IRS Forms Required for New Independent Contractors

Understanding the Forms You Need as a New Independent Contractor

If you've recently embarked on the path of being an independent contractor, congratulations! This new journey offers freedom and the potential for growth, but with it comes a unique set of responsibilities, particularly when it comes to taxes. In this guide, we will delve into the various IRS forms you'll need to be familiar with to ensure your tax filing process is smooth and compliant with regulations. Let's start with the basics.

Key Forms for Independent Contractors

As an independent contractor, you're essentially running a small business. Here are the key IRS forms you'll encounter:

- Form W-9, Request for Taxpayer Identification Number and Certification

- Form 1099-NEC, Nonemployee Compensation

- Form 1099-MISC, Miscellaneous Income

- Form 1040, U.S. Individual Income Tax Return

- Schedule C (Form 1040), Profit or Loss from Business

- Form 1099-K, Payment Card and Third Party Network Transactions

Form W-9: Establishing Your Status

The W-9 Form is one of the first forms you'll fill out as an independent contractor. Here's what it's about:

- You'll use this form to provide your TIN (Taxpayer Identification Number) to the companies or individuals paying you for your services.

- It certifies that you're not subject to backup withholding, which is a situation where you have underreported your interest and dividends.

- This form is crucial for your clients or payers to issue you a 1099-NEC or 1099-MISC at tax time.

📝 Note: Ensure you fill out the W-9 accurately to avoid any delays in receiving payments or incorrect tax reporting.

