5 Essential Documents for Home Refinancing

Refinancing your home can offer numerous financial benefits, from lowering your monthly mortgage payments to reducing the total interest paid over the life of your loan. However, the process isn't as simple as signing a new set of papers. To ensure a smooth refinancing journey, you'll need to gather a few key documents. Here's a detailed look at the five essential documents you'll need when refinancing your home.

1. Proof of Income

Income verification is a cornerstone of any mortgage application, including refinancing. Lenders want to ensure you have a stable income to cover the new mortgage payments. Here’s what you might need:

- Recent Pay Stubs: Typically, lenders will ask for the last two or three months of pay stubs. Ensure they detail your gross pay, deductions, and net income.

- W-2 Forms: For the past two years, especially if you are self-employed or have varied income.

- Tax Returns: Including both personal and business returns if applicable, for the last two years.

💡 Note: If you have income from other sources like investments, pensions, or child support, documentation for these will also be required.

2. Asset Verification

Lenders not only want to see your income but also your ability to save and manage your finances:

- Bank Statements: Last two to three months of statements from all your accounts, including checking, savings, and investment accounts.

- Investment Account Statements: If you have assets in stocks, bonds, or mutual funds.

- Retirement Accounts: Recent statements to show your financial stability over time.

Having a healthy savings account or investments can show the lender your capacity to handle unexpected expenses or changes in income.

3. Debt and Liability Information

Your debt-to-income ratio (DTI) is a critical factor in refinancing approval. Here’s what to prepare:

- Credit Report: Although lenders will likely pull their own, it’s beneficial to review your credit report beforehand for any discrepancies.

- Current Mortgage Statements: To provide details on your current loan balance, payment amount, and terms.

- Other Debt Obligations: Statements or agreements for car loans, student loans, credit cards, and any other debts.

A detailed overview of your liabilities helps lenders determine your financial health and ability to take on new debt.

4. Insurance Documents

Homeowners insurance is mandatory for securing a mortgage. Here are the documents you’ll need:

- Homeowners Insurance Policy: Current policy details including coverage limits, premiums, and expiration dates.

- Hazard Insurance: If your home is in an area prone to specific risks (like floods or earthquakes), you’ll need this additional coverage.

⚠️ Note: If you're refinancing because your current insurer doesn't meet lender standards, you'll need to show proof of new insurance that does.

5. Property Documents

Your property itself plays a vital role in refinancing. Here’s what you should gather:

- Title Report or Title Insurance Policy: To prove ownership and check for liens or other issues.

- Appraisal Report: Recent appraisal if available, or prepare for the lender to order a new one.

- Survey: If there are any disputes over property lines or recent constructions, a survey might be needed.

The value and condition of your property can significantly influence your refinancing terms.

Final Thoughts

Preparing these documents upfront can significantly streamline the refinancing process. It demonstrates to lenders that you’re organized, financially stable, and serious about improving your mortgage terms. By knowing what to expect, you can gather all necessary paperwork, reducing the time spent waiting for approvals or handling requests for additional information. This preparation not only makes the refinancing process smoother but also gives you a better chance of securing favorable terms on your new mortgage.

What happens if I can’t provide all the documents?

+

If you’re missing some documents, you should reach out to your lender. They might be able to guide you on alternative documents or might even waive certain requirements under specific circumstances. However, having as many documents as possible upfront helps expedite the process.

Can I refinance if I’ve recently changed jobs?

+

Yes, but it might be more challenging. Lenders look for job stability. If you’ve switched industries or positions, provide letters of employment, updated pay stubs, and explain any transitions to show income continuity.

How long does the refinancing process usually take?

+

The refinancing process can take anywhere from 30 to 60 days, depending on how quickly you can gather documents, the complexity of your loan, property appraisal delays, and the efficiency of your lender.

