Essential Paperwork Needed Before Selling Your Home Alone

In the ever-evolving world of real estate, more homeowners are choosing to sell their homes themselves without the assistance of traditional real estate agents. This method, often referred to as "for sale by owner" (FSBO), can save significant commissions, but it also requires an understanding of the essential paperwork needed to navigate the legalities and streamline the sale process. This comprehensive guide will walk you through the critical documentation required before you sell your home alone, ensuring you're well-prepared for the legal and financial responsibilities that come with selling property.

1. Deeds and Ownership Documents

Before you can list your property for sale, it's crucial to verify your legal rights to the property. Here are some key documents you'll need:

- Warranty Deed: Proves your ownership and legally transfers it to the buyer.

- Quitclaim Deed:

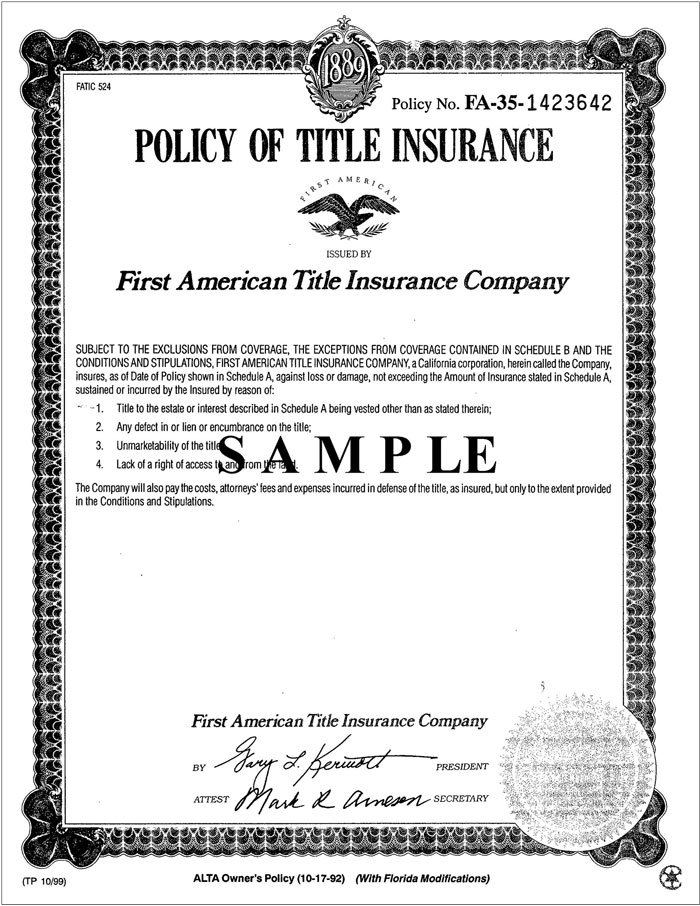

- Owner's Title Policy: Ensures the buyer receives a clear title.

- Deed of Trust or Mortgage: If there is a mortgage, this shows the terms of your loan.

📚 Note: Double-check that all names on the deeds are accurate and reflect any changes due to marriage, divorce, or legal name change.

2. Property Details and Disclosure Forms

Providing transparency to potential buyers not only builds trust but is often legally required. You'll need:

- Property Disclosure Statement: Detailing known defects or issues with the home.

- Lead-Based Paint Disclosure: For homes built before 1978.

- Homeowners Association (HOA) Documents: If your property is in an HOA, this outlines rules and fees.

- Home Warranty Information: If applicable, to show if there's any existing coverage.

3. Financial and Loan Documents

Even if you're selling your home alone, your mortgage status plays a pivotal role. You should have:

- Payoff Statement: From your lender, detailing the exact amount needed to pay off your mortgage.

- Loan Assumptions: If the buyer might take over your existing loan, this outlines the terms.

- Escrow Account Statement: Reflecting any insurance, taxes, or other escrowed items.

| Document | Description |

|---|---|

| Payoff Statement | Amount needed to settle your mortgage on sale |

| Loan Assumptions | Potential for buyer to assume your existing loan |

4. Contracts and Agreements

Even without a realtor, you'll still need to draw up or understand the following documents:

- Purchase Agreement: Outlines the terms and conditions of the sale.

- Seller's Disclosure: Important for legal protection and full transparency.

- Condo or HOA Resale Addendum: If applicable, provides information on the association.

5. Tax Information

Taxes are a significant part of the home selling process:

- Property Tax Statements: Ensure you have the latest tax bills.

- Capital Gains Tax Worksheet: Understand your potential tax liability.

- IRS Form 8822: Update your address with the IRS post-sale.

By the time you've collected all these documents, you'll have a strong foundation to handle the complexities of selling your home independently. While this approach requires more work, it gives you full control over the selling process and can save you the hefty commissions often associated with real estate agents.

📝 Note: Always seek legal or financial advice when unsure about any documents. This process can be complex, and small oversights can lead to significant issues.

Remember, your property is one of your most valuable assets, and ensuring you have all the right paperwork in place will streamline your sale, protect your interests, and potentially increase your net proceeds. With the right preparation and understanding of these essential documents, selling your home alone can be both rewarding and profitable.

Do I need a real estate attorney to sell my home?

+

While not legally required in every jurisdiction, having a real estate attorney can help navigate the legal complexities and ensure all documentation is properly prepared.

What happens if I miss some essential documents?

+

Omitting important documents can delay or even jeopardize the sale. It’s better to prepare thoroughly to avoid legal or financial repercussions.

Can I sell my home if there’s still an outstanding mortgage?

+

Yes, but you’ll need to provide the buyer with a payoff statement to ensure they understand the total amount required to clear the mortgage upon sale.