5 Steps to Organize Your Tax Paperwork

Managing your tax documents effectively is not just about compliance; it's also about peace of mind and ease during tax season. Here's a guide to help you organize your tax paperwork, making the tax filing process as smooth as possible:

1. Gather Essential Documents

Start by identifying all the documents you’ll need:

- Income Statements: W-2s, 1099-MISCs, 1099-DIVs, etc.

- Expense Receipts: Business or freelance work expenses.

- Deductions and Credits: Charitable donations, home mortgage interest, property taxes, medical expenses, etc.

- Previous Year’s Tax Returns: Useful for comparison and reference.

2. Sort Documents into Categories

Organizing your documents into logical categories can significantly streamline the process:

- Income: All forms showing your earnings.

- Expenses: Receipts, invoices, or bills related to business or deductible expenses.

- Deductions and Credits: Documentation for tax-deductible items.

- Financial: Bank statements, investment reports, etc.

Here’s how you can categorize your documents:

| Category | Examples |

|---|---|

| Income | W-2, 1099 |

| Expenses | Business receipts, travel logs |

| Deductions | Mortgage interest statements, medical bills |

| Financial | Investment summaries, bank statements |

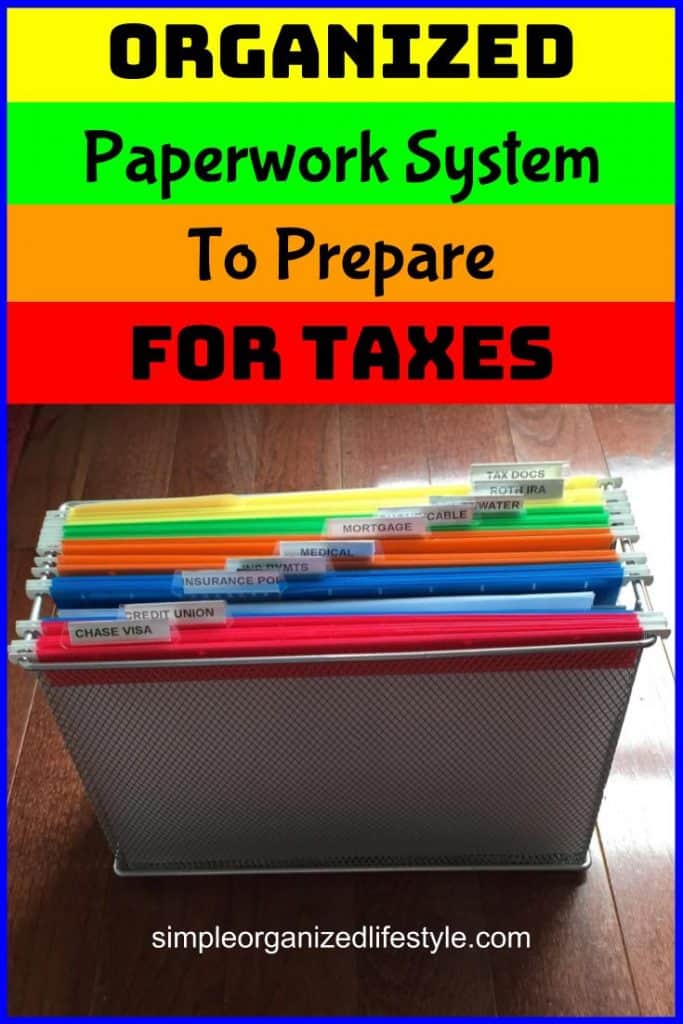

3. Create a Filing System

Physical or digital, having a dedicated space for your tax documents is crucial:

- Physical Filing: Use folders, color-coded or labeled for easy sorting.

- Digital Storage: Create folders on your computer or cloud services like Google Drive or Dropbox. Ensure secure backup of your digital files.

4. Keep Track of Deadlines

Stay organized with dates:

- Tax Filing Deadline: Commonly April 15, but check IRS for exact date.

- Quarterly Estimated Tax Payments: Due on April 15, June 15, September 15, and January 15 of the next year.

5. Maintain Records Throughout the Year

Don’t wait for tax season:

- Keep receipts, bills, and notices throughout the year.

- Use an app or software to track your expenses and categorize them appropriately.

🗒️ Note: Regularly backing up your tax documents, both physically and digitally, is an excellent habit to ensure you don't lose any crucial data.

In organizing your tax paperwork, the key is consistency and foresight. By setting up a system that allows for easy retrieval of documents and having everything you need at hand when tax time rolls around, you can minimize stress and reduce the likelihood of errors or missed deductions. Keep in mind, the effort you put into organizing now will save you time and potentially even money, as you’ll be more likely to take full advantage of all available tax benefits. The process, though initially time-consuming, will become easier each year as you refine your approach. Remember, taxes aren’t just about the calculations; they’re also about the confidence of knowing your documents are in order, which can make all the difference in your financial peace of mind.

What documents do I need to keep for tax purposes?

+

Keep records of income, like W-2s and 1099s, along with receipts and statements for expenses, deductions, and credits. Also, retain copies of your tax returns and financial statements for reference.

How long should I keep my tax records?

+

The IRS recommends keeping records for three years from the date you file your return or two years from the date you paid the tax, whichever is later. However, in cases of fraud or unreported income, keeping records for up to six years is advisable.

Can I file taxes without all my documents?

+

Yes, you can file an extension if you’re missing documents. However, remember that you’ll need to provide accurate information when filing your final return or face penalties. Always consult with a tax professional if you’re uncertain.