5 Essential Documents in Car Loan Paperwork

When you're in the market for a new or used car, one of the most daunting aspects can be the paperwork involved. Navigating through car loan paperwork can feel like a legal labyrinth, especially if it's your first time. Understanding the essential documents you'll encounter not only helps streamline the process but also ensures you're well-informed about what you're signing up for. Here's a comprehensive guide to the five essential documents you'll need to process your car loan effectively.

1. Loan Application Form

The journey starts with the loan application form. This document is the gateway to your car loan; it’s where you’ll provide all your personal and financial details.

- Your full name and contact information

- Address and employment details

- Monthly income

- Loan amount you’re seeking

- Preferred repayment terms

This form is crucial as it determines your eligibility for the loan. Lenders use the information here to assess your creditworthiness. Be accurate and honest because discrepancies could lead to loan rejection.

🔔 Note: Fill out the form meticulously to avoid delays or denials in your car loan application.

2. Credit Report Authorization

Before approving your loan, lenders need to check your credit history. The credit report authorization form grants them permission to do so. This document outlines:

- Your consent for the lender to pull your credit report from one or more credit bureaus

- The purpose for which your credit report is being accessed

- The time frame within which the lender can review your credit

Your credit report plays a pivotal role in determining your interest rate, loan amount, and terms. By signing this form, you’re acknowledging that the lender has a legal right to evaluate your financial behavior before deciding on your loan.

3. Promissory Note

A promissory note is your promise to repay the car loan. It contains:

- The principal amount borrowed

- Interest rate

- Repayment schedule

- Loan duration

- Default and prepayment penalties

- Any special conditions or covenants

Think of the promissory note as a legal contract between you and the lender, outlining the terms of your loan repayment. Review this document carefully because it dictates your financial commitment over the loan period.

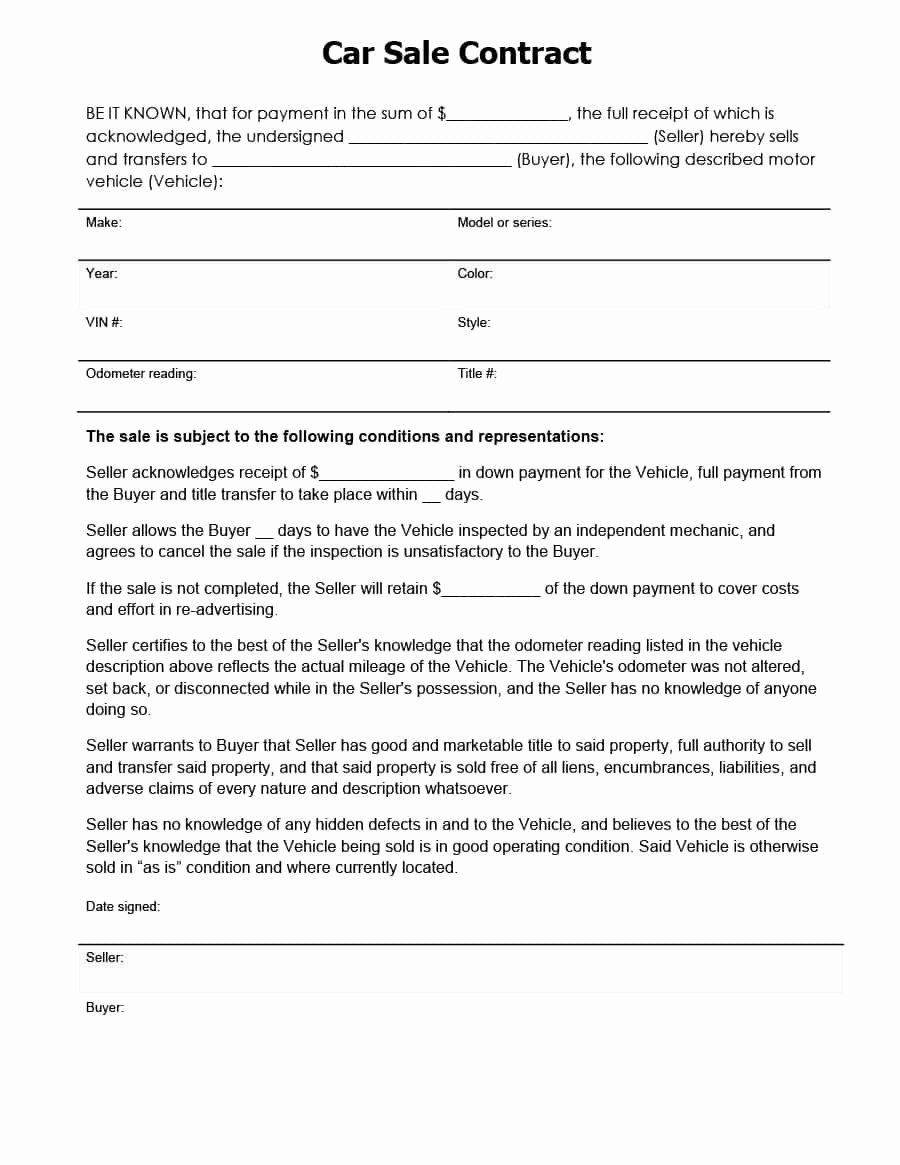

4. Retail Installment Contract or Conditional Sale Contract

When buying a car from a dealership, you might encounter either a retail installment contract (RIC) or a conditional sale contract. These documents serve similar purposes, covering:

- The car’s purchase price

- Down payment amount

- Loan terms

- Finance charges

- Tax, title, and license fees

- Payment schedule and amount

- Ownership details, including when the car’s title will be transferred to you

Both contracts outline your obligation to make payments on time to retain possession of the car until the loan is fully paid off. Here’s where you might learn whether your down payment or car’s equity is contributing to loan reduction.

🔔 Note: Ensure you understand the terms, especially regarding ownership and payment obligations.

5. Proof of Insurance

Most lenders require you to have car insurance before approving your loan. This document proves:

- The car is insured against theft, damage, and other covered perils

- You have at least liability coverage

- The coverage meets the lender’s minimum requirements

Your lender might need to be listed as the lienholder on your insurance policy. This ensures that they are notified in case of any significant claim, protecting their investment in your vehicle.

Understanding these key documents when applying for a car loan can help you navigate the process with confidence. Knowing what to expect and preparing the necessary paperwork upfront can significantly speed up your loan approval. Here's a summary of why each document is essential:

- The Loan Application Form sets the stage for your loan approval.

- The Credit Report Authorization gives the lender a view into your financial past.

- The Promissory Note is your contractual promise to repay.

- The Retail Installment or Conditional Sale Contract outlines your purchase and loan terms.

- Proof of Insurance protects both you and the lender from financial loss.

Now that you're equipped with this knowledge, remember that being proactive in understanding and preparing these documents can make your car buying journey much smoother. Whether you're financing your first car or upgrading to a new model, the paperwork might seem extensive, but it's all part of the journey towards driving off with your dream car.

What happens if I miss signing one of these essential documents?

+

Missing a document or not signing one can delay or even jeopardize your loan approval. Always ensure all documents are properly filled out and signed.

Can I change the terms of the promissory note after signing?

+

Once you’ve signed the promissory note, changing its terms is generally not allowed without a new agreement between you and the lender.

Is there a way to pay less for car insurance?

+

Yes, shopping around for insurance, increasing your deductible, or bundling policies can often reduce your car insurance costs. Always keep in mind to meet the lender’s minimum requirements.