5 Documents to Check for IRA Beneficiaries

Managing an Individual Retirement Account (IRA) involves more than just deciding where to invest your money or when to start withdrawing funds. One critical aspect often overlooked by IRA holders is the designation of beneficiaries. Properly setting up your IRA beneficiaries ensures that your assets are distributed according to your wishes after you pass away. Here are five essential documents you should review and potentially update to safeguard your IRA legacy:

Will or Estate Plan

While an IRA does not become part of your estate in the traditional sense, your will or estate plan can provide key information and instructions about your financial intentions, potentially affecting how your IRA is handled post-death:

- Who are your named beneficiaries? - Ensure your will reflects your current wishes and matches your IRA beneficiary designations.

- Does your estate plan include a trust? - IRA funds can sometimes flow into a trust, which can affect the distribution process and tax implications.

- Have you considered the need for a disclaimer? - Your will can include provisions for beneficiaries to disclaim their inheritance, allowing it to pass to secondary beneficiaries.

By ensuring alignment between your will and your IRA designations, you avoid potential conflicts or unintended inheritance issues.

IRA Beneficiary Designation Form

The IRA beneficiary designation form is a crucial document that explicitly states who will inherit your IRA assets:

- Single Beneficiary: If you name one person, they can choose to roll over the IRA into an inherited IRA.

- Multiple Beneficiaries: Each person must set up separate accounts, affecting their tax implications.

- Contingent Beneficiaries: Designate backup beneficiaries in case your primary beneficiaries predecease you or are unable to receive the funds.

❗ Note: It’s crucial to update this form if your life circumstances change (divorce, births, deaths, etc.)

Life Insurance Policies

While not directly related to IRAs, life insurance policies can play a significant role in estate planning:

- They can provide liquidity to your heirs, potentially reducing the need to withdraw from the IRA immediately.

- Beneficiaries of life insurance are often different from IRA beneficiaries, ensuring diversified financial support.

By coordinating your life insurance beneficiaries with your IRA beneficiaries, you can create a comprehensive strategy for your heirs.

| Document | What to Check |

|---|---|

| IRA Beneficiary Form | Primary and contingent beneficiaries, legal names, and consistency with will |

| Will or Estate Plan | Instructions for IRA distributions, trust provisions, and beneficiary considerations |

| Life Insurance Policies | Beneficiary designations and integration with IRA plan |

| Trust Documents | Provisions for IRA assets, potential tax strategies, and beneficiary directives |

| Tax Planning Documents | Understanding required minimum distributions (RMDs) and beneficiary implications |

Trust Documents

If you’ve established a trust, here’s what you need to check:

- Is your IRA payable to the trust? - Review how IRA assets are directed to flow into your trust, ensuring proper beneficiary designations.

- Trust provisions for IRA assets: How will the IRA funds be managed? Are there any restrictions or strategies outlined?

🔍 Note: Consult with an estate planning attorney to ensure your trust integrates seamlessly with your IRA plans.

Tax Planning Documents

Understanding the tax implications for your IRA beneficiaries can significantly affect how they manage and benefit from your legacy:

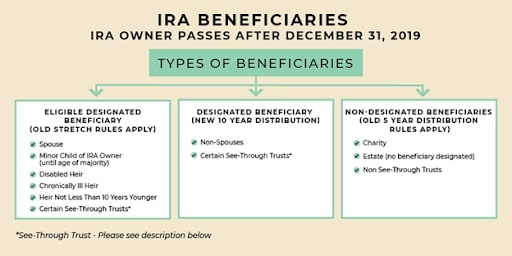

- Required Minimum Distributions (RMDs): How they apply to your beneficiaries, especially if they are non-spousal.

- Income Tax Considerations: Distributions from your IRA are generally taxable to beneficiaries, which might necessitate strategic planning.

- Estate Tax Considerations: If your estate exceeds certain thresholds, estate taxes might apply, influencing your planning strategy.

These documents form the backbone of a well-considered IRA beneficiary plan. Ensuring they are in sync will help your legacy unfold as you intended, offering peace of mind and financial security to your loved ones.

Why is it important to update IRA beneficiary designations?

+

Life changes like marriage, divorce, births, or deaths can significantly alter your estate plans. Regularly updating your IRA beneficiary designations ensures your assets pass to the intended heirs, avoiding disputes or unintended inheritance.

What happens if I don’t name a beneficiary for my IRA?

+

If no beneficiary is named, your IRA assets will typically pass to your estate, where they become subject to probate. This can delay distribution and may result in different tax treatments than if a beneficiary was directly named.

Can I name a charity as my IRA beneficiary?

+

Yes, charities can be named as IRA beneficiaries. They will receive the IRA funds tax-free, making it a strategic way to support causes important to you while potentially reducing estate and income taxes for your heirs.