Essential Paperwork for Opening a Business Bank Account

Opening a business bank account is a pivotal step for any entrepreneur embarking on their business venture. It provides a clear distinction between personal and business finances, which is not only essential for financial management but also crucial for legal and tax purposes. This separation of funds aids in maintaining accurate records, simplifies the process of bookkeeping, and ensures that the business owner's personal assets remain protected from potential business liabilities. In this comprehensive guide, we will delve into the essential paperwork you need to prepare when you're looking to open a business bank account, navigating through the paperwork maze to set your enterprise on the path to success.

Business Entity Documents

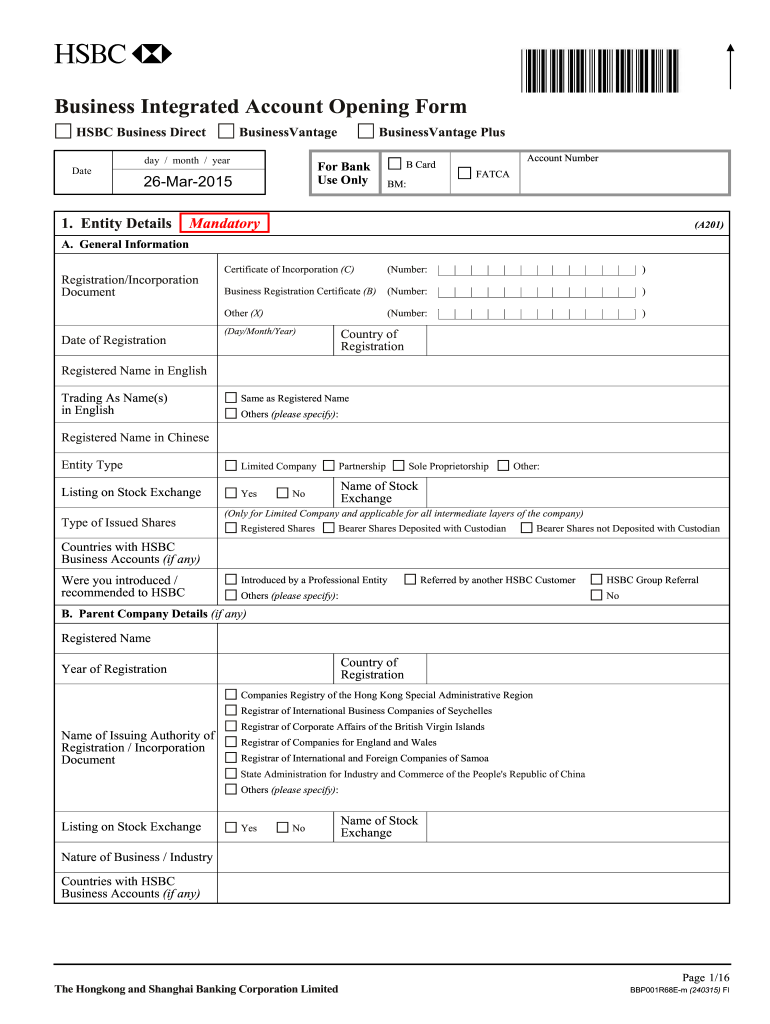

First and foremost, you will need to prove the legal existence and legitimacy of your business. The documents required will differ based on the type of business structure you have chosen:

- LLC: Articles of Organization, Operating Agreement, and EIN Confirmation Letter from the IRS.

- Corporation: Articles of Incorporation, Corporate Resolution Authorizing the Account, EIN Confirmation Letter, and Corporate Bylaws.

- Partnership: Partnership Agreement, EIN Confirmation Letter, and Certificate of Partnership.

- Sole Proprietorship: No specific business documents are needed, but you might be required to show a Doing Business As (DBA) Certificate if you operate under a name other than your own.

Identification and Personal Information

Banks require identification for those opening the account. Here’s what you’ll need:

- Driver’s license or passport for identification purposes.

- Your Social Security Number or Employer Identification Number (EIN) for tax identification.

Business Addresses and Contact Information

Your business’s address and contact details are fundamental for establishing your account:

- A physical address for your business, which cannot be a P.O. Box.

- Business phone number and email address.

Initial Deposit

Some banks might require an initial deposit to activate your account. This amount varies from bank to bank, so make sure you have the funds ready. While preparing your initial deposit:

- Bring cash or a business check for the deposit.

- If depositing via check, ensure it’s from a business account to avoid potential complications.

Other Key Documents

Depending on your business model or the bank’s policies, you might need additional documents:

- Business licenses or permits relevant to your industry.

- Tax documentation, like a recent tax return for sole proprietors.

- Documents showing the business’s activity, such as utility bills in the business name.

⚠️ Note: Not all banks require all of these documents, and some might have unique requirements. Contact the bank you're considering for their specific list.

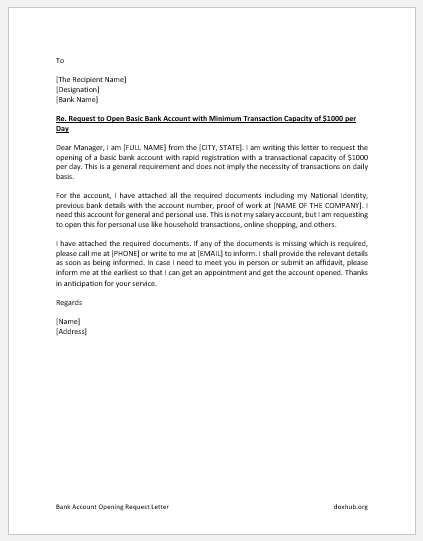

Once you have gathered all the necessary paperwork, you can approach your chosen bank to open the account. Here are some tips to streamline the process:

- Call ahead or visit the bank's website to verify the required documents.

- Make an appointment to open an account if possible, which can expedite the process.

- Have digital copies of documents available, as some banks may offer online or mobile account opening options.

📋 Note: Ensure all documents are up-to-date and legible. Faded or outdated documents might cause delays in the account opening process.

In conclusion, preparing the right paperwork when opening a business bank account can save time, reduce stress, and set a professional tone for your business operations. By gathering and organizing these documents, you not only streamline your own process but also contribute to the efficient and effective operation of your business. A well-documented and separate business bank account is a fundamental tool that will support your business's growth, provide transparency, and offer peace of mind as you manage your enterprise's financial affairs. Now, let's look at some common questions that might arise as you go through this process.

Can I open a business bank account if my business is registered in another state?

+

Yes, you can open a business bank account even if your business is registered in another state. You’ll need to provide all the standard documentation, along with proof of your business’s registration from the state where it’s registered.

What if I don’t have an EIN?

+

If your business structure doesn’t require an EIN, like a sole proprietorship, you might use your Social Security Number. However, for many business structures, an EIN is recommended to avoid personal liability. You can apply for an EIN online through the IRS website.

Do I need a physical location for my business to open an account?

+

No, you don’t necessarily need a physical location. However, the bank might require a physical address for legal purposes, which can sometimes be a home office or a virtual office service.

Can I use a P.O. Box for my business address?

+

Most banks do not allow the use of a P.O. Box as the primary business address. However, you might be able to use it as a mailing address, in addition to providing a physical address.