Essential Paperwork for Independent Contractor Agreements

Starting a new job as an independent contractor can feel like venturing into uncharted waters. The allure of flexibility and the joy of controlling one's work-life balance often overshadow the need for meticulous documentation. However, navigating the legal intricacies of contractor work requires understanding essential paperwork. This article aims to arm you with knowledge on the key documents necessary for a smooth working relationship between independent contractors and their clients.

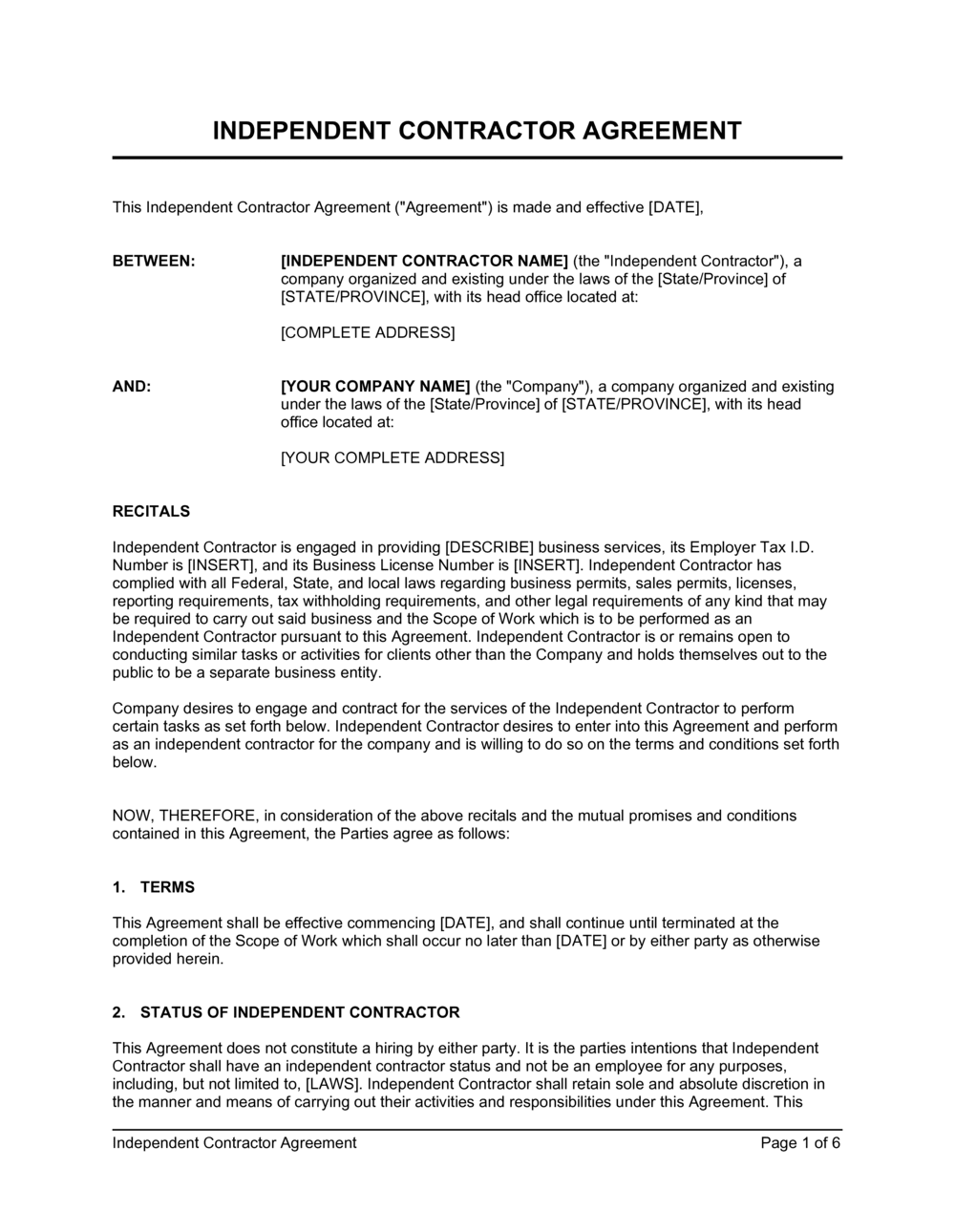

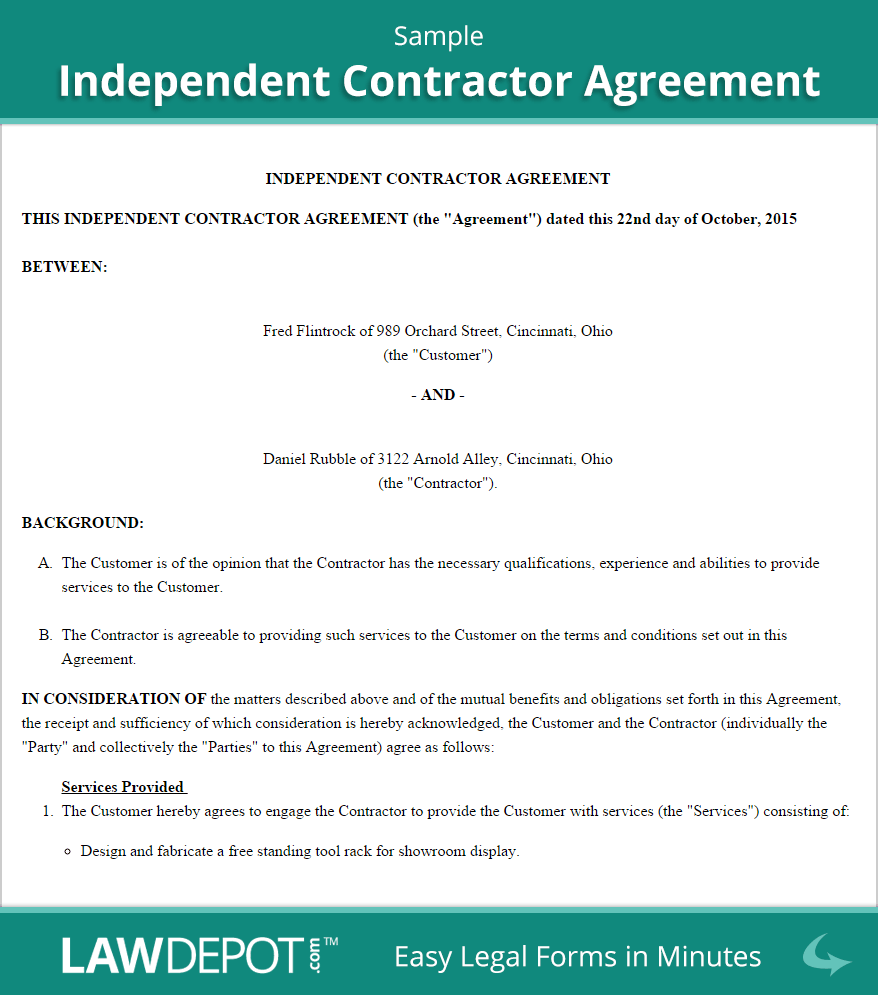

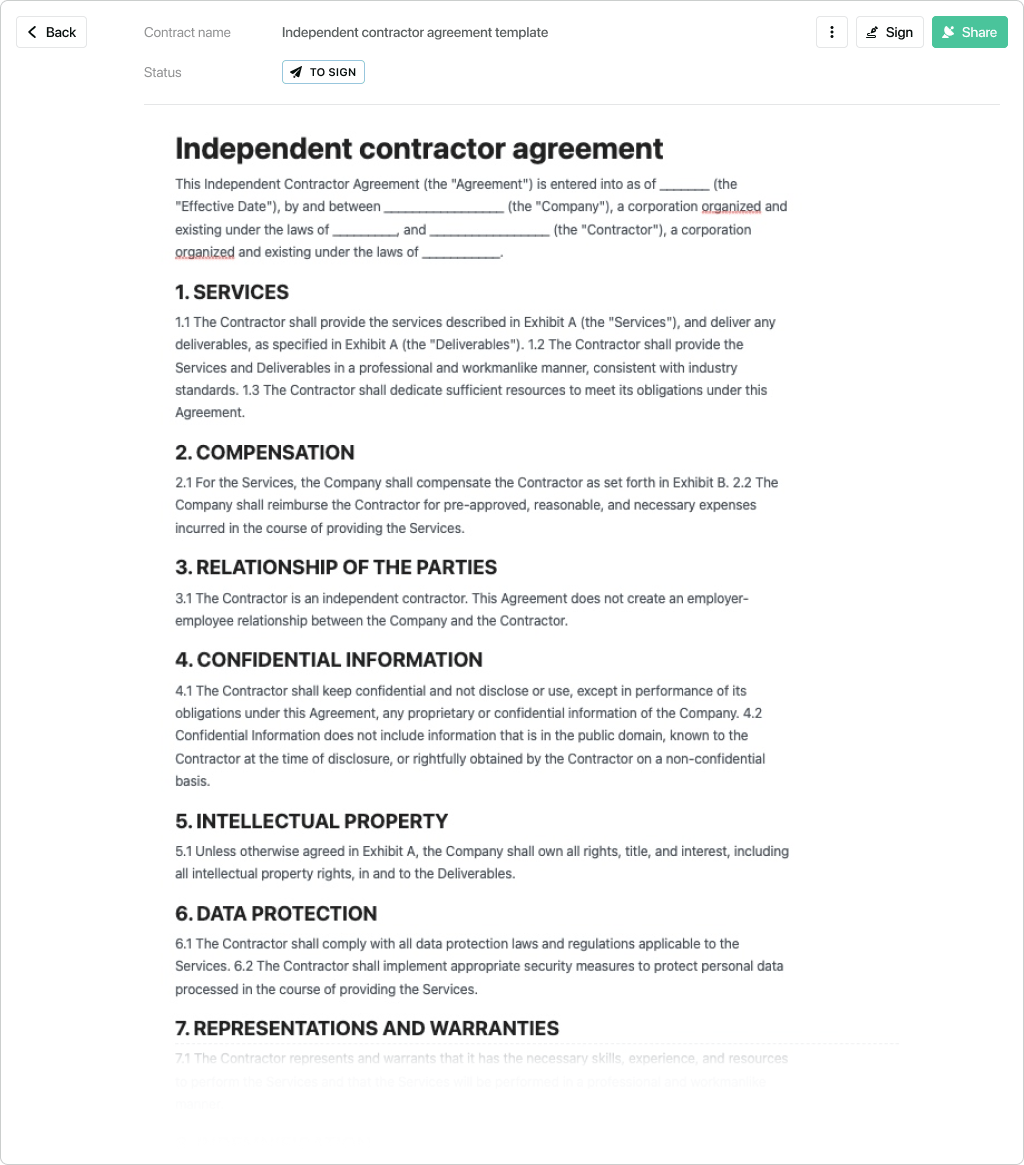

1. Independent Contractor Agreement

The cornerstone of any contractor-client relationship is the Independent Contractor Agreement (ICA). This document defines:

- The scope of work to be performed

- Compensation details

- Duration of the contract

- Termination terms

- Confidentiality clauses

- Liability and insurance details

