Essential Paperwork for Securing College Loans

Embarking on a college journey is an exciting venture, but it often comes with the need for substantial financial support. College loans can be an excellent way to bridge the gap between available scholarships, grants, personal savings, and the actual cost of education. However, navigating the complex landscape of college loans requires careful preparation, especially when it comes to understanding and gathering the necessary paperwork. This comprehensive guide aims to demystify the essential documents you'll need for securing a college loan, ensuring you're equipped to maximize your loan potential and manage your finances effectively.

Understanding Types of College Loans

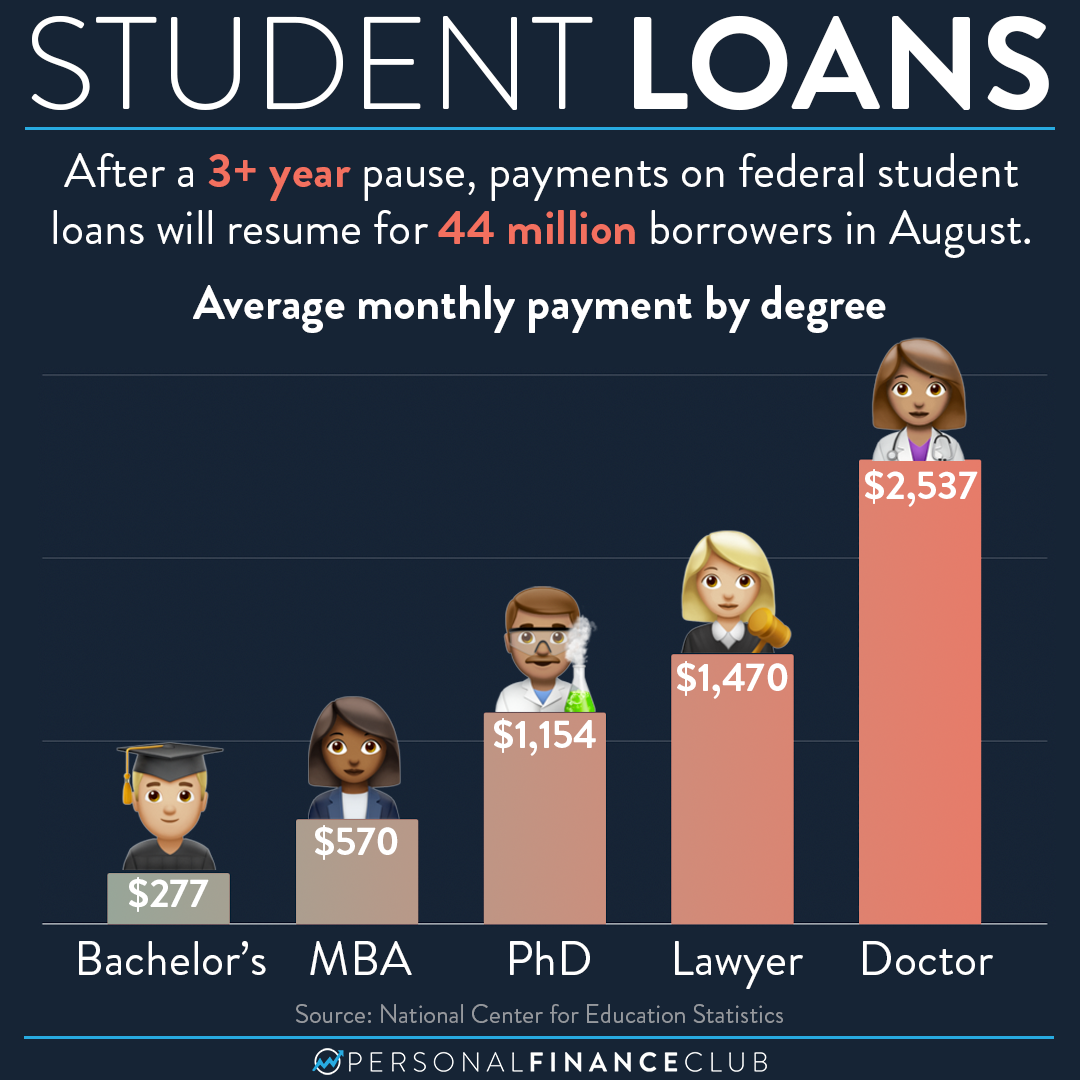

Before diving into the paperwork, it's beneficial to understand the different types of loans you might encounter:

