Essential Bills and Paperwork to Keep Organized

Keeping your essential bills and paperwork organized is not just about having a clutter-free environment; it's a crucial aspect of financial management that ensures timely payments, accurate tax filings, and ease of access when needed. This organization can save you from the stress of last-minute searches and late fees, streamline the process of locating important documents, and make your life much more manageable. Here's a comprehensive guide on the types of documents you should keep organized, how to manage them, and why it's important.

Types of Documents to Keep Organized

Bills:

- Utility Bills: Electricity, Gas, Water, Internet, etc.

- Service Subscriptions: Streaming services, gym memberships, etc.

- Insurance Premiums: Health, Car, Home, Life, etc.

- Loan Statements: Mortgage, Car Loans, Student Loans, etc.

- Credit Card Statements

Legal Documents:

- Birth Certificate, Social Security Card, Passport

- Property Deeds

- Will, Trust, and Estate Planning Documents

- Marital Contracts (e.g., Prenuptial Agreements)

- Divorce decrees or legal separations

Financial Records:

- Tax Returns: Federal and State

- Investment Statements

- Bank Statements and Savings Accounts

- Retirement Account Information

Health and Medical Records:

- Immunization Records

- Prescription Records

- Insurance Explanation of Benefits (EOBs)

- Medical Bills

Organizing Your Documents

To manage these documents effectively, consider the following strategies:

Physical Filing System

Design a physical filing system that divides documents into categories. Here’s how you can structure it:

| Category | Description |

|---|---|

| Active Bills | Bills that require monthly attention. |

| Long-Term Records | Documents needed for years or indefinitely. |

| Pending Paperwork | Documents awaiting action (like a property sale). |

| Financial Archives | Old bank statements, past tax returns. |

📌 Note: Always use sturdy folders or binders to protect your documents from wear and tear.

Digital Organization

Digitize your documents for backup and easy retrieval:

- Scan physical documents or request electronic copies from providers.

- Use a secure cloud storage service for backup.

- Organize files into folders using a clear naming convention.

📝 Note: Keep passwords and access codes for digital documents in a secure place or use password managers.