It's vital to customize your ICA for the specific job, protecting both parties from potential disputes. A well-drafted agreement serves as the blueprint for the contractor engagement, reducing the risk of miscommunication.

2. Work-for-Hire Agreement

A Work-for-Hire Agreement is crucial when intellectual property rights are a concern. This agreement specifies that:

- The client will retain ownership of any created work product

- How modifications or revisions are handled

- Indemnity clauses against infringement claims

Creating this document, especially in creative fields, helps to avoid disagreements over who owns the end product and under what terms.

3. Non-Disclosure Agreement (NDA)

To safeguard business secrets, a Non-Disclosure Agreement (NDA) is often required:

- Defines what constitutes confidential information

- Stipulates the duration of confidentiality

- Outlines how confidential material should be handled

This document ensures that contractors do not misuse or disclose any proprietary information they encounter during their work.

4. Statement of Work (SOW)

An adjunct to the ICA, the Statement of Work (SOW), outlines:

- Specific milestones or deliverables

- Project deadlines

- Payment schedules

- Criteria for acceptance of the work

An SOW provides clarity, reducing the likelihood of scope creep and project misunderstandings.

5. Non-Compete Agreement

A Non-Compete Agreement might be necessary if the contractor's skills or knowledge could benefit competitors:

- Defines geographic scope

- Specifies time frame

- Outlines activities considered competitive

This document helps maintain a competitive edge by preventing contractors from working with direct competitors during or after their engagement.

🔍 Note: Non-Compete Agreements vary in enforceability by jurisdiction, so ensure they comply with local laws.

6. Invoicing and Payment Terms

Clear documentation of payment terms in the form of an invoice:

- Establishes the rate, whether hourly, per project, or another arrangement

- Details payment schedule

- Includes any agreed-upon expenses or reimbursements

- Sets late payment penalties or interest if necessary

Proper invoicing documentation helps maintain cash flow and reduces the likelihood of payment disputes.