- Federal Student Loans: Government-backed loans with fixed interest rates, offering various programs like Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans.

- Private Student Loans: Loans provided by banks, credit unions, or private lenders, which often require a good credit score or a cosigner.

- State-Sponsored Loans: Some states offer their own loan programs which might have unique requirements.

Essential Documents for Federal Student Loans

The federal loan application process, primarily through the Free Application for Federal Student Aid (FAFSA), involves gathering the following documents:

- Social Security Number: Critical for your FAFSA application.

- Federal Income Tax Returns, W-2 Forms, and Other Records of Income: For both you and your parents if you're considered a dependent student.

- Records of Assets: Including savings accounts, investments, and real property.

- Alien Registration Number (if not a U.S. citizen): For non-U.S. citizens, this is necessary for identification purposes.

After submitting the FAFSA, you'll receive an Estimated Family Contribution (EFC) which influences your loan amount.

📝 Note: Ensure all documents are accurate and up-to-date; errors can delay your loan process or reduce your eligibility.

Documents for Private Loans

Private loans might demand additional or different documentation:

- Proof of Income: Often requiring your parents or cosigner to provide recent pay stubs or tax returns to verify their ability to repay the loan.

- Employment Information: Details about your job, if applicable, and certainly about your cosigner's employment.

- Credit Report: Both yours and your cosigner's credit will be evaluated, impacting loan terms.

- Enrollment Verification: A letter from your college or university confirming your enrollment status and expected graduation date.

- Academic Records: Some lenders might request transcripts to assess your academic progress.

Private lenders might also have proprietary applications, which could require additional forms or documentation.

Additional Documents for Loan Disbursement

Once your loan is approved, here are documents you might need:

- Master Promissory Note (MPN): Your commitment to repay the loan, which needs to be completed before funds can be disbursed.

- Entrance Counseling: Mandatory for first-time borrowers to understand rights and responsibilities.

- Student Aid Report (SAR): Review this document after submitting FAFSA to ensure accuracy.

🔍 Note: Be proactive in reviewing all documents for accuracy to avoid any delays in fund disbursement.

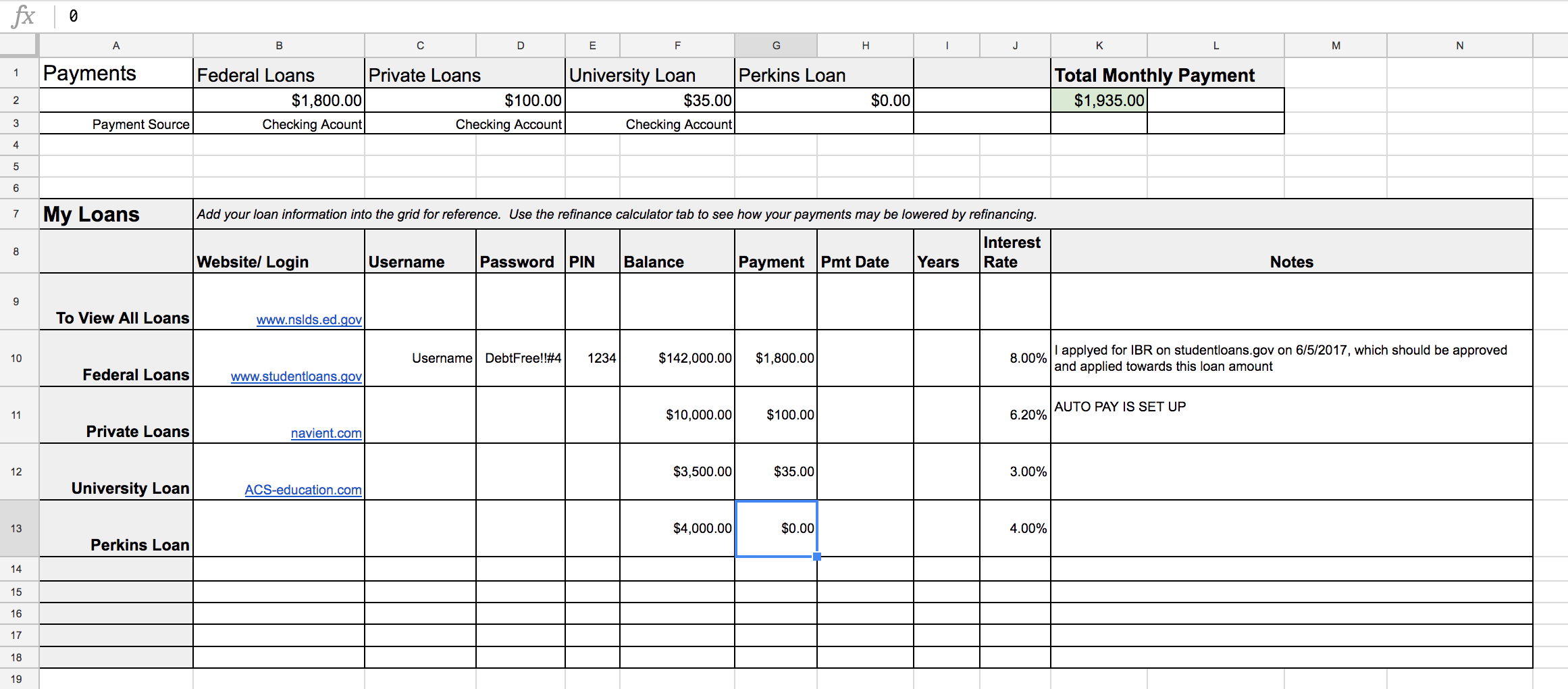

Managing Loan Documents

Keeping track of your loan documents is crucial:

- Organize Documents: Use folders or binders to keep physical documents safe and easily accessible.

- Digital Copies: Scan and save all documents electronically for safekeeping and easy retrieval.

- Know Your Loan: Understand the terms of your loan, repayment options, and grace periods to avoid surprises.

To wrap up our exploration of essential paperwork for securing college loans, remember that the key to a smooth loan application process is preparation. Gathering the necessary documents ahead of time can prevent delays and ensure you secure the funds you need when you need them. Whether you're applying for federal loans, private loans, or state-sponsored programs, each has its set of requirements, but they all aim towards the same goal: helping you fund your education. By understanding the types of loans available, preparing the required documentation, and managing your loan records efficiently, you are setting yourself up for a successful educational journey, unburdened by financial stress.

What if my parents don’t have a social security number?

+

If your parents are not U.S. citizens and do not have a social security number, you’ll need to enter all zeros or use their ITIN (Individual Taxpayer Identification Number) on the FAFSA. It’s important to contact the financial aid office at your institution for specific guidance or additional forms.

Can I apply for a private loan without a cosigner?

+

While some private lenders offer loans without a cosigner, it’s rare and typically comes with higher interest rates and stricter approval criteria. Establishing your creditworthiness first can improve your chances of securing a loan without a cosigner.

What should I do if I lose my loan documents?

+

Keep digital copies of all important documents. If you lose your loan documents, you can contact your loan servicer or lender for replacements or check online portals where copies are often available. For FAFSA, corrections can be made online if discrepancies are noticed.