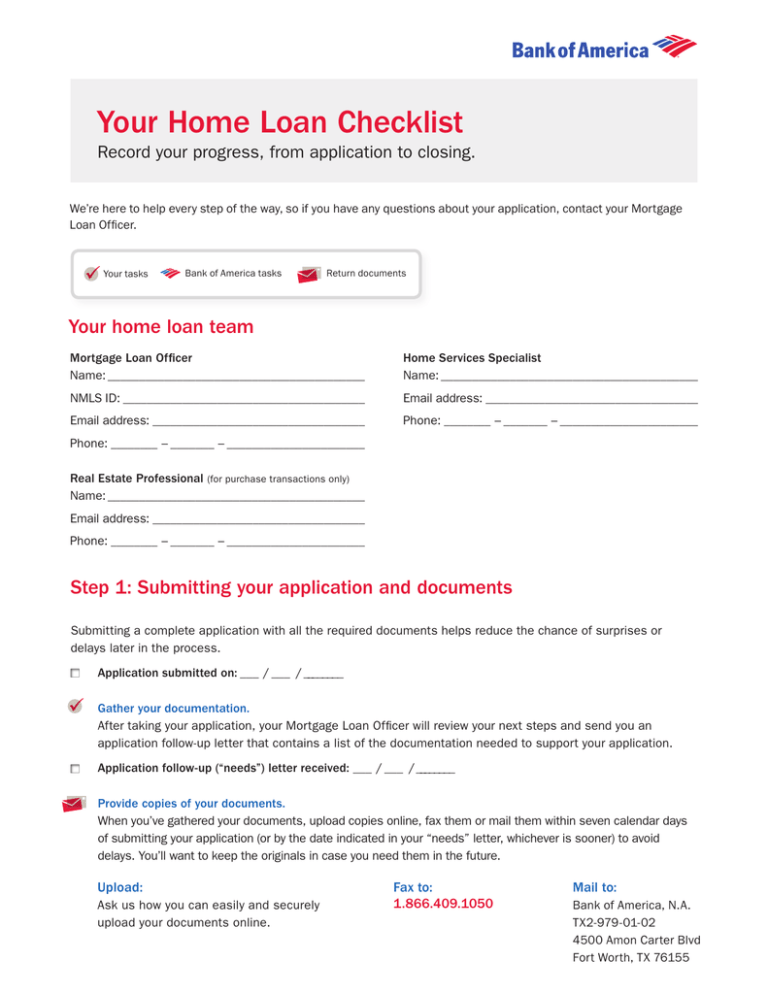

5 Essential Documents for Mortgage Approval

The mortgage approval process can seem daunting, particularly with all the documentation required. Whether you're a first-time homebuyer or looking to upgrade, understanding the essential documents for mortgage approval is crucial. Here, we detail five key documents to streamline your application process and boost your chances of securing that home loan.

1. Proof of Income

Lenders need to confirm your ability to repay the loan, making your income one of the most critical factors in mortgage approval. Here are the documents you should gather:

- Recent Pay Stubs: Typically, lenders will request the last 30 days’ worth of pay stubs to assess your monthly income.

- W-2 Forms: Submit your W-2 forms from the previous two years to showcase stable employment.

- Tax Returns: Lenders may request full tax returns for the past two years, particularly for self-employed individuals or those with significant income fluctuations.

⚠️ Note: If you’ve recently changed jobs, expect to provide documentation for your former employment as well to demonstrate continuity.

2. Credit Report

Your credit score impacts the interest rate you’ll receive on your mortgage. A thorough check of your credit history is performed by lenders:

- Ensure no errors appear on your credit reports from the three major bureaus - Experian, Equifax, and TransUnion.

- Be aware that hard inquiries can temporarily lower your credit score, so minimize them before applying for a mortgage.

- If you’ve had financial issues, prepare explanations or evidence of recovery.

3. Bank Statements

Lenders review your recent bank statements to verify your financial health and cash reserves. Here’s what you need:

- Savings: Statements for your savings accounts for the past three to six months.

- Checking: Recent statements for your checking account to prove regular deposits and expenditures.

- Investment Accounts: If you use investment funds for a down payment, provide statements to show the liquidity of these assets.

💡 Note: Large, unexplained deposits may require a gift letter from the donor stating it’s not a loan.

4. Employment Verification

Proving steady employment is vital. Here’s what you’ll need:

- Employment Letter: A formal letter from your employer stating your position, tenure, salary, and payment frequency.

- Payroll Records: These might be requested to complement your pay stubs or W-2 forms.

📢 Note: If you’re self-employed, expect to provide profit and loss statements or balance sheets.

5. Asset and Property Information

The property you’re buying and your assets play a significant role in the loan approval process:

- Purchase Agreement: A signed agreement outlining the terms between you and the seller.

- Property Details: Lenders may require information about the property’s condition, value, and any improvements.

- Asset Documentation: Statements for retirement accounts, rental properties, or other assets that could be considered for loan qualification.

To wrap up, having these five essential documents ready significantly speeds up your mortgage application. They provide lenders with the necessary assurance of your financial stability, creditworthiness, and the feasibility of your loan request. Remember, the better your preparation, the smoother your journey to homeownership.

What if my income varies significantly from month to month?

+

Lenders often use an average of your income over a specific period, so providing detailed documentation of your earnings for the past two years is crucial. They’ll also look at your tax returns and YTD earnings to determine your income for mortgage approval.

How recent do my pay stubs need to be?

+

Typically, lenders will request pay stubs from the last 30 days before your mortgage application. If you receive pay stubs less frequently, the most recent one or the last one from each employer within the 30-day period would suffice.

Can I use a gift for a down payment?

+

Yes, many lenders allow gifts to be used as a down payment. However, the donor must provide a gift letter stating that the funds are not a loan, and sometimes the donor’s banking information may be required to verify the source of funds.