Tally Your Balance Sheet in Excel Effortlessly

In today's world, managing finances effectively requires meticulous planning and organizational tools. Microsoft Excel stands out as one of the best tools for creating and maintaining balance sheets. Whether you are running a small business or simply trying to keep track of your personal finances, learning how to tally your balance sheet in Excel can be an incredibly useful skill. This blog post will guide you through the steps to create an effective balance sheet in Excel, ensuring accuracy and simplicity.

Why Excel for Balance Sheets?

Before diving into the how-to, let's briefly explore why Excel is an excellent choice for tallying balance sheets:

- Flexibility: Excel allows for custom formulas, making it adaptable to various financial needs.

- Automation: Automate repetitive calculations with formulas, reducing human error.

- Data Analysis: Excel's built-in functions can help analyze financial health over time.

- Sharing: Spreadsheets can be easily shared, making collaboration on financial reporting straightforward.

Step-by-Step Guide to Creating a Balance Sheet in Excel

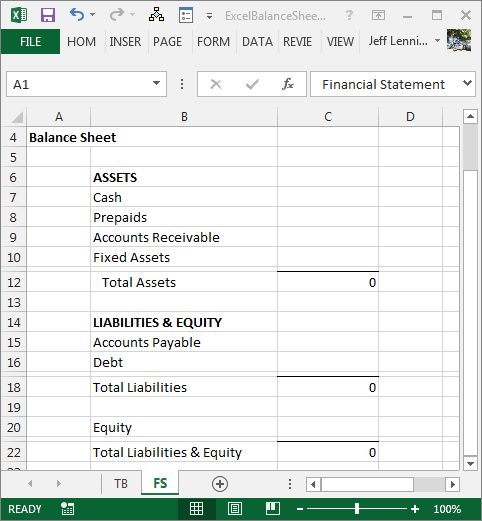

Step 1: Setting Up Your Spreadsheet

Begin by opening Excel and setting up your workbook:

- Create a new workbook or open an existing one.

- Select the first sheet where you’ll input your balance sheet data.

- Format your sheet with appropriate row heights and column widths for clarity.

Here’s an example of how you might start setting up your balance sheet:

| A | B | C | |

|---|---|---|---|

| 1 | Assets | Value | Comments |

| 2 | Current Assets | ||

| 3 | Cash | ||

| 12 | Total Assets |

💡 Note: Customize this table to include categories relevant to your financial situation.

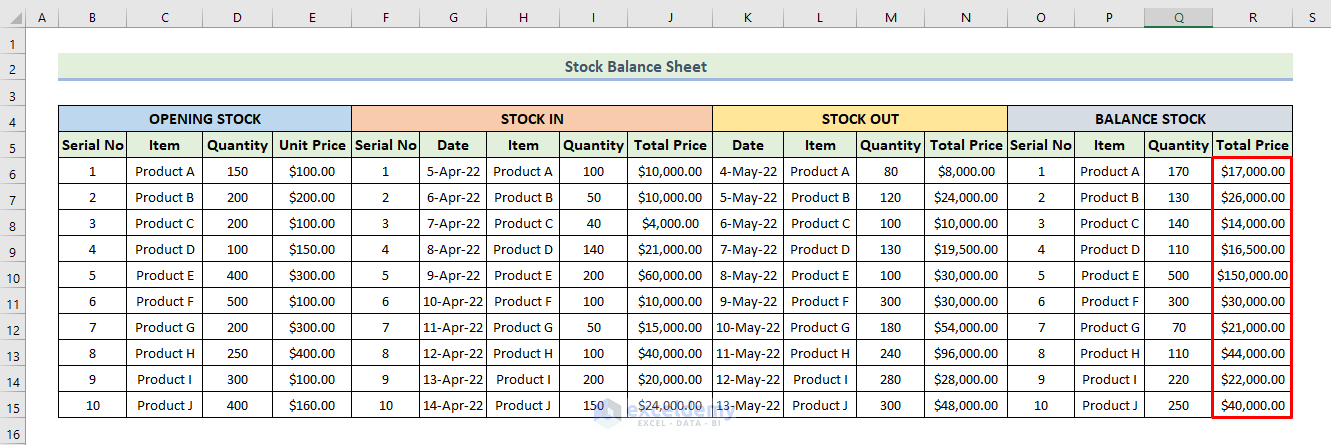

Step 2: Entering Data

Now, let’s input your financial data into the balance sheet:

- Categorize: List all your assets, liabilities, and equity separately.

- Value: Enter the current value for each item in the corresponding cells.