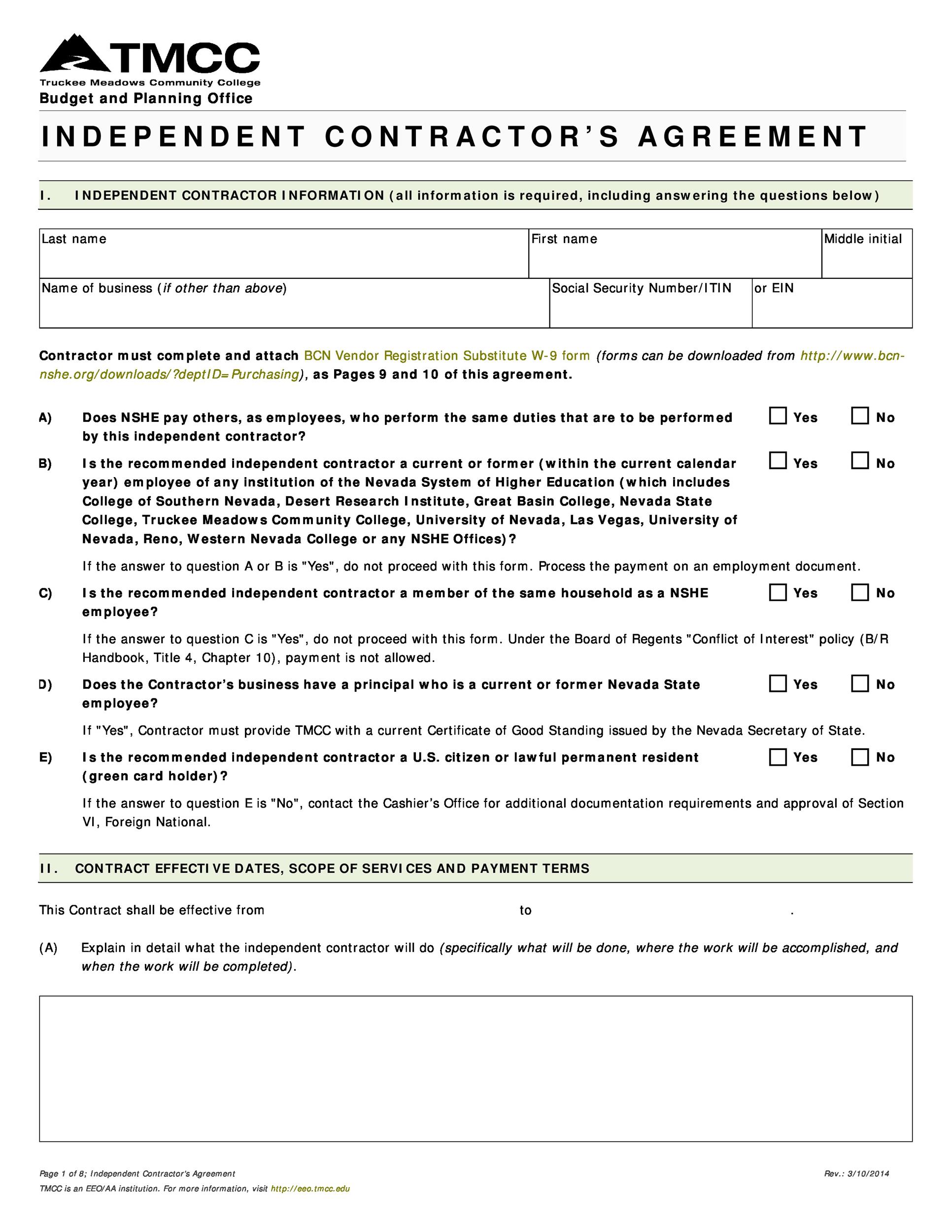

Form 1099-NEC and Form 1099-MISC: Reporting Your Income

These forms are sent to you by your clients at the end of the year:

- 1099-NEC: This form reports nonemployee compensation over $600 in a year. As of 2020, the NEC form replaced the former box 7 on the 1099-MISC for reporting payments to independent contractors.

- 1099-MISC: This form still covers miscellaneous income like rent, royalties, and other payments. Box 7, however, is no longer used for nonemployee compensation.

🗓 Note: Keep track of the due dates for your clients to send you these forms – they should be furnished by January 31 of the following year for the 1099-NEC, and February 1 for the 1099-MISC.

Form 1040 and Schedule C: Filing Your Income

When it's time to file your taxes:

- Form 1040 is your standard tax form where you report your income, deductions, and credits.

- Schedule C is where you'll detail your business income, expenses, and calculate your net profit or loss from your independent contractor work.

Income reported on Schedule C comes from Form 1099-NEC or 1099-MISC, but also includes income not reported on these forms, like cash payments or barter income.

Form 1099-K: Online and Payment Network Transactions

If you use payment platforms or online marketplaces to receive payments for your services:

- Form 1099-K is issued when your transactions exceed $20,000 and involve over 200 transactions in a year.

- This form reports payments from third-party networks like PayPal, Venmo, etc.

📲 Note: Ensure you reconcile the amounts reported on Form 1099-K with your income reported on Schedule C to avoid any discrepancies.

Tax Deductions and Strategies

As an independent contractor, you're eligible for several deductions that can reduce your taxable income:

- Home Office Deduction: If you work from home and have a dedicated space for business activities, you can claim a portion of your home-related expenses like mortgage interest, rent, utilities, and insurance.

- Self-Employment Tax Deduction: You can deduct half of the self-employment taxes you pay on Schedule SE from your income taxes.

- Health Insurance Deduction: You can deduct premiums you pay for medical, dental, and long-term care insurance for yourself, your spouse, and your dependents.

Strategic tax planning can significantly lower your tax liability:

- Consider setting aside a percentage of your income throughout the year for quarterly estimated tax payments to avoid a large tax bill at year-end.

- Invest in retirement accounts like a SEP-IRA or a Solo 401(k) to lower your taxable income.

- Keep meticulous records of all business expenses, even if they're small, as they all add up to reduce your tax burden.

| Expense Category | Example | Deductible? |

|---|---|---|

| Office Expenses | Postage, stationery, office supplies | Yes |

| Business Travel | Flights, hotels, meals (subject to 50% limit) | Yes |

| Professional Fees | Legal, accounting, consulting | Yes |

| Health Insurance | Health, dental, long-term care | Yes |

📊 Note: Keeping a well-organized record of your expenses throughout the year will simplify your tax preparation process.

Transitioning into the role of an independent contractor comes with its complexities, especially in managing your taxes. However, with the right approach and understanding of the necessary forms and deductions, you can navigate this terrain effectively. Remember, while this guide offers a broad overview, consulting with a tax professional can provide personalized advice tailored to your unique situation.

What should I do if I don’t receive a 1099-NEC from a client?

+

If you don’t receive a 1099-NEC, you’re still required to report the income. Use any record of payment you have, like bank statements or invoices, to estimate your income.

Can I still deduct expenses if I don’t itemize on my tax return?

+

Yes, as an independent contractor, you can deduct business-related expenses on Schedule C even if you don’t itemize deductions on your personal tax return.

How do I know if I should make estimated tax payments?

+

If you expect to owe more than $1,000 in taxes when you file your return or if the amount due is more than 100% of your previous year’s tax bill, you should make estimated tax payments to avoid penalties.

Is there a cap on how much I can contribute to my retirement account?

+

Yes, there are annual contribution limits for retirement accounts like SEP-IRA and Solo 401(k), which can vary based on your age and income.

Do I need to use all the forms mentioned, or are some optional?

+

Some forms, like Form 1040 and Schedule C, are mandatory for filing your taxes as an independent contractor. Others, like Form 1099-K, are issued by third parties if you meet specific criteria.