Mortgage Tax Paperwork: Essential Documents Explained

Navigating the mortgage application process can be daunting, especially with the array of tax-related paperwork required. This blog post will dive deep into the essential tax documents needed when applying for a mortgage, explaining why each document is necessary, how to obtain them, and tips on managing them efficiently.

Why Tax Documents Matter in Mortgage Applications

When you apply for a mortgage, lenders look at several factors to determine your ability to repay the loan. Among these, your income stability and tax history play crucial roles:

- Proof of Income: Tax documents show your income history, which helps lenders assess your financial reliability.

- Financial Health: These documents reveal your debt-to-income ratio, ensuring you're not overstretched with other financial commitments.

- Compliance: Lenders need to comply with IRS regulations, ensuring all mortgage applications are backed by accurate financial reporting.

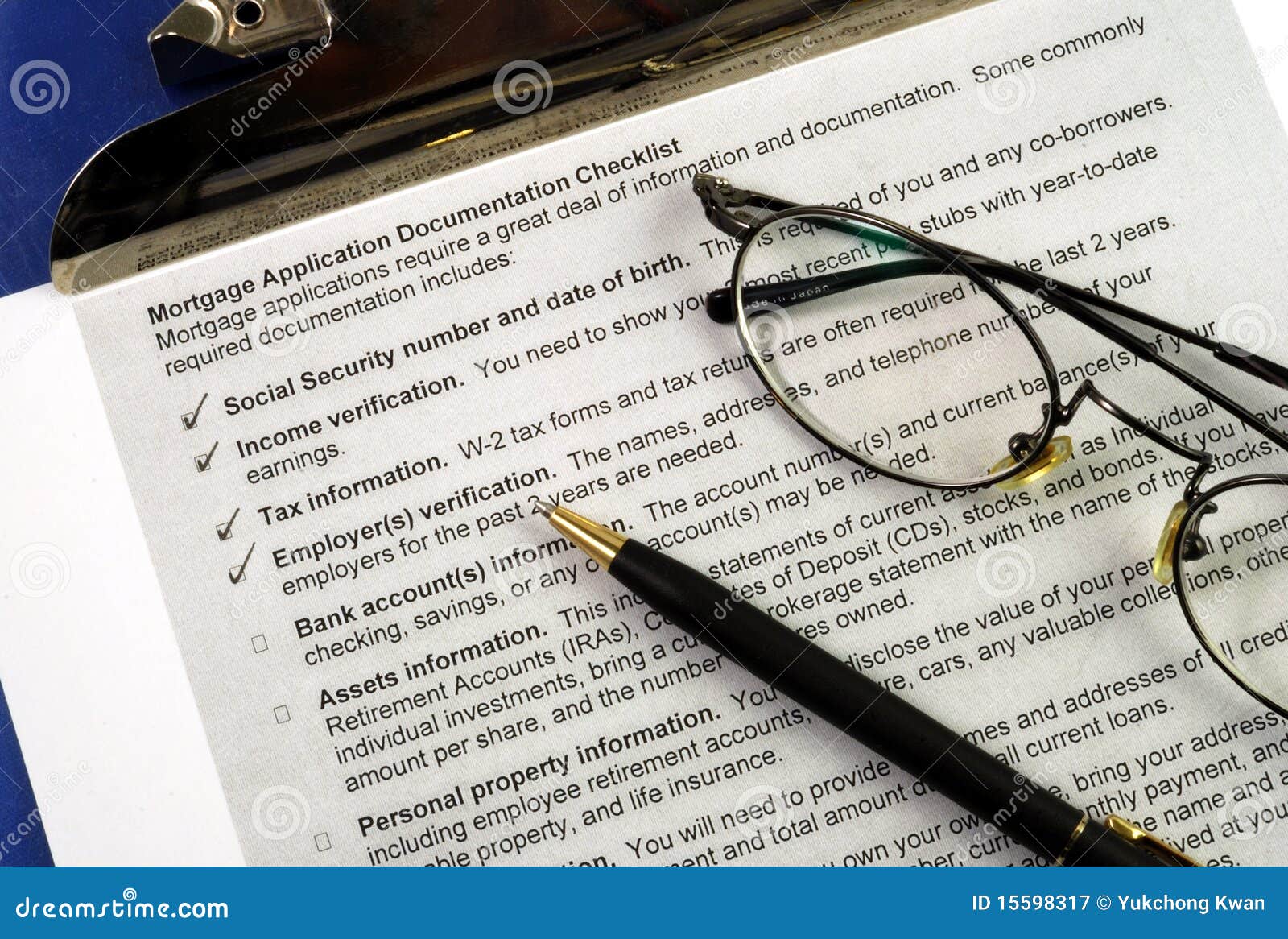

Essential Tax Documents for Mortgage Applications

W-2 Forms

W-2 forms are issued by employers to their employees to report wages paid and taxes withheld throughout the year. They include:

- Your name, address, and Social Security number.

- Total wages, tips, and other compensation.

- Tax withheld for federal, state, and sometimes local taxes.

🌟 Note: Always keep your W-2 forms for at least seven years in case of audits or when applying for loans.

1099 Forms

If you’re self-employed, an independent contractor, or receive income other than from a W-2 job, you’ll need:

- 1099-MISC: For freelance work, gigs, or rental income.

- 1099-INT: Interest income from banks, credit unions, or other financial institutions.

- 1099-DIV: Dividends and capital gains distributions from stocks.

Federal Income Tax Returns

Lenders typically request the last two years of federal tax returns. These documents:

- Show your adjusted gross income (AGI), which is used to calculate your eligibility for different loan programs.

- Detail your tax liabilities, exemptions, and deductions, providing a comprehensive view of your financial health.

- Includes schedules like Schedule C for business profits or losses, which are crucial for self-employed applicants.

Profit and Loss Statement

For the self-employed or business owners, providing a recent profit and loss statement might be required to:

- Demonstrate current year earnings, especially if your income has significantly changed since your last tax filing.

Documentation for Other Income Sources

Income from sources like alimony, child support, or government benefits might need:

- Court orders, letters of explanation, or award letters for alimony or child support.

- Proof of receipt for consistent government benefits like Social Security or disability.