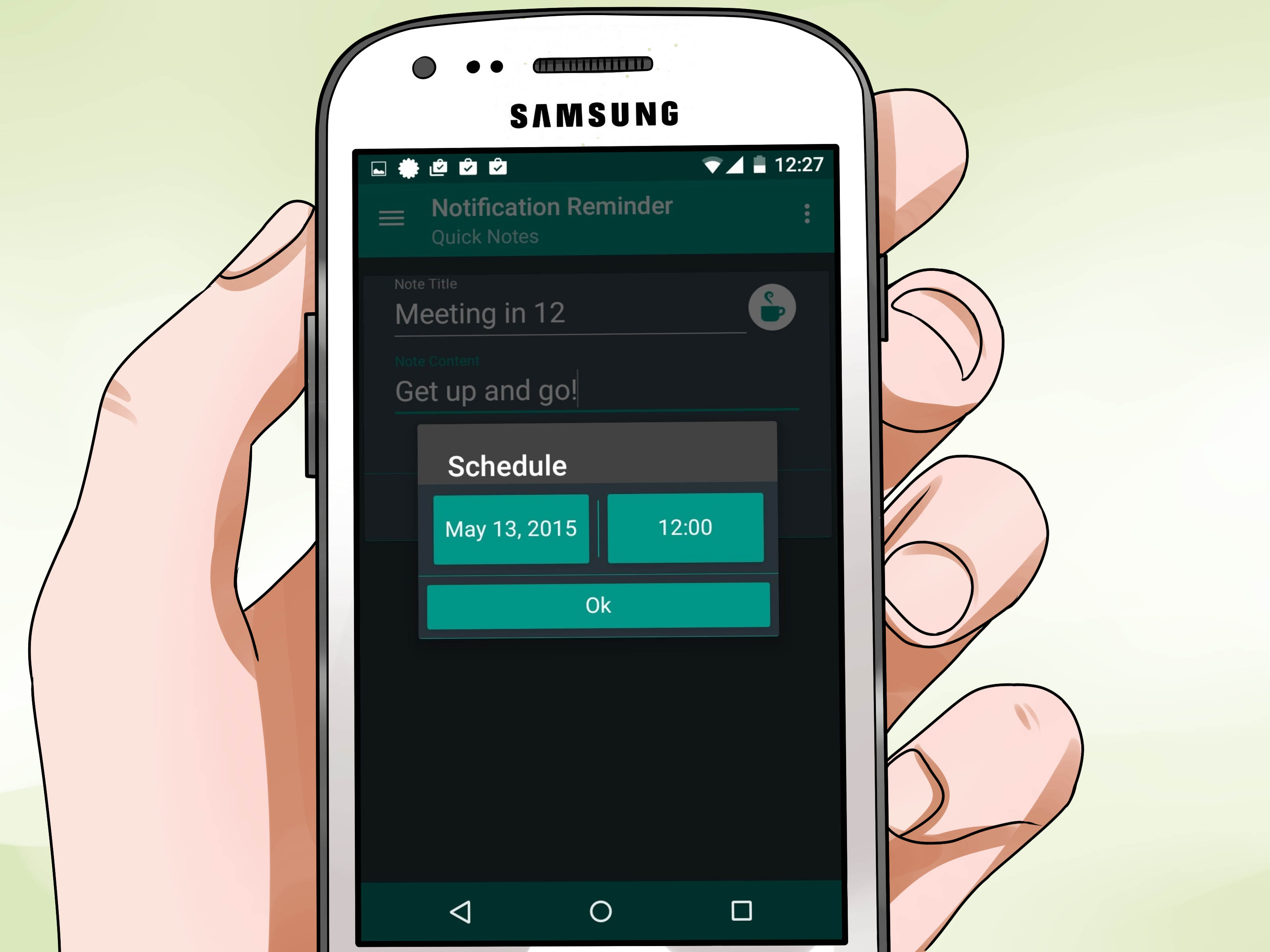

Timely Action

To avoid late payments or fines:

- Set reminders for due dates.

- Pay bills immediately when received or have them auto-paid.

- Keep a running list of when to expect bills and renewals.

Record Keeping and Retention

Understanding how long to keep different types of documents:

- Keep Permanently: Birth certificates, Social Security card, property deeds, wills, etc.

- 7 Years: Tax returns, credit card statements, pay stubs, and other financial documents that could be audited.

- 3 Years: Utility bills, insurance policies, canceled checks.

- 1 Year or Less: Bank statements, medical bills after payment (unless for tax purposes).

Paperless Billing

To reduce paper clutter:

- Sign up for paperless billing with utility companies, banks, etc.

- Download and save documents in a secure, organized manner.

🔒 Note: Ensure the security of your electronic accounts by using strong, unique passwords and enabling two-factor authentication.

In summary, organizing your essential bills and paperwork is an investment in your financial health and peace of mind. The process involves categorizing documents, deciding whether to keep them physically or digitally, managing retention periods, and taking timely action. Regularly reviewing these documents ensures you're always up-to-date with your financial obligations and personal records. This approach not only helps in avoiding late fees and fines but also in responding effectively to any emergencies that might require quick access to these records.

What documents should I keep forever?

+

Documents like birth certificates, Social Security cards, property deeds, wills, and marriage certificates should be kept indefinitely, as they are essential for establishing identity, ownership, or legal status.

How long should I keep utility bills?

+

Typically, you can keep utility bills for one year unless they are related to tax deductions or home renovations where longer retention might be needed.

Can I shred old financial documents?

+

Yes, shred financial documents like bank statements, credit card statements, and paid bills after the recommended retention period to protect against identity theft. Be sure to shred any documents containing personal information.

What’s the benefit of going paperless with bills?

+

Going paperless reduces clutter, makes it easier to store and organize documents, enhances security, and supports environmental conservation efforts by reducing paper usage.

How should I secure my digital documents?

+

Use strong, unique passwords for all accounts, enable two-factor authentication, regularly backup your documents to a secure cloud service, and encrypt sensitive files where possible.