Essential Paperwork for Hiring a 1099 Contractor

Understanding 1099 Independent Contractors

When you decide to hire a 1099 independent contractor, it’s crucial to understand the implications and paperwork involved. A 1099 contractor is a self-employed individual who provides services to your business on a contract basis. Unlike traditional employees, these contractors are not subject to employment taxes withheld by the employer, which means different documentation and compliance requirements are in place. Here’s what you need to know:

- Flexibility: Independent contractors provide businesses with the flexibility to engage skilled workers without the long-term commitment of employment.

- Cost Savings: Hiring 1099 contractors can be more cost-effective due to no employment tax obligations and fewer HR responsibilities.

- Legal and Tax Considerations: You must classify these workers correctly to avoid potential legal and financial repercussions from misclassification.

Essential Paperwork for 1099 Independent Contractors

Ensuring all the necessary documentation is in place before hiring an independent contractor is key for legal compliance, clear expectations, and smooth business operations. Below, we delve into the vital paperwork:

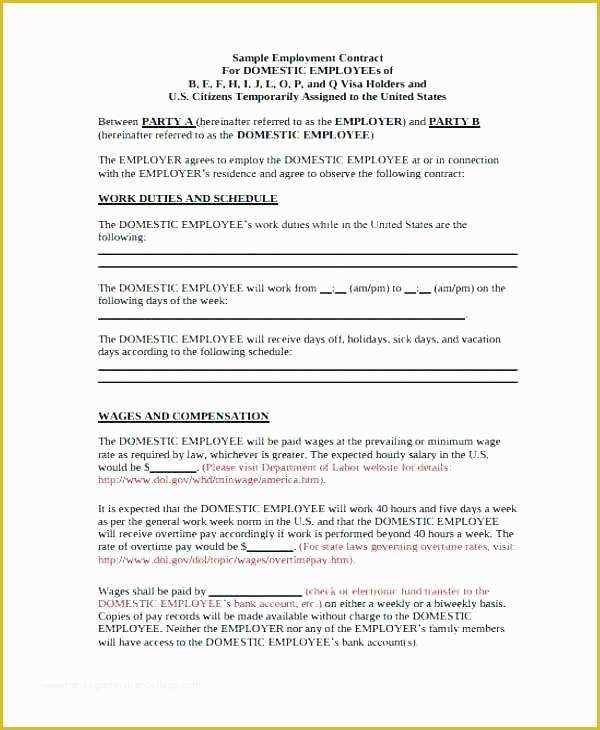

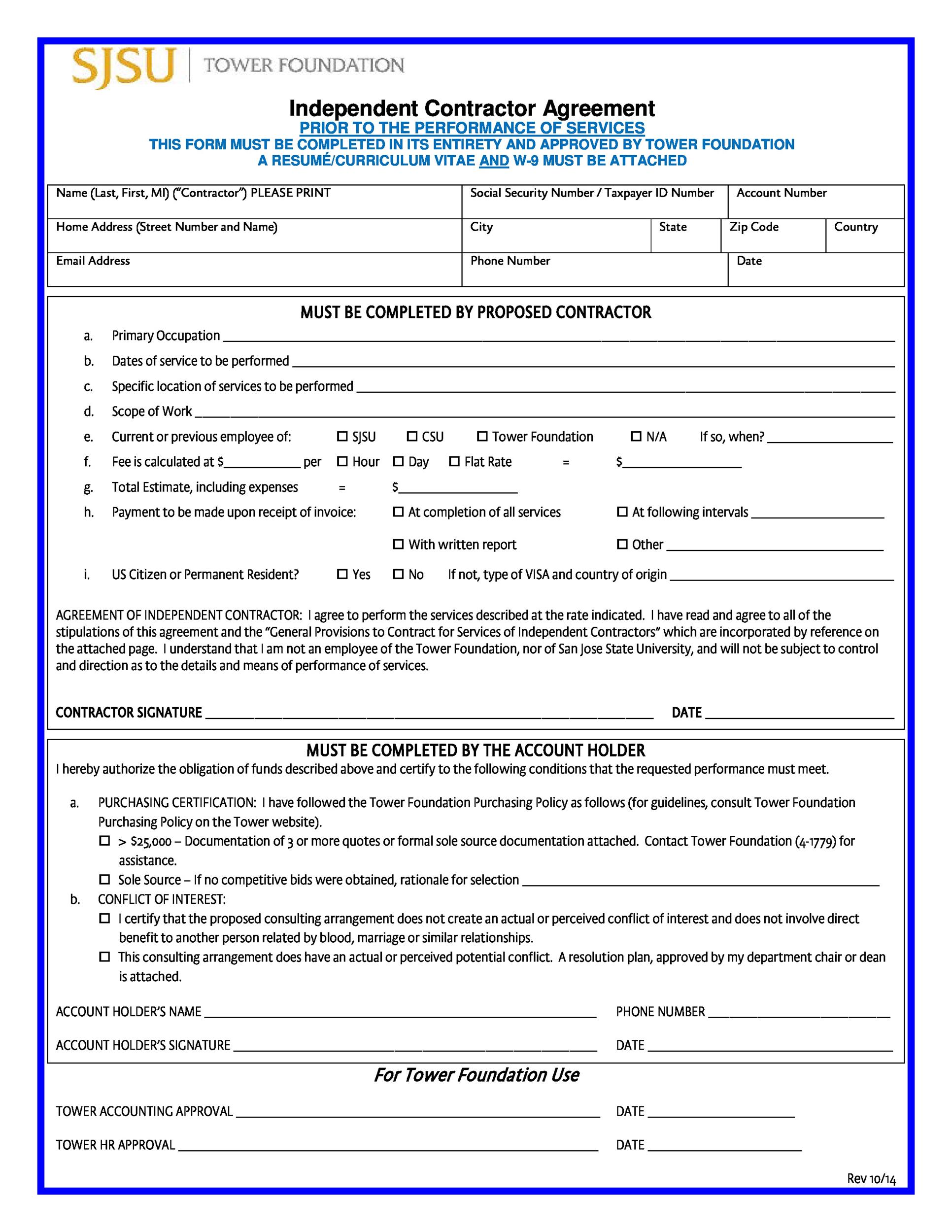

1. Independent Contractor Agreement

This document outlines the terms of engagement between you and the contractor. Key elements include:

- Scope of Work: Clearly define what services the contractor will provide.

- Payment Terms: Details on payment schedules, rates, and conditions for reimbursement of expenses.

- Duration: The start and end dates of the contract, including any options for renewal or termination.

- Confidentiality Clause: To protect your business’s proprietary information.

💡 Note: Review the agreement with a legal advisor to ensure it complies with state and federal laws.

2. Form W-9

The W-9 form is vital for gathering the contractor’s personal information necessary for tax reporting:

- Name and Address: Of the contractor or their business.

- Taxpayer Identification Number (TIN): This could be a Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: The contractor certifies under penalties of perjury that the TIN provided is correct.

This form is essential for issuing the 1099-NEC form at tax time.

3. Form 1099-NEC

If you pay a contractor $600 or more in a year, you’re required to issue this form to the contractor and the IRS:

- Necessary Information: Includes payments made to the contractor, your business information, and the contractor’s TIN.

- Filing Deadline: Must be filed by January 31 of the following year.

4. Certificate of Insurance

Depending on the nature of work, contractors might need to provide proof of:

- General Liability: Covers damage to people or property.

- Workers’ Compensation: For contractors with their own employees.

5. Non-Disclosure Agreement (NDA)

When dealing with sensitive information or proprietary technologies, an NDA can be crucial to:

- Protect Intellectual Property: Ensure contractors maintain confidentiality.

6. Confidentiality and Invention Assignment Agreement

