Loan Completion Paperwork: What You Need to Know

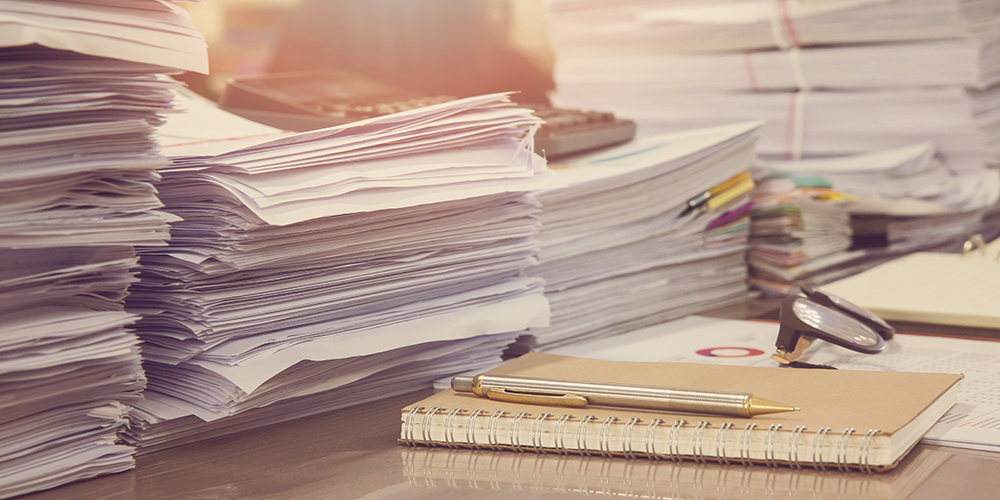

Completing a loan, whether it be for buying a home, funding an education, starting a business, or any other major life event, is not just about getting the funds. It's a meticulous journey through paperwork, ensuring every detail is correct and every document is signed off. Understanding the loan completion paperwork process can save you time, stress, and potentially money. In this guide, we'll explore what you need to know about the paperwork involved in loan completion.

What Documents Are Typically Needed for Loan Completion?

The paperwork you need will vary depending on the type of loan and the lender, but here are some common documents:

- Loan Agreement: The primary document detailing the terms of the loan including interest rate, repayment schedule, and loan amount.

- Promissory Note: This note is your promise to repay the loan, specifying the conditions of the repayment.

- Disclosure Statements: Required by law, these forms provide information about the loan costs, terms, and associated fees.

- Title Insurance: Particularly for real estate loans, this protects against title disputes.

- Mortgage or Deed of Trust: If the loan is secured against property, this document transfers the legal title to the property to the lender as security for the loan.

- Insurance Policies: Lenders often require proof of insurance to cover their collateral (like home insurance for a mortgage).

- Closing Disclosure: Provides a final summary of your loan terms and associated costs before you sign.

- Identification Documents: Government-issued ID, social security number, or passport.

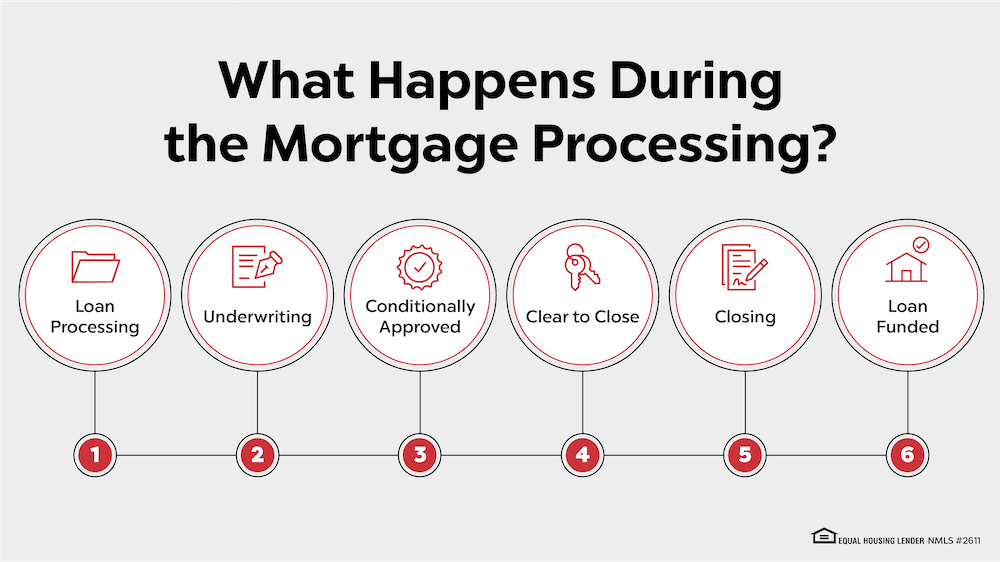

Steps in the Loan Completion Process

Here’s a step-by-step look at what happens during the loan completion process:

1. Review of Loan Application

Once your application is approved, the lender will prepare all necessary documents:

- The underwriter will review all provided documentation to ensure compliance and accuracy.

2. Verification of Information

Lenders will verify your:

- Income

- Employment

- Credit history

- Other details in your application.

3. Sending Loan Documents

You’ll receive the loan documents for review and signing. This can happen in person, or through secure electronic means:

- Review every document carefully.

- Check for any discrepancies or errors.

4. Signing the Documents

Once you’re satisfied with the documents:

- Sign and date each document.

- Ensure you have notary or witness services if required.

5. Funding

After all paperwork is completed and returned:

- Your loan will be funded.

- The lender will disburse the funds according to the terms of your loan.

📝 Note: Ensure all parties sign and date the documents in the correct places to avoid delays.

Tips for Smooth Loan Completion

To ensure the loan completion process goes smoothly:

- Read everything: Never sign a document without thoroughly understanding its contents.

- Ask questions: If you’re unsure about anything, seek clarification from your lender.

- Keep copies: Retain copies of all signed documents for your records.

- Stay organized: Keep your paperwork in order and easily accessible.

- Respond promptly: Lenders often need additional information quickly, so be prompt in your responses.

🕐 Note: Delays in document processing can lead to funding delays or even loan cancellation. Timeliness is crucial.

Common Issues in Loan Completion

Some common problems you might encounter:

- Errors in documentation: Incorrect dates, missing signatures, or outdated information.

- Funding delays: Due to last-minute changes or paperwork errors.

- Conflicting terms: Discrepancies between what was agreed upon and what’s written in the documents.

- Legal issues: If property title or insurance requirements aren’t met.

The process of completing a loan involves a significant amount of paperwork. Ensuring you understand each document, staying organized, and responding promptly to any requests can make the process smoother. Remember, this is not just about receiving funds; it's about committing to a financial agreement that can impact your life significantly. Be diligent, ask questions, and keep all paperwork in order to prevent any surprises or delays in your loan completion journey.

What should I do if I find an error in my loan documents?

+

Contact your lender immediately to correct the error. Most issues can be resolved before signing, but if found post-signing, you might need to renegotiate or amend the terms.

How long does it take to complete loan paperwork?

+

The process can take anywhere from a few days to a couple of weeks, depending on document complexity, the lender’s efficiency, and your responsiveness.

Can I back out after signing the loan completion paperwork?

+

Yes, within a certain time frame (often 3 days), known as the “right of rescission.” After this period, backing out can be complicated and might incur fees.