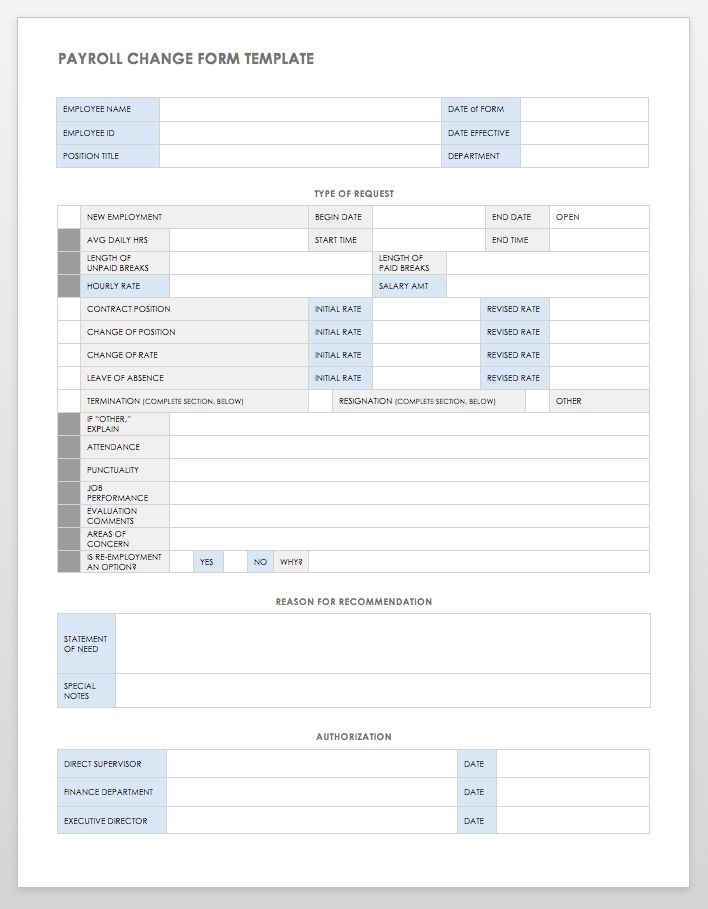

5 Essential Documents for New Employee Payroll Setup

Getting payroll right from the start is crucial for any business. The process of setting up new employee payroll involves several key documents that ensure compliance with legal standards, accuracy in tax withholdings, and ease of financial record keeping. Here are the essential documents that employers need to prepare and maintain:

1. Employment Contract

An employment contract sets the foundation for the employment relationship. Here’s what it should include:

- Job title and description: Defines the role, responsibilities, and expectations.

- Start date: When the employee will officially begin work.

- Working hours: Details on work schedules and hours.

- Salary or wage: Information on compensation, including payment frequency.

- Benefits: Overview of health insurance, retirement plans, vacation policy, etc.

- Probation period: If applicable, defines the duration and conditions of probation.

- Termination conditions: Details on how the employment can be legally ended by either party.

2. IRS Form W-4

The IRS Form W-4, or Employee’s Withholding Certificate, is essential for determining the correct federal income tax withholding from an employee’s paycheck. This form helps in:

- Collecting personal information like name, address, and Social Security number.

- Allowing employees to claim allowances based on their financial situation, which impacts how much tax is withheld.

3. I-9 Form (Employment Eligibility Verification)

The I-9 Form is a must-have to verify the identity and employment authorization of individuals hired for employment in the United States:

- Employees must provide documentation proving their identity and authorization to work.

- Employers must examine these documents to ensure they are valid.

4. State Tax Forms

Depending on the state, you might need to fill out various state-specific tax forms:

- These forms are used to determine state income tax withholding, which varies by location.

- Examples include the DE-4 Form for California or IT-2104 Form for New York.

📋 Note: State tax forms can change, so it’s wise to check the latest versions from state tax authorities.

5. Direct Deposit Authorization Form

While not legally required, using direct deposit for payroll processing is increasingly common:

- This form requires the employee’s bank account information for direct deposit.

- It makes payroll distribution more efficient and secure.

The Importance of Proper Documentation

The right documentation ensures:

- Legal Compliance: Helps meet federal, state, and local employment laws.

- Accuracy: Avoids errors in payroll calculations, tax deductions, and benefits distribution.

- Ease of Administration: Streamlines onboarding, payroll setup, and record management.

- Employee Satisfaction: Ensures employees receive their pay and benefits promptly and accurately, which can positively impact their job satisfaction and retention.

Having a solid payroll setup process with all the necessary documents in place not only helps in complying with legal requirements but also builds a foundation for efficient HR practices. By ensuring all documentation is correctly gathered and maintained, employers can:

- Prevent legal issues by ensuring compliance.

- Provide clear communication to new employees about their employment terms.

- Facilitate smooth payroll operations, reducing errors and delays.

- Maintain detailed records for audits and future reference.

What happens if an employee doesn’t complete Form W-4?

+

If an employee fails to provide a completed Form W-4, the employer must withhold taxes at the highest rate, potentially leading to an overpayment of taxes, which could be inconvenient for the employee.

Can an employee work without an I-9?

+

Technically, an employee can start work without an I-9, but the form must be completed within three days of hire. Non-compliance can result in legal penalties for the employer.

What if an employee does not want to use direct deposit?

+

While direct deposit is becoming the norm, some employees might prefer paper checks. Employers should accommodate this preference, ensuring they have a policy to handle such situations fairly.