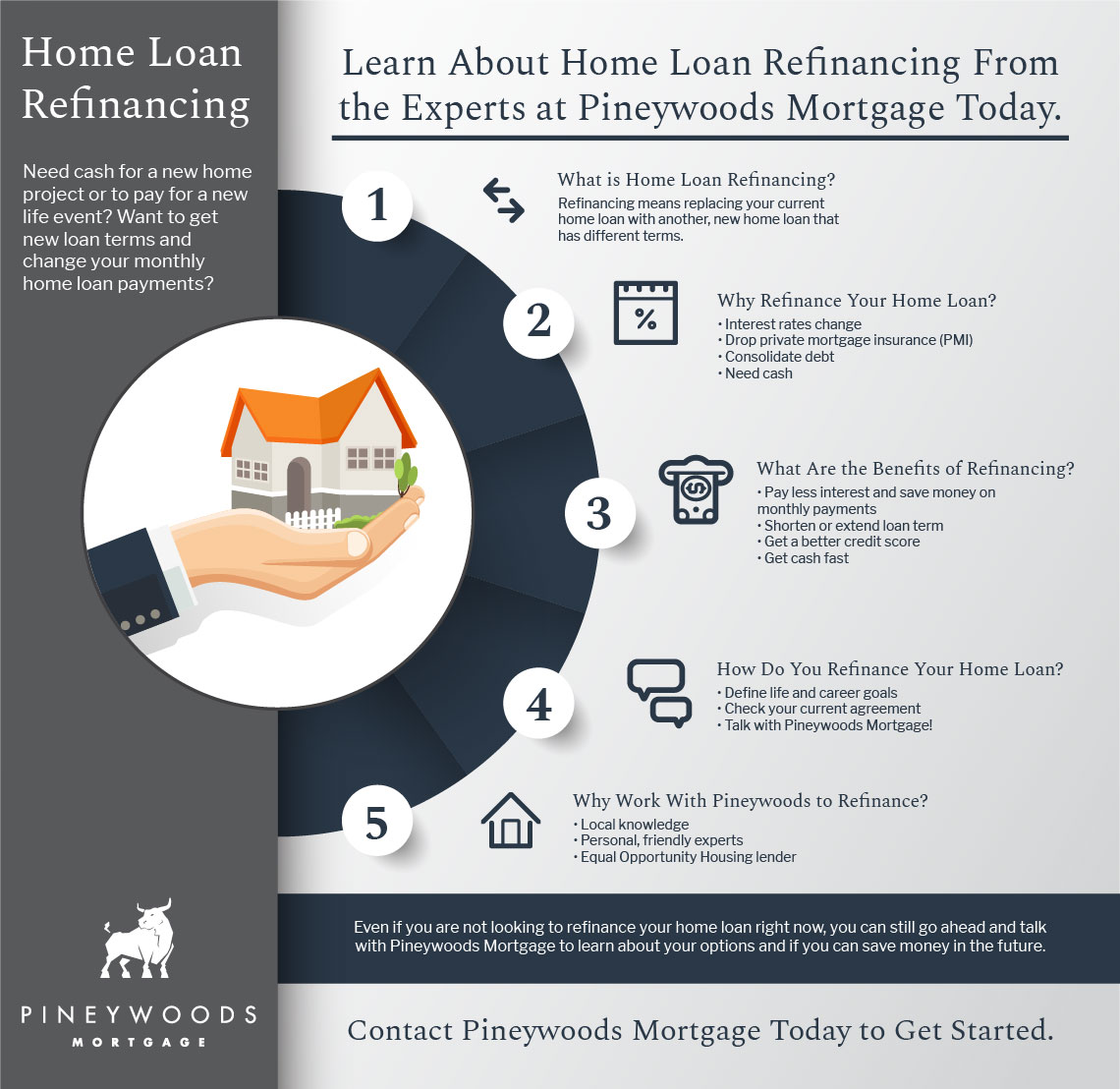

What are the benefits of refinancing my home?

+

Refinancing can lower your interest rate, reduce monthly payments, shorten the loan term, convert from adjustable to fixed rate, or even allow you to cash out home equity for other financial needs. Each benefit depends on your personal financial situation and market conditions.

Do I need to keep my current homeowners insurance when refinancing?

+

Not necessarily. Your lender will require homeowners insurance, but they might have their own list of approved insurers. If your current policy doesn’t meet their standards, you’ll need to find one that does or let the lender secure a new policy for you.