5 Essential Documents for Your Tax Paperwork

When tax season rolls around, the stress of gathering all necessary documents can be overwhelming. To make this process smoother and to ensure you're maximizing your deductions while staying compliant with tax laws, understanding and assembling the 5 Essential Documents for your tax paperwork is crucial. This comprehensive guide will walk you through each document, explaining its importance and how to leverage them for your tax return.

1. Form W-2 and Other Wage Statements

If you've had a job this year, one of the first documents you'll need is your Form W-2. This form is issued by your employer and summarizes your annual wages and the amount of taxes withheld from your paycheck.

- Earnings: Total wages, salaries, and tips before taxes.

- Taxes Withheld: Federal income tax, social security tax, and Medicare tax withheld.

- Other Benefits: Employer contributions to certain retirement plans or health savings accounts.

Make sure you receive one for each employer you worked for during the tax year. If you've changed jobs, ensure all W-2s are accounted for.

📝 Note: Employers are required to send out W-2s by January 31st, so keep an eye on your mailbox. If you haven't received one by mid-February, contact your employer or check your online payroll system.

2. 1099 Forms for Freelance Work, Dividends, and Miscellaneous Income

Not all income comes from a traditional job. If you've freelanced, received interest or dividends, or earned money in other ways, various forms of 1099s will be issued:

- 1099-NEC: For freelance or contract work.

- 1099-INT: For interest income.

- 1099-DIV: For dividends.

- 1099-MISC: For miscellaneous income like rent, royalties, or prizes.

| Form | Type of Income |

|---|---|

| 1099-NEC | Freelance Work |

| 1099-INT | Interest Income |

| 1099-DIV | Dividends |

| 1099-MISC | Rent, Royalties, etc. |

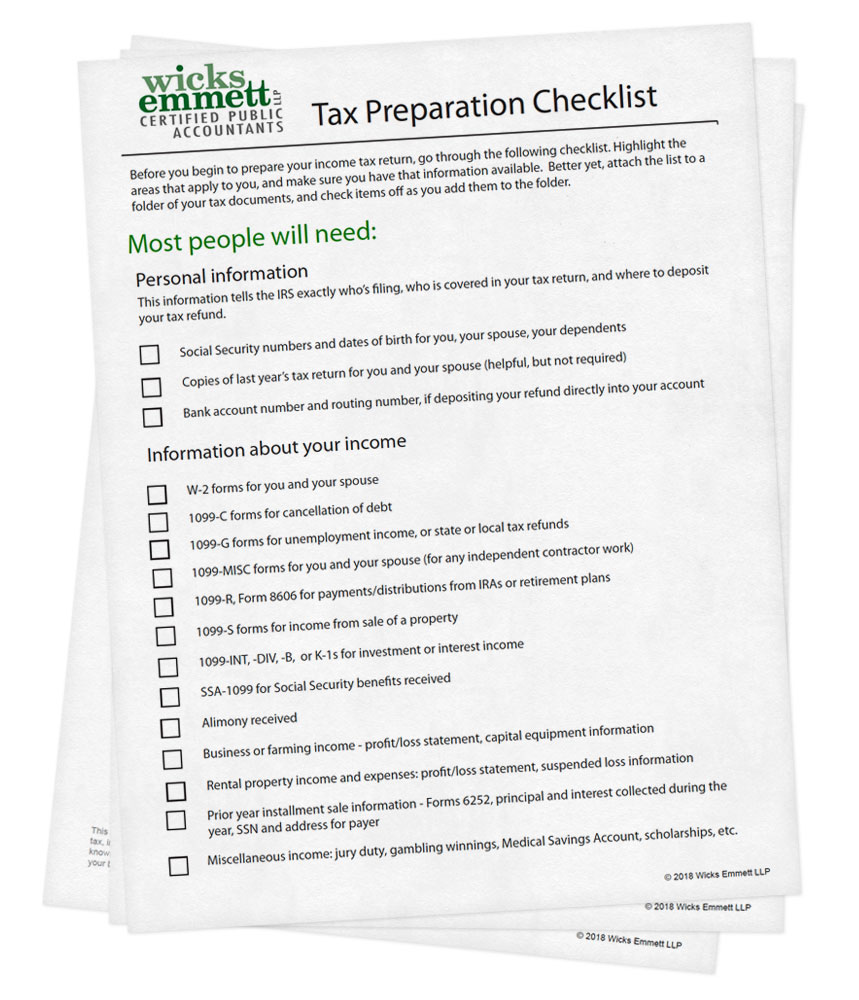

3. Receipts and Records for Deductions

Tracking your expenses is key for deductions. Here's a list of common deduction categories:

- Medical Expenses: Include receipts for doctor visits, medications, insurance premiums, etc.

- Charitable Contributions: Donations to qualified organizations, including non-cash items.

- Work Expenses: Uniforms, travel, business use of car or home, office supplies, etc.

- Education: Tuition, books, and related course materials.

Keep these receipts organized; you'll need them to substantiate your deductions if audited.

💼 Note: Ensure your records are clear and detailed to avoid any issues during an audit. Consider using tax software or a dedicated app for managing receipts.

4. Records of Childcare Expenses

If you've paid for childcare to work or look for work, you might be eligible for the Child and Dependent Care Credit:

- Provider Information: Name, address, and Taxpayer Identification Number (TIN) of the provider.

- Payments: Record all payments made, including cash transactions.

5. Home Ownership Documents

Being a homeowner comes with its tax advantages. Keep the following documents handy:

- Mortgage Interest Statement (Form 1098): Shows interest paid on your mortgage.

- Real Estate Taxes Paid:

- Home Improvement Receipts: For deductions on improvements if selling or renting.

In sum, preparing your tax paperwork involves gathering key documents like W-2s, 1099s, deduction records, childcare receipts, and homeownership documents. Properly assembling these documents not only ensures compliance with tax laws but also maximizes your potential tax benefits. Keep all documentation well-organized, as this will simplify the filing process and help in case of an audit.

What if I haven’t received my W-2 by January 31st?

+

Contact your employer or the HR department immediately. If you’re unable to get a copy, you can file for an extension or use a Form 4852 to substitute the missing W-2.

Can I deduct expenses without receipts?

+

While some minor expenses might be deductible without a receipt, having receipts or records for all your deductions can substantiate your claims, especially in case of an audit. It’s always better to keep detailed records.

What’s the difference between a tax credit and a tax deduction?

+

A tax credit reduces your tax liability dollar-for-dollar, while a deduction reduces the amount of income subject to tax. Credits are generally more beneficial as they directly lower the tax you owe.

Do I need to keep records of charitable donations if I don’t itemize?

+

If you’re not itemizing your deductions, you don’t need detailed records for charitable contributions as you can claim a standard deduction for these. However, keeping records is always wise for potential future audits or tax law changes.

How long should I keep tax documents?

+

The IRS typically has three years to audit your return, but keeping records for six to seven years is advisable, especially if you have complex returns or unreported income.