Pension Filing Paperwork: A Complete Guide

Applying for your pension can seem daunting with all the required paperwork and legal steps, but we've broken down the process into manageable steps to help ensure you can retire comfortably. Whether you're nearing retirement or planning for the future, this guide provides a detailed walkthrough of the pension application process.

Understanding Pension Plans

Before diving into the paperwork, it's crucial to grasp the basics of pension plans. Pension plans are retirement funds set up by your employer or personal investments that provide income when you stop working.

- Defined Benefit Pension Plans: These promise a specified monthly benefit upon retirement, based on salary and years of service.

- Defined Contribution Plans: Here, you and possibly your employer contribute to your retirement account, but your benefits depend on investment returns.

- Hybrid Plans: Combining elements of both defined benefit and contribution plans, offering flexibility and security.

Pre-Filing Considerations

- Retirement age eligibility

- Your total years of service

- Contributions made by you or your employer

- Any decisions on lump sum payments versus annuity options

- Your health status for considering early retirement or disability benefits

Documents Required for Pension Filing

The following documents are typically required:

| Document | Purpose |

|---|---|

| Proof of Identity | Verifies your identity |

| Birth Certificate or Passport | Confirms your age |

| Social Security Number | Necessary for tax purposes and benefit coordination |

| Employment Records | Details service years and contributions |

| Marriage Certificate (if applicable) | For spousal benefits |

| Bank Details | To arrange pension disbursements |

Step-by-Step Application Process

- Contact Your Pension Provider: Verify specifics like retirement age, benefits, and the exact documents needed.

- Gather Documents: Compile all necessary documents as per the above list.

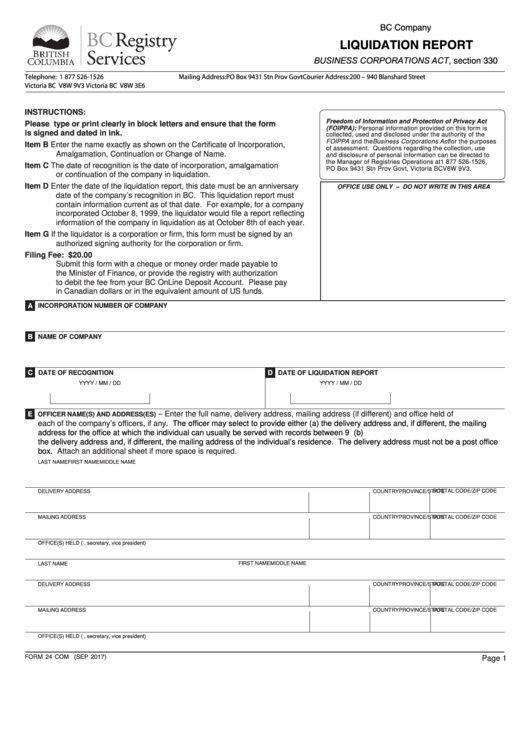

- Complete Application Forms: Carefully fill out all required forms, making sure to double-check all information for accuracy.

- Submit Application: Send your application through your employer, the pension fund, or online if available. Ensure to keep a copy for your records.

- Review and Approval: Your application will be reviewed, which might include additional verification processes or medical assessments if early retirement is requested.

- Pension Commencement: Upon approval, your pension will begin, either as a lump sum payment or monthly disbursements.

💡 Note: Always keep an organized record of your contributions, years of service, and communications with your pension provider.

Post-Filing Considerations

Once your pension is set up, there are several important aspects to consider:

- Survivor Benefits: How will your spouse or dependents be affected by your pension?

- Tax Implications: Your pension income may be taxable. Consult a financial advisor to optimize your strategy.

- Cost of Living Adjustments (COLA): Understand how COLA might affect your pension over time.

- Investment Choices: If your pension plan allows investment, evaluate your options to ensure growth in retirement funds.

Tips for a Successful Pension Application

To navigate the pension filing process smoothly:

- Start early to avoid rushing at the last minute

- Seek advice from your HR or pension provider

- Organize your documents systematically

- Stay updated on any changes in pension laws or regulations

- Consider consulting a financial planner for personalized advice

To sum up, while the process of filing for your pension can appear intricate, meticulous preparation and understanding the system can streamline the procedure. By following this guide, you'll be better equipped to tackle the application process, ensuring your retirement years are as financially secure and worry-free as possible.

What happens if I lose some of my pension documents?

+

Most pension providers keep records of your contributions. Contact them for replacements or alternatives.

Can I receive my pension while still working?

+

It depends on your plan rules. Some allow partial pension payments while employed, while others might require retirement.

What if I get divorced or my spouse passes away?

+

Your pension might be affected. Check your plan’s rules regarding spousal benefits and survivor options.