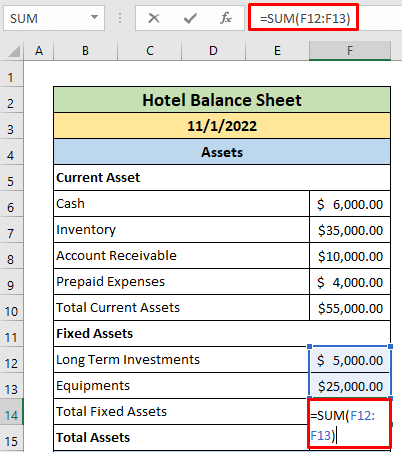

- Subtotal: Use Excel’s SUM function to calculate the subtotal of your assets, liabilities, and equity.

Formula Example: =SUM(B3:B10) for total current assets

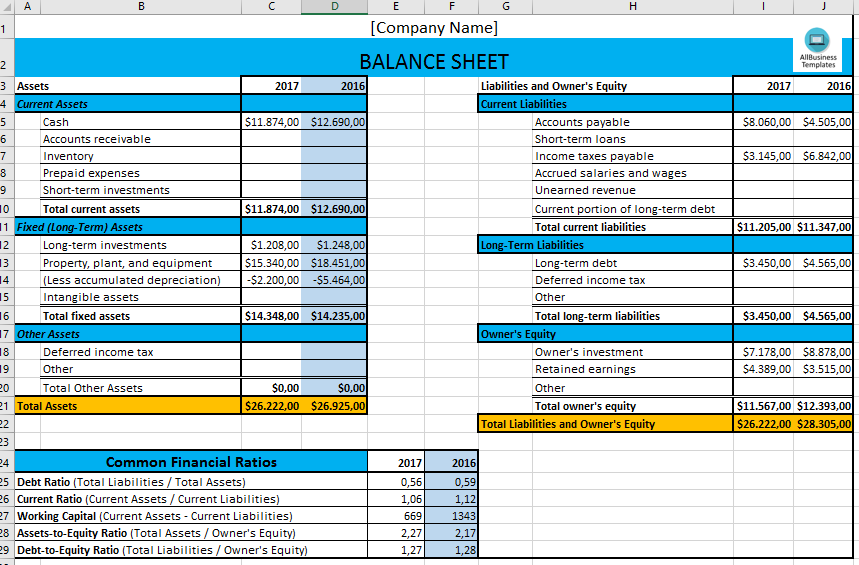

Step 3: Calculating the Balance

The balance sheet equation is simple: Assets = Liabilities + Equity. Ensure your balance sheet tallies correctly:

- Enter the formula in the Total Liabilities + Equity cell to match the Total Assets.

- Check if they are equal. If not, review your entries for mistakes.

Step 4: Formatting and Styling

Formatting your balance sheet not only improves readability but also professionalism:

- Use the Home tab to apply cell styles, like currency format.

- Bold headers and totals for emphasis.

- Apply color coding if needed; for example, green for assets, red for liabilities.

- Freeze panes to keep headers in view when scrolling through the sheet.

Step 5: Checking for Errors and Consistency

Before finalizing your balance sheet:

- Double-check formulas and values entered.

- Use Excel’s built-in error-checking tools to catch common mistakes.

- Ensure consistent formatting throughout the document.

Finalizing and Saving

Save your work:

- Save your Excel file with a clear name, possibly including the date.

- Consider using macros for repeated balance sheet updates to streamline the process.

🛈 Note: Always save a backup of your financial data, preferably on cloud storage or an external drive.

Analyzing Your Balance Sheet

With your balance sheet complete, you can now use Excel’s analytical tools to understand your financial health:

- Financial Ratios: Calculate ratios like current ratio, quick ratio, or debt-to-equity.

- Year-Over-Year Comparisons: Use pivot tables to compare financial performance over time.

- Charts and Graphs: Visualize your financial data with Excel charts for presentations or reports.

Excel's versatility extends far beyond creating a balance sheet; it can also be used to forecast future financial trends, assess liquidity, and manage budgets. By mastering Excel for financial management, you gain control over your financial destiny, making informed decisions based on accurate, up-to-date data.

How often should I update my balance sheet?

+

Update your balance sheet at least quarterly or whenever significant changes in assets or liabilities occur to keep your financial data current.

What if my assets do not equal liabilities plus equity?

+

This imbalance indicates an error. Review your data entry for any inaccuracies, ensure all formulas are correctly applied, and re-check your figures.

Can I use Excel for other financial statements?

+

Absolutely! Excel is versatile enough to handle income statements, cash flow statements, and other financial analysis documents.