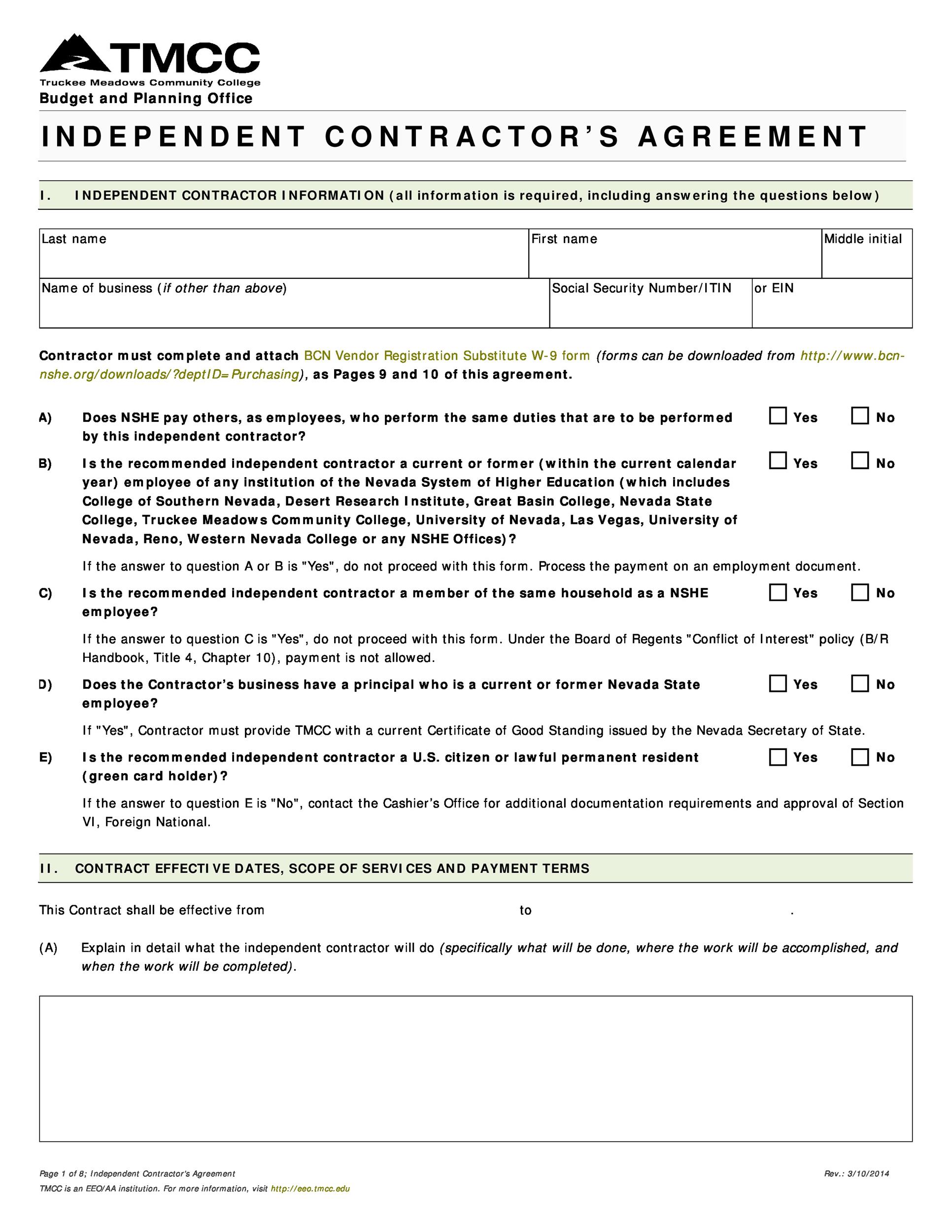

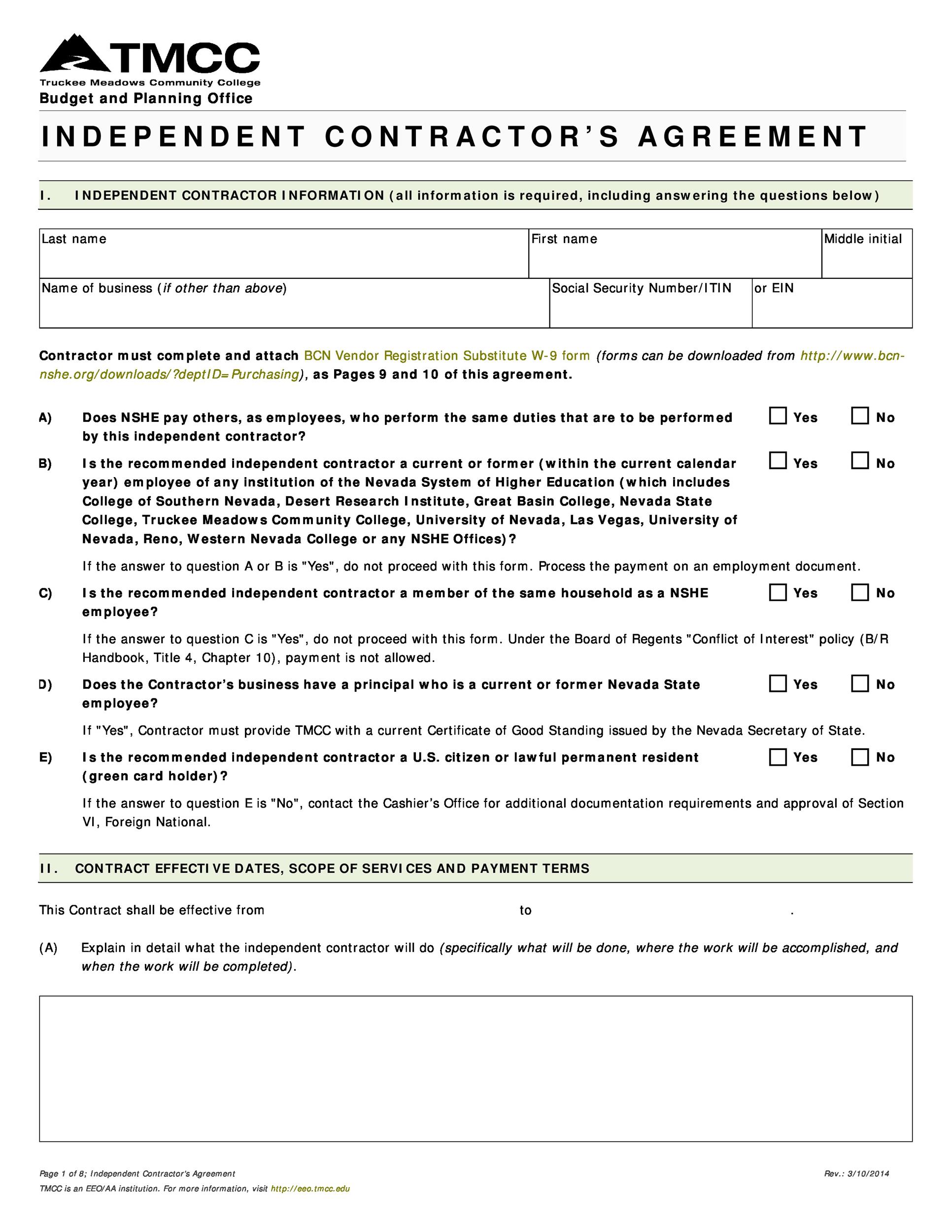

7. Worker Classification Form (W-9 or 1099)

For U.S. contractors, the IRS requires:

- A W-9 form from contractors before starting work

- Clients to issue a 1099-NEC form at year-end if payments exceed $600

Accurate worker classification is essential for compliance with tax regulations, avoiding penalties for misclassification.

📑 Note: Both contractors and clients must be diligent in maintaining proper worker classification documentation for tax purposes.

8. Certificate of Insurance

Depending on the nature of work:

- Proof of insurance coverage might be necessary

- Types might include General Liability, Professional Liability, or Worker’s Compensation

This certification acts as a safety net, protecting both parties in case of claims or damages.

Stepping into the shoes of an independent contractor involves much more than just skill or expertise; it demands a solid understanding of the legal and financial framework that supports the independent work relationship. These essential documents help contractors and clients navigate their collaboration, reducing misunderstandings and setting the stage for a successful professional partnership.

Can an Independent Contractor Agreement be changed after it’s signed?

+

Yes, amendments can be made through mutual agreement, but it’s important to document these changes formally.

Is it necessary to sign a Work-for-Hire Agreement?

+

If ownership of the created work is a concern, then yes. Without it, the contractor might retain copyright over the work product.

Are NDAs legally enforceable?

+

Generally, yes, provided they are drafted within legal bounds and don’t conflict with public policy or local laws.