New Employee Paperwork Essentials for Oregon Businesses

Starting a new job in Oregon is an exciting milestone, both for the employee embarking on a new chapter in their career and for the employer who is expanding their team. However, before the official start date, there is a series of critical paperwork that must be completed to ensure a smooth transition and compliance with both federal and state regulations. This comprehensive guide will walk Oregon businesses through the essential new employee paperwork, highlighting why each form is necessary, and how to complete them properly.

Essential Forms for New Hires

When onboarding a new employee, the following documents are fundamental:

- Form W-4 - For federal tax withholding

- Form I-9 - To verify employment eligibility

- New Hire Reporting Form - Required under Oregon state law

- Oregon Employment Application - While not mandatory, it's advisable for record-keeping

- Employee Handbook Acknowledgement - To confirm the receipt of company policies

Form W-4: Employee's Withholding Certificate

The Form W-4 is one of the first pieces of paperwork a new employee needs to complete. This form directs the employer on how much federal income tax to withhold from the employee's paycheck.

Here’s how to handle it:

- Provide the employee with the current Form W-4 from the IRS website.

- Instruct them to fill out the form, ensuring all sections are correctly completed, especially if they claim exemption from withholding.

- Keep the completed form on file for at least 4 years in case of an IRS audit.

📝 Note: The IRS periodically updates the W-4, so always ensure you’re providing the most current version.

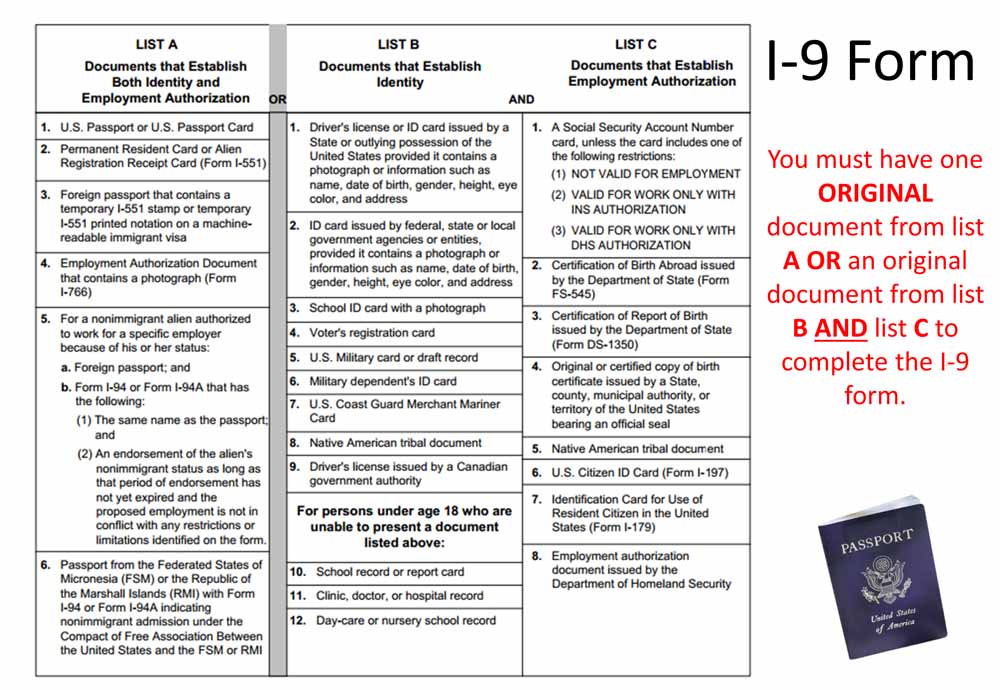

Form I-9: Employment Eligibility Verification

Completing Form I-9 is not just about paperwork; it's a legal requirement to verify that an individual is authorized to work in the United States.

| Step | Action |

|---|---|

| 1 | Have the new employee complete Section 1 on or before their first day of work. |

| 2 | Examine the employee's documents within three business days of the start date. |

| 3 | Complete Section 2, documenting the verification. |

| 4 | File the form correctly for future reference, typically for three years after the date of hire or one year after termination, whichever is later. |

New Hire Reporting Form

Under Oregon law, employers must report newly hired or rehired employees to the Oregon Child Support Program within 20 days of the hire date.

- Provide employee’s name, address, social security number, and date of hire.

- Submit the information electronically or by mail/fax.

📝 Note: Timely reporting helps in locating noncustodial parents for child support enforcement.

Oregon Employment Application

While not legally required, an employment application provides a comprehensive record of an employee's professional background and can be useful for various HR purposes.

Employee Handbook Acknowledgement

After reviewing the company's policies, it’s essential for the new employee to sign an acknowledgment form, confirming their understanding and agreement to abide by the company's policies.

Additional State-Specific Paperwork

Oregon has a few unique requirements for new hires:

- Workplace Harassment Prevention and Reporting - Oregon law mandates training to prevent and report workplace harassment.

- Worker's Compensation Notice - Ensure new hires are aware of their worker's compensation rights through a formal notice.

Workplace Harassment Prevention and Reporting

Employers in Oregon with at least six employees must provide annual training. Here’s how to comply:

- Conduct training sessions or utilize training materials provided by Oregon's Bureau of Labor and Industries (BOLI).

- Have employees sign off on receiving and understanding the training.

Worker's Compensation Notice

By law, you must provide written information about worker's compensation to new hires. This notice should include:

- Information on how to report a work injury

- The rights of employees regarding worker's compensation

The Onboarding Process

Effective onboarding goes beyond paperwork. It's about setting up the new employee for success by:

- Creating an orientation program

- Assigning a mentor or buddy

- Providing job-specific training

Consider using technology to streamline this process, such as HR software that automates form distribution and reminders for completion.

📝 Note: A well-structured onboarding process can significantly improve employee retention and satisfaction.

The paperwork involved in onboarding a new employee in Oregon can be complex, but it is essential for compliance and creating a positive work environment. By ensuring all the necessary documents are completed correctly, businesses can avoid legal issues, foster a culture of transparency, and promote a smooth transition for new hires. It’s not just about ticking boxes; it's about building the foundation for a productive and harmonious work relationship.

What happens if an employer does not submit a New Hire Reporting Form?

+

Failing to submit the New Hire Reporting Form in Oregon can result in penalties, as this form helps the state locate parents for child support enforcement purposes.

How long should Form I-9 be retained?

+

Form I-9 must be kept for three years after the date of hire or one year after the employee’s termination, whichever is later.

Can an employer conduct training sessions for workplace harassment on their own?

+

Yes, employers can conduct their own training sessions, but they must meet the Oregon Bureau of Labor and Industries (BOLI) standards or use BOLI-provided materials.