How to Gather and Organize Tax Documents

Collect All Documents

Start by:

- Gathering recent W-2s, 1099s, and tax returns from the past two years.

- Requesting missing forms from employers or from your tax preparer.

- Organizing your documents in a folder or digital file for easy access.

Use Digital Tools

Utilize:

- Tax software like TurboTax, H&R Block, or IRS Free File for tracking and organizing tax records.

- Document management apps to store digital copies securely.

Verification Process

Lenders might:

- Require a CPA’s letter confirming self-employment income or business operations.

- Ask for additional documents or explanations if there are discrepancies or unusual items in your tax returns.

Tips for Efficient Mortgage Tax Paperwork Management

Stay Organized

Keep your:

- Tax documents in a dedicated folder or file, labeled by year.

- Digital copies backed up in the cloud or on an external hard drive.

Communicate with Your Lender

- Inform your lender of any significant changes in your income or employment status.

- Be proactive in providing any requested documents promptly.

Professional Help

Consider:

- Hiring a tax professional or using tax preparation services if your income is complex.

- Seeking advice from a mortgage broker or financial advisor on which documents are critical for your specific mortgage type.

Understanding and managing your tax documents is not just about meeting mortgage application requirements; it's about presenting yourself as a trustworthy borrower with a stable financial background. Ensuring you have all the necessary documents in order can streamline the loan process, potentially saving time and reducing stress. Remember, these documents serve as proof of your financial reliability, so thorough preparation and organization are key to success in securing your home loan.

Why do lenders need my tax returns for a mortgage application?

+Lenders use tax returns to verify your income and assess your financial health, ensuring you have the capacity to repay the loan.

What if I have recently changed jobs?

+If you’ve changed jobs, lenders will need to see both your old and new employment details, including W-2 forms and income statements from the new employer.

Can I provide tax documents electronically?

+Most lenders accept electronic copies, but they must be secure and sometimes verified through third-party e-filing services or your tax preparer.

What if my tax returns are audited?

+An audit can delay the mortgage process. Inform your lender immediately, provide any audit documentation, and expect possible underwriting delays.

Do I need tax documents if I am getting a gift for my down payment?

+Even with a gift, lenders often require proof of the donor’s ability to provide the gift, which might include their tax documents to show the financial capacity.