This agreement can protect the work produced by the contractor:

- Ownership of Inventions: Clarifies who owns any inventions or work products developed during the contract period.

| Document | Purpose |

|---|---|

| Independent Contractor Agreement | To outline terms and conditions of the engagement. |

| Form W-9 | To gather necessary tax information from the contractor. |

| Form 1099-NEC | To report payments made to the IRS and the contractor. |

| Certificate of Insurance | To ensure the contractor has necessary insurance coverage. |

| NDA | To safeguard your business's confidential information. |

| Confidentiality and Invention Assignment Agreement | To establish ownership of inventions or work products. |

📝 Note: The above table summarizes key documents, but always ensure compliance with specific state or industry requirements.

Steps to Hire a 1099 Independent Contractor

Here are the practical steps to take when you decide to bring on a 1099 contractor:

Verify Work Eligibility: Ensure the contractor is legally allowed to work in the U.S.

Classify Correctly: Misclassification can lead to penalties. Understand IRS guidelines for distinguishing between employees and independent contractors.

Collect Required Paperwork: As outlined above, secure all necessary documents before work begins.

Set Clear Expectations: Discuss and document the scope of work, deadlines, and deliverables.

Make Payments: Agree on payment terms and ensure they are in compliance with tax regulations, typically without any deductions for employment taxes.

🛑 Note: Misclassification of a worker as a contractor when they should be an employee can result in legal issues and back taxes.

To summarize the journey of hiring a 1099 independent contractor, it’s about preparation and understanding the legal and financial obligations involved. This includes crafting a comprehensive Independent Contractor Agreement, gathering key forms like W-9 and 1099-NEC, and ensuring compliance with privacy and intellectual property rights through NDAs and Confidentiality Agreements. Correct classification and adherence to IRS regulations are paramount to avoid financial and legal consequences.

Keeping in mind these essential elements, you’re on your way to benefiting from the expertise and flexibility of independent contractors while maintaining compliance with state and federal regulations.

Can I classify someone as a 1099 contractor if they work exclusively for me?

+

Working exclusively for your business might raise concerns about misclassification. The IRS considers the degree of control over work, whether the worker is economically dependent on your company, and how integral their services are to your business.

What happens if I forget to file Form 1099-NEC?

+

Failure to file or incorrectly filing Form 1099-NEC can result in penalties from the IRS. It’s advisable to have a system in place to track payments and ensure compliance with tax deadlines.

Do I need to withhold taxes for a 1099 contractor?

+

No, you do not withhold taxes for a 1099 contractor. They are responsible for paying their own self-employment and income taxes. However, you must report their earnings to the IRS if you pay them more than $600 in a year.