5 Tips to Simplify Your State Tax Paperwork

If you are a new resident in a state or an individual who prefers managing your own taxes, you might find state tax paperwork a bit overwhelming. Simplifying this process can save you time, reduce stress, and might even help you find deductions you wouldn't have noticed otherwise. Here are five actionable tips to streamline your state tax preparation process:

1. Understand Your State’s Tax Structure

Each state in the U.S. has its own tax laws which can significantly vary. Understanding these differences is crucial:

- Learn the Tax Brackets: Know what percentage of your income will be taxed at each level. Some states have progressive taxes like federal taxes, while others might have flat rates.

- Identify Deductions and Credits: States often have unique deductions or credits. For example, some states offer tax incentives for energy-efficient home improvements, or special credits for families.

- Familiarize Yourself with Reciprocity Agreements: If you work in one state but live in another, some states have agreements to avoid double taxation.

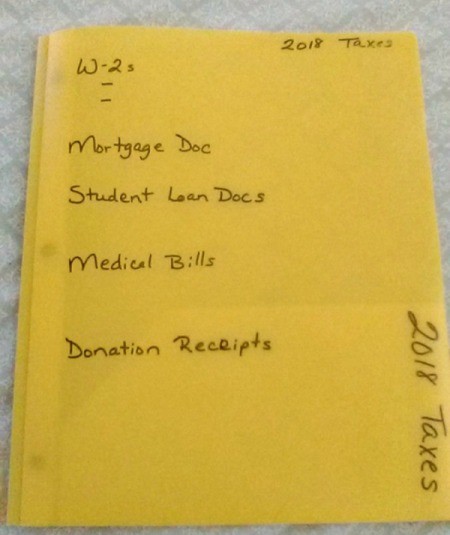

2. Keep Organized Records

Organization is key to a hassle-free tax filing experience:

- File Everything Digitally: Use document management software to scan and categorize your tax-related documents. This makes retrieval and reference much easier.

- Use Cloud Storage: Upload your tax documents to cloud services for secure backup and easy access from any device.

- Regularly Update Your Records: Keep your records up-to-date throughout the year, not just at tax time. This habit can prevent the scramble for missing documents during tax season.

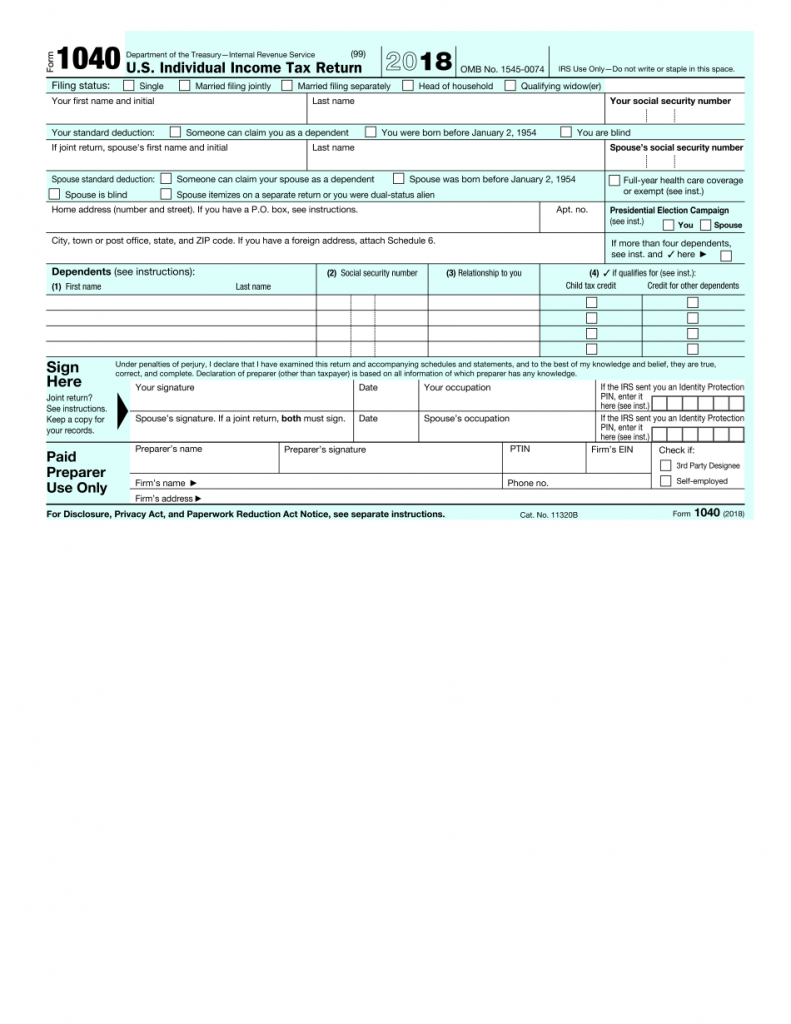

3. Use Tax Preparation Software

Tax software can guide you through the process and automatically fill in forms:

- Ease of Use: Most software provides step-by-step guidance, reducing the chance of errors.

- State-Specific Versions: Choose software that has versions tailored to your state’s tax laws.

- Import Capability: Many programs allow importing of last year’s tax data or direct downloads from your financial institutions.

4. File Electronically

E-filing is not only faster, but often more accurate due to built-in error checks:

- Direct Deposit: File electronically to get your refund faster by choosing direct deposit.

- Paperwork Reduction: Less physical paperwork means less clutter and fewer chances for documents to get lost.

- Security: Reputable e-file services use encryption to keep your data safe.

5. Seek Professional Help When Necessary

If state tax laws are particularly complex or if you’re unsure:

- Accountants and CPAs: They can provide tailored advice and handle filing for you.

- Volunteer Tax Assistance: Look for programs like VITA (Volunteer Income Tax Assistance) which offer free help for those meeting certain income criteria.

- Use Software with Expert Access: Some tax software includes the option to consult with a tax professional if needed.

By following these tips, managing your state tax paperwork can become a more straightforward and less intimidating process. Whether you're dealing with income from multiple states, complex investments, or simply trying to navigate through state-specific deductions, a little preparation goes a long way.

💡 Note: Always keep track of tax law changes as states often update their regulations. Staying informed can save you from unexpected tax liabilities or fines.

To summarize, efficient tax preparation involves understanding your state's tax environment, keeping thorough and organized records, utilizing software, choosing electronic filing, and, when needed, not hesitating to seek professional assistance. This approach not only simplifies your tax paperwork but can also maximize your potential refunds or minimize your tax burden.

What is the difference between federal and state income tax?

+

Federal income tax is collected by the IRS and applies to everyone in the U.S., whereas state income taxes are collected by individual states and have their own rates, brackets, and rules. Some states have no income tax, while others have complex systems with multiple tax brackets.

Can I e-file state and federal taxes together?

+

Yes, many tax preparation software packages allow you to file both state and federal taxes simultaneously, often guiding you through the process in a seamless manner.

Are there any benefits to filing state taxes electronically?

+

Absolutely. E-filing can reduce errors, speed up processing time, and allow for direct deposit of refunds. It also eliminates the need for physical paperwork, which can be lost or delayed